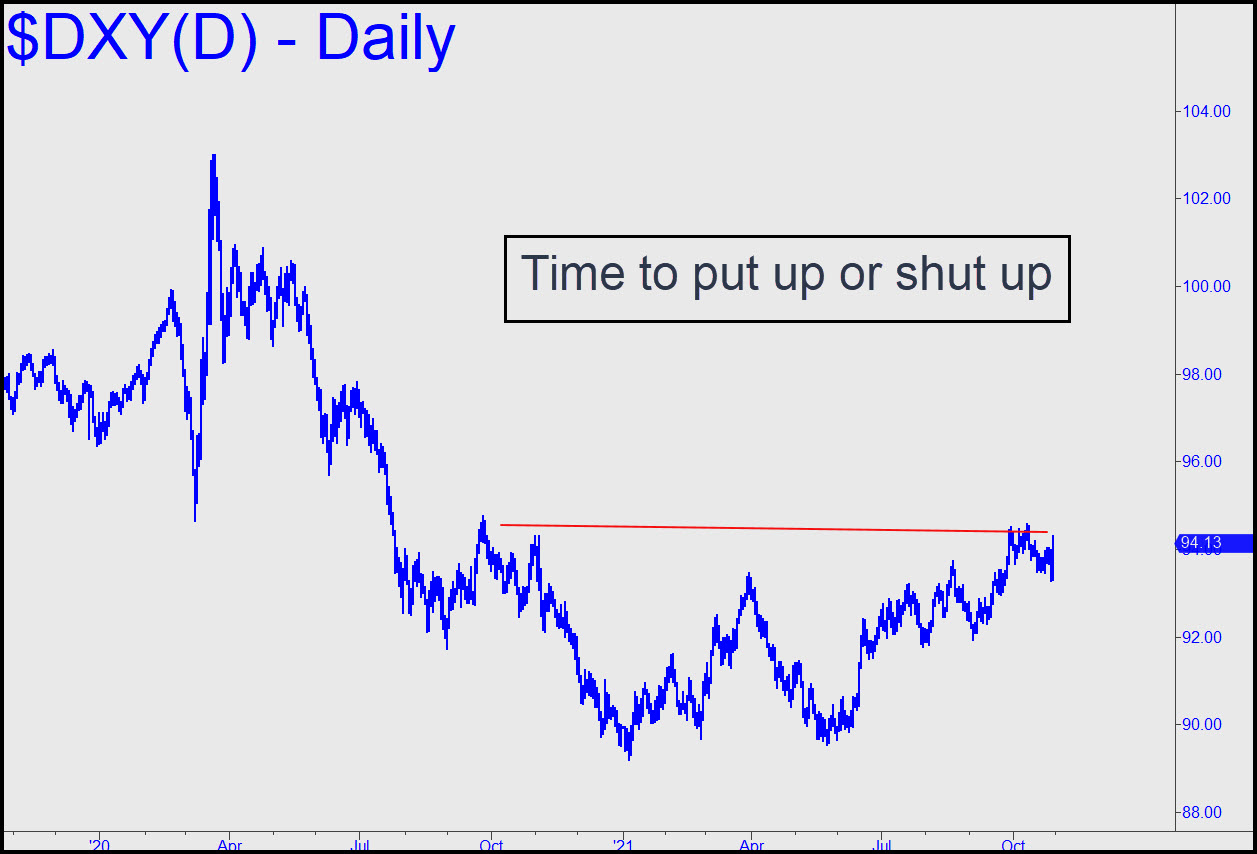

Since January, the dollar has made more headway than anyone might have imagined against the Fed’s heroic efforts to trash it. Even so, the rally has yet to pass a single ‘external’ peak of significance on the daily chart. The nearest lies at 94.74, less than a point above, and getting past it will be crucial to the long-term outlook — not just for the buck, but for gold and silver as well. If and when that happens, it will open a path to at least 98, where another peak recorded 16 months ago will test the rally’s mettle. For now, let’s set a screen alert at 94.75 to announce the breakout. It looks likely, though not quite a done deal. _______ UPDATE (Nov 4, 11:42 p.m.): With the dollar about to break out, putting a nasty new squeeze on stubborn bears, let’s raise our sights to the 94.86 target shown in this chart. _______ UPDATE (Nov 10, 1:19 a.m.): The rally detumesced after having gone no higher on Friday than 94.60. The 94.86 target remains viable nonetheless as a minimum upside objective for the near term. _______ UPDATE (Nov 11, 9:31 p.m.): If inflation is about to devour us, the dollar doesn’t seem to know it. Use the 95.52 target shown in this chart a a minimum upside target for the moment; it is certain to be reached. If the rally impales it, the next ‘D’ lies at 95.89, abased on an ‘A’ low to the left of the one shown. An easy move through it would suggest the inflation-bet unwind is about to come under even greater pressure. ______ UPDATE (Nov 16, 5:47 p.m.): The uptrend poked slightly above 95.89 — no easy feat, considering it is the ‘D’ target of two bullish patterns. A two-day close above it could set dollars bears scrambling for cover.

Since January, the dollar has made more headway than anyone might have imagined against the Fed’s heroic efforts to trash it. Even so, the rally has yet to pass a single ‘external’ peak of significance on the daily chart. The nearest lies at 94.74, less than a point above, and getting past it will be crucial to the long-term outlook — not just for the buck, but for gold and silver as well. If and when that happens, it will open a path to at least 98, where another peak recorded 16 months ago will test the rally’s mettle. For now, let’s set a screen alert at 94.75 to announce the breakout. It looks likely, though not quite a done deal. _______ UPDATE (Nov 4, 11:42 p.m.): With the dollar about to break out, putting a nasty new squeeze on stubborn bears, let’s raise our sights to the 94.86 target shown in this chart. _______ UPDATE (Nov 10, 1:19 a.m.): The rally detumesced after having gone no higher on Friday than 94.60. The 94.86 target remains viable nonetheless as a minimum upside objective for the near term. _______ UPDATE (Nov 11, 9:31 p.m.): If inflation is about to devour us, the dollar doesn’t seem to know it. Use the 95.52 target shown in this chart a a minimum upside target for the moment; it is certain to be reached. If the rally impales it, the next ‘D’ lies at 95.89, abased on an ‘A’ low to the left of the one shown. An easy move through it would suggest the inflation-bet unwind is about to come under even greater pressure. ______ UPDATE (Nov 16, 5:47 p.m.): The uptrend poked slightly above 95.89 — no easy feat, considering it is the ‘D’ target of two bullish patterns. A two-day close above it could set dollars bears scrambling for cover.

DXY – NYBOT Dollar Index (Last:95.25)

Posted on October 31, 2021, 5:02 pm EDT

Last Updated November 16, 2021, 5:46 pm EST

Posted on October 31, 2021, 5:02 pm EDT

Last Updated November 16, 2021, 5:46 pm EST