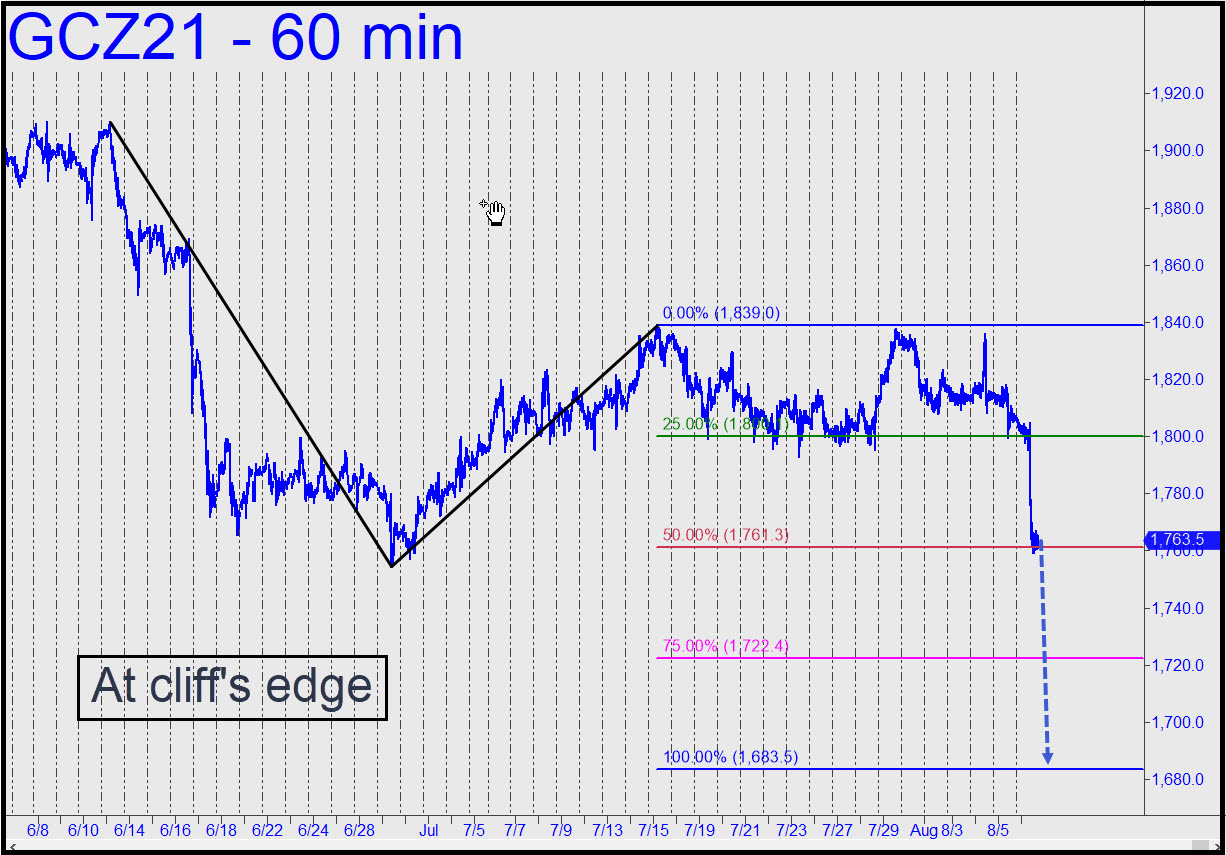

Strong employment numbers and the higher interest rates this supposedly will bring drove gold sharply lower on Friday, according to the usual experts. What rubbish! Gold dropped simply because it was time for it to drop. It’s not as though the market actually divines the future and discounts it in a rational way. If investors possessed even a mote of rationality, gold would be trading above $2000, discounting the biggest monetary blowout in history. Instead, bullion looks poised to drop even further, since the bounce from an opportune midpoint Hidden Pivot support at 1763.30 was so weak that it’s hardly visible on the hourly chart. (That didn’t stop us from making money with some very precise bottom-fishing. Check out my 10:48 post in the chat room to see how.) For now, we’ll use p2=1722.40 as a minimum downside target and 1683.50 as worst case for the next 2-3 weeks. This is jumping the gun, since I ordinarily wouldn’t project another leg down until the midpoint pivot has been decisively breached. In this case, however, I’ll give bears the benefit of the doubt, since they seemed so feisty on Friday. We can use the chart shown in the usual ways, to get long or short as opportunities arise, so stay tuned to the trading Room if you care! _______ UPDATE (Aug 8, 10:53 p.m.): The 1683.50 target nailed the low of an $85 death dive within three-tenths of one percent. Virtually any strategy you might have used to get long at the low — or short ahead of the spectacular, gratuitous swoon — would have produced a large profit with almost no pain. Maximum gain on the short position from the time the tout went out would have been a little more than $34,000 on four lots; the so-far bounce could have produced additional profits of up to $26,000. Not bad for a Sunday evening’s work. Some patterns are so un-obvious that no one but us, using the simple rules governing impulse legs, can see them. If you’ve wondered what I am talking about when I speak of an ABCD pattern as being ‘gnarly perfection’, this one was a textbook example. Here’s the chart for your enlightenment. ______ UPDATE (Aug 1, 8:42 p.m.): I’ll have more to suggest when gold emerges from this coyly vicious phase. _______ UPDATE (Aug 12, 9:26 p.m.): Shorts have gotten tortured lately and bulls encouraged, so it must be assumed this rally from last week’s bombed out low is corrective, a prelude to another leg down. Use this pattern to orient yourself, subject to revision if the futures stop out yesterday’s 1759.6 high. The D target, now shown, is 1601.60.

