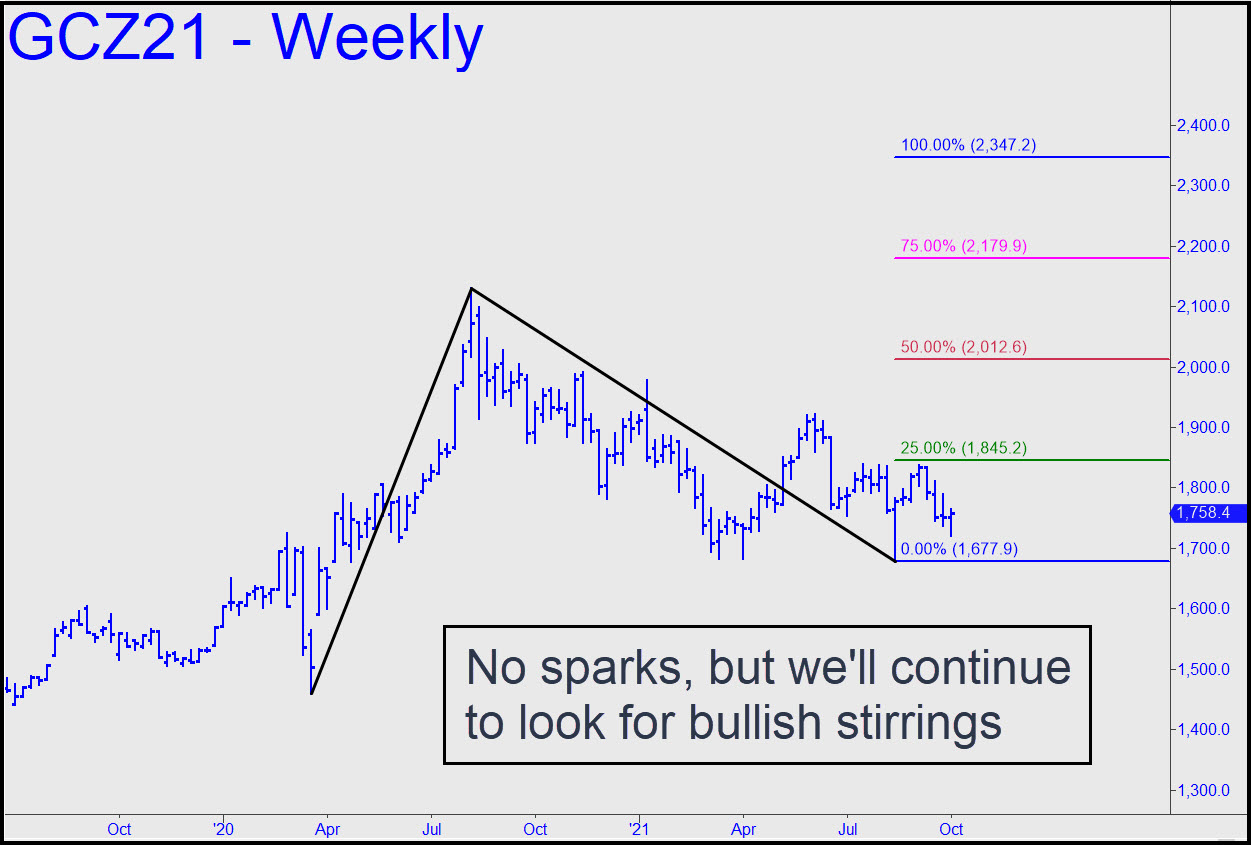

Last week produced an exceptional one-day rally, then a sideways follow-through that looks like a bullish consolidation. The start of something big? Probably not, but we should take the possibility seriously, since, if stocks have entered a bear market, that would be the kind of paradigm shift that could change a picture in bullion that has remained stagnant for a year. I’ve displayed a weekly chart to put the rally in perspective: it is not even a blip, at least not yet. Nor should we get too excited if a fresh burst hits the green line, triggering a theoretical buy signal of long-term degree. That’s happened twice since last summer, only to fail with the creation of two new point ‘C’ lows. This time price action so far is arguably less bullish, since the reaction rally off mid-August’s stop-’em-out low didn’t even reach the green line, nor was it impulsive on the weekly chart. I can offer no trading suggestions at the moment, but if you are scouting the lesser charts for opportunities, please don’t hesitate to ask about them in the chat room. _____ UPDATE (Oct 4, 5:10 p.m. ET): If bears can chew through p=1770 tonight they’ll be in good shape for a follow-through to the 1792.40 target of this pattern. Using ‘camouflage’ to avoid $1100 of entry risk per contract, buy a pullback to the green line ‘mechanically’ if the opportunity should arise, especially in the wee hours. _______ UPDATE (Oct 5, 6:53 a.m.): The trade triggered at 12:39 a.m., 14 minutes after the futures pulled back to the green line (1758.90). The set-up, shown here on the one-minute chart, produced a gain on four contracts of as much as $480 in 40 minutes before gold peaked shortly thereafter and dove. Initial, theoretical risk would have been $200. The trigger was created with a pattern that employed a simple rule of camouflage: Use the first instance of an impulse leg on a lesser (in this case leastmost) chart to draw your tradeable abc pattern. In this case, additionally, to avoid using a buy-stop entry, one could have placed a ‘mechanical’ bid at the green line and waited for the pullback from p2=1759.70 to trigger the trade, stop 1758.50. Looking ahead, December Gold looks like crap this morning, presumably headed for a test of ‘structural’ support at 1747.70 ‘Camouflage’ set-ups can be used in conjunction with any other trading system, not just the Hidden Pivot Method. The technique is covered in detail in a mini-course available to Rick’s Picks subscribers. ______ UPDATE (Oct 5, 5:50 p.m.): The 