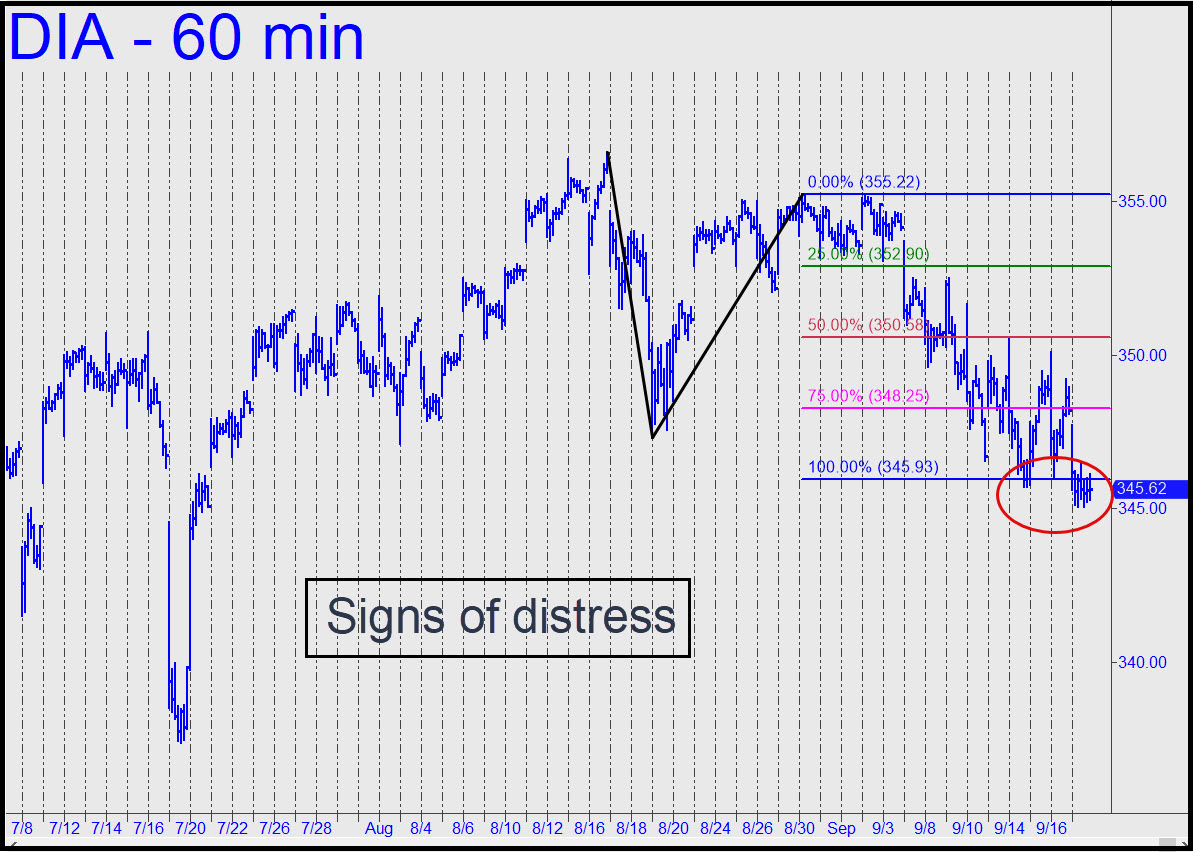

Usually, violent swings make for profitable ‘mechanical’ trading. In this case, however, the ride south has been marked by heavy chop that’s made trading an obvious downtrend as difficult as surfing in a storm. DIA has triggered just one legitimate short along the C-D leg — but from the red line rather than the less risky place at the green one where we typically jump aboard. I am still looking for a tradeable if temporary upturn from around 340, which would be well within the discomfort zone that has cued up so many of our trades in recent months. As noted here earlier, this gambit will require an rABC-type entry recommended only for those who are familiar with the tactic. _____ UPDATE (Sep 20, 12:52 p.m.): Sellers have pushed DIA well below 340, implying that the next place we might look for a ‘discomfort-zone’ low would be in the range 335.15-337.40 (visually estimated). if you understand why, I would encourage you to attempt the trade. Here’s a graph to help you visualize the set-up. ______ UPDATE (Sep 20, 10:04): The trade worked, but because it entailed an especially challenging entry and only one subscriber reported doing it, I have not established a tracking position. Now let’s see if the little bugger can make it up into to the gap between 342.16 and 345.31. _______ UPDATE (Sep 21, 10:34 p.m.): The little bugger’s rally failed near the middle of the gap, setting up a nice ‘discomfort zone’ short for any Pivoteer who was eager to trade. The subsequent downtrend projects to at least 336.90 (60-min, a= 342.16 at 10:30 a.m. on 9/20 , b=335.99 and c=343.07. _______ UPDATE (Sep 22, 9:36 p.m.): The rally had shorts mildly on the run at the close. It also negated the short-term bearish pattern, albeit without convincing me the rally is going anywhere. We’ll pay heed, nonetheless, to the propensity of punk short-squeeze rallies to turn into monster moves if skeptics remain too skeptical for even a tad too long. _______ UPDATE (Sep 23, 9:45 p.m.): A short-covering panic failed to lift DIA above a series of peaks that I’ve labeled ‘the seven dwarves’ in this chart. Let’s see if DaBoyz can keep the heat on bears as a nutty week draws to a close. _______ UPDATE (Sep 28, 5:38 p.m.): DaBoyz in fact got their clock cleaned, but don’t expect them to go quietly into the night. Today’s plunge likely has farther to go, but any trading opportunities will need to be culled from DIA’s intraday histrionics.

