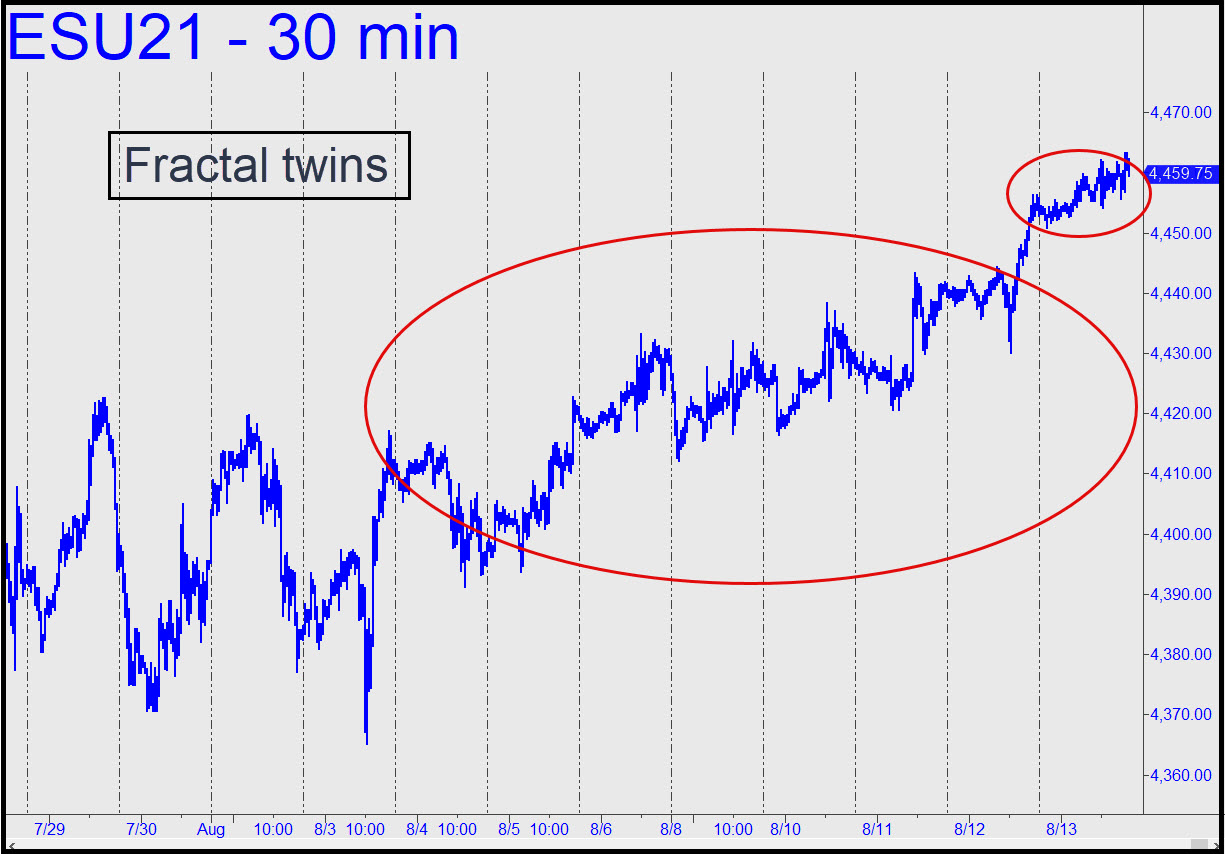

Last week’s finishing stroke was a fractal clone of schizoid price action traced out over the previous two weeks. Both exuded the stink of nervous sweat that is symptomatic of unrelieved short-covering. We would surely know, having gotten short ourselves via an rABC pattern that took almost five hours to produce a measly $600 profit. Our hard work was taken as evidence that still higher prices lay in store, as indeed they did. But how long can it go on? My strong gut feeling is that DaBoyz are getting ready to pull the plug, and soon, after they’ve extracted the last ounce of buying power from wrong-way bettors. I give this fool’s rally another 4-7 days to run , if that long, and would therefore suggest laying in a small inventory of put butterfly spreads well below the market and 6-8 weeks out. You can do this using SPY, keying on strikes at 410 or below. For a more precise handle on immediate prospects, here’s your SPY road map (see inset). The stall at p=445.52 could potentially be fatal, but we’ll wait for the rally to fail, if it does, before we pass judgment. In the E-Mini S&Ps, a comparable resistance lies at p=4461.25, which also has produced a so-far precise stall. Its associative ‘D’ target is 4557.50, and any move decisively past p would put this target in play. SPY’s ‘D’ target is 455.05. ______ UPDATE (Aug 16, 4:40 p.m.): Biden’s egregious mishandling of our withdrawal from Afghanistan is an appalling preview of how so much else that concerns the nation is about to spin wildly out of control. And yet, the stock market barely flinched and actually closed higher! Rather than go on about how the bull market is under the spell of epic, psychotic delusion, I’ll stick strictly with the technicals. In that regard, today’s short-squeeze did not exceed 4461.25 by enough to imply that more upside to D=4557.50 is a done deal. Let’s see what the next couple of days bring, since ABCD logic cannot but tell us whether the uptrend still has much power left in it. _______ UPDATE (Aug 17, 10:55 p.m.): So far so good. The futures fell more than 60 points before bears, scared of winning, scrambled to cover. Let’s see if they embarrass themselves further on Wednesday. ______ UPDATE (Aug 18, 11:25 p.m.): A test of two prior lows at 4364.75 is all but certain, as is a tradeable bounce from somewhere near there. Use a=4430.25 (10:00 a.m.) to attempt bottom-fishing with a ‘reverse’ buy trigger, but I’d suggest a very tight a-b segment, since the bounce could be microscopic. This trade is not recommended unless you’ve attended or viewed at least five recent tutorial sessions. _______ UPDATE (Aug 19, 6:05 p.m.) The previous update got things precisely right, and I hope at least a few of you were able to act on it, since the web site has been out of commission for more than a day. Hope to see you tomorrow! In the meantime, bulls held the edge, much as they have for the last 12 years, at the closing bell. The penetration of p=4409.38 implies the target will be reached and that the futures can be bought ‘mechanically’ on a pullback to x=4393.56, using a 4337.00 stop-loss. Here’s the chart.