1792.40 rally target will remain viable as long as C=1747.70 holds. It did so today, barely. ______ UPDATE (Oct 6, 7:38): Gold gratuitously stopped out the low — then whipped around and sprinted higher, of course. This headless-chicken, grind-’em-up-and-spit-em-out price action is getting so tiresome, solipsistic and annoying that I will avert my eyes for a while. I will lean bullish nonetheless because bulls have gotten the worst of it lately, a condition that often precedes significant rallies.

Last week produced an exceptional one-day rally, then a sideways follow-through that looks like a bullish consolidation. The start of something big? Probably not, but we should take the possibility seriously, since, if stocks have entered a bear market, that would be the kind of paradigm shift that could change a picture in bullion that has remained stagnant for a year. I’ve displayed a weekly chart to put the rally in perspective: it is not even a blip, at least not yet. Nor should we get too excited if a fresh burst hits the green line, triggering a theoretical buy signal of long-term degree. That’s happened twice since last summer, only to fail with the creation of two new point ‘C’ lows. This time price action so far is arguably less bullish, since the reaction rally off mid-August’s stop-’em-out low didn’t even reach the green line, nor was it impulsive on the weekly chart. I can offer no trading suggestions at the moment, but if you are scouting the lesser charts for opportunities, please don’t hesitate to ask about them in the chat room. _____ UPDATE (Oct 4, 5:10 p.m. ET): If bears can chew through p=1770 tonight they’ll be in good shape for a follow-through to the 1792.40 target of this pattern. Using ‘camouflage’ to avoid $1100 of entry risk per contract, buy a pullback to the green line ‘mechanically’ if the opportunity should arise, especially in the wee hours. _______ UPDATE (Oct 5, 6:53 a.m.): The trade triggered at 12:39 a.m., 14 minutes after the futures pulled back to the green line (1758.90). The set-up, shown here on the one-minute chart, produced a gain on four contracts of as much as $480 in 40 minutes before gold peaked shortly thereafter and dove. Initial, theoretical risk would have been $200. The trigger was created with a pattern that employed a simple rule of camouflage: Use the first instance of an impulse leg on a lesser (in this case leastmost) chart to draw your tradeable abc pattern. In this case, additionally, to avoid using a buy-stop entry, one could have placed a ‘mechanical’ bid at