Strong employment numbers and the higher interest rates this supposedly will bring drove gold sharply lower on Friday, according to the usual experts. What rubbish! Gold dropped simply because it was time for it to drop. It’s not as though the market actually divines the future and discounts it in a rational way. If investors possessed even a mote of rationality, gold would be trading above $2000, discounting the biggest monetary blowout in history. Instead, bullion looks poised to drop even further, since the bounce from an opportune midpoint Hidden Pivot support at 1763.30 was so weak that it’s hardly visible on the hourly chart. (That didn’t stop us from making money with some very precise bottom-fishing. Check out my 10:48 post in the chat room to see how.) For now, we’ll use p2=1722.40 as a minimum downside target and 1683.50 as worst case for the next 2-3 weeks. This is jumping the gun, since I ordinarily wouldn’t project another leg down until the midpoint pivot has been decisively breached. In this case, however, I’ll give bears the benefit of the doubt, since they seemed so feisty on Friday. We can use the chart shown in the usual ways, to get long or short as opportunities arise, so stay tuned to the trading Room if you care! _______ UPDATE (Aug 8, 10:53 p.m.): The 1683.50 target nailed the low of an $85 death dive within three-tenths of one percent. Virtually any strategy you might have used to get long at the low — or short ahead of the spectacular, gratuitous swoon — would have produced a large profit with almost no pain. Maximum gain on the short position from the time the tout went out would have been a little more than $34,000 on four lots; the so-far bounce could have produced additional profits of up to $26,000. Not bad for a Sunday evening’s work. Some patterns are so un-obvious that no one but us, using the simple rules governing impulse legs, can see them. If you’ve wondered what I am talking about when I speak of an ABCD pattern as being ‘gnarly perfection’, this one was a textbook example. Here’s the chart for your enlightenment. ______ UPDATE (Aug 1, 8:42 p.m.): I’ll have more to suggest when gold emerges from this coyly vicious phase. _______ UPDATE (Aug 12, 9:26 p.m.): Shorts have gotten tortured lately and bulls encouraged, so it must be assumed this rally from last week’s bombed out low is corrective, a prelude to another leg down. Use this pattern to orient yourself, subject to revision if the futures stop out yesterday’s 1759.6 high. The D target, now shown, is 1601.60.

GCZ21 – December Gold (Last:1756.10)

Posted on August 8, 2021, 5:15 pm EDT

Last Updated August 12, 2021, 9:26 pm EDT

Posted on August 8, 2021, 5:15 pm EDT

Last Updated August 12, 2021, 9:26 pm EDT