Last week’s finishing stroke was a fractal clone of schizoid price action traced out over the previous two weeks. Both exuded the stink of nervous sweat that is symptomatic of unrelieved short-covering. We would surely know, having gotten short ourselves via an rABC pattern that took almost five hours to produce a measly $600 profit. Our hard work was taken as evidence that still higher prices lay in store, as indeed they did. But how long can it go on? My strong gut feeling is that DaBoyz are getting ready to pull the plug, and soon, after they’ve extracted the last ounce of buying power from wrong-way bettors. I give this fool’s rally another 4-7 days to run , if that long, and would therefore suggest laying in a small inventory of put butterfly spreads well below the market and 6-8 weeks out. You can do this using SPY, keying on strikes at 410 or below. For a more precise handle on immediate prospects, here’s your SPY road map (see inset). The stall at p=445.52 could potentially be fatal, but we’ll wait for the rally to fail, if it does, before we pass judgment. In the E-Mini S&Ps, a comparable resistance lies at p=4461.25, which also has produced a so-far precise stall. Its associative ‘D’ target is 4557.50, and any move decisively past p would put this target in play. SPY’s ‘D’ target is 455.05. ______ UPDATE (Aug 16, 4:40 p.m.): Biden’s egregious mishandling of our withdrawal from Afghanistan is an appalling preview of how so much else that concerns the nation is about to spin wildly out of control. And yet, the stock market barely flinched and actually closed higher! Rather than go on about how the bull market is under the spell of epic, psychotic delusion, I’ll stick strictly with the technicals. In that regard, today’s short-squeeze did not exceed 4461.25 by enough to imply that more upside to D=4557.50 is a done deal. Let’s see what the next couple of days bring, since ABCD logic cannot but tell us whether the uptrend still has much power left in it. _______ UPDATE (Aug 17, 10:55 p.m.): So far so good. The futures fell more than 60 points before bears, scared of winning, scrambled to cover. Let’s see if they embarrass themselves further on Wednesday. ______ UPDATE (Aug 18, 11:25 p.m.): A test of two prior lows at 4364.75 is all but certain, as is a tradeable bounce from somewhere near there. Use a=4430.25 (10:00 a.m.) to attempt bottom-fishing with a ‘reverse’ buy trigger, but I’d suggest a very tight a-b segment, since the bounce could be microscopic. This trade is not recommended unless you’ve attended or viewed at least five recent tutorial sessions. _______ UPDATE (Aug 19, 6:05 p.m.) The previous update got things precisely right, and I hope at least a few of you were able to act on it, since the web site has been out of commission for more than a day. Hope to see you tomorrow! In the meantime, bulls held the edge, much as they have for the last 12 years, at the closing bell. The penetration of p=4409.38 implies the target will be reached and that the futures can be bought ‘mechanically’ on a pullback to x=4393.56, using a 4337.00 stop-loss. Here’s the chart.

ESU21 – Sep E-Mini S&P (Last:4401.50)

Posted on August 15, 2021, 5:17 pm EDT

Last Updated August 19, 2021, 6:14 pm EDT

Posted on August 15, 2021, 5:17 pm EDT

Last Updated August 19, 2021, 6:14 pm EDT