Usually, violent swings make for profitable ‘mechanical’ trading. In this case, however, the ride south has been marked by heavy chop that’s made trading an obvious downtrend as difficult as surfing in a storm. DIA has triggered just one legitimate short along the C-D leg — but from the red line rather than the less risky place at the green one where we typically jump aboard. I am still looking for a tradeable if temporary upturn from around 340, which would be well within the discomfort zone that has cued up so many of our trades in recent months. As noted here earlier, this gambit will require an rABC-type entry recommended only for those who are familiar with the tactic. _____ UPDATE (Sep 20, 12:52 p.m.): Sellers have pushed DIA well below 340, implying that the next place we might look for a ‘discomfort-zone’ low would be in the range 335.15-337.40 (visually estimated). if you understand why, I would encourage you to attempt the trade. Here’s a graph to help you visualize the set-up. ______ UPDATE (Sep 20, 10:04): The trade worked, but because it entailed an especially challenging entry and only one subscriber reported doing it, I have not established a tracking position. Now let’s see if the little bugger can make it up into to the gap between 342.16 and 345.31. _______ UPDATE (Sep 21, 10:34 p.m.): The little bugger’s rally failed near the middle of the gap, setting up a nice ‘discomfort zone’ short for any Pivoteer who was eager to trade. The subsequent downtrend projects to at least 336.90 (60-min, a= 342.16 at 10:30 a.m. on 9/20 , b=335.99 and c=343.07. _______ UPDATE (Sep 22, 9:36 p.m.): The rally had shorts mildly on the run at the close. It also negated the short-term bearish pattern, albeit without convincing me the rally is going anywhere. We’ll pay heed, nonetheless, to the propensity of punk short-squeeze rallies to turn into monster moves if skeptics remain too skeptical for even a tad too long. _______ UPDATE (Sep 23, 9:45 p.m.): A short-covering panic failed to lift DIA above a series of peaks that I’ve labeled ‘the seven dwarves’ in this chart. Let’s see if DaBoyz can keep the heat on bears as a nutty week draws to a close. _______ UPDATE (Sep 28, 5:38 p.m.): DaBoyz in fact got their clock cleaned, but don’t expect them to go quietly into the night. Today’s plunge likely has farther to go, but any trading opportunities will need to be culled from DIA’s intraday histrionics.

DIA – Dow Industrials ETF (Last:342.94)

Posted on September 19, 2021, 9:57 pm EDT

Last Updated October 4, 2021, 10:47 am EDT

Posted on September 19, 2021, 9:57 pm EDT

Last Updated October 4, 2021, 10:47 am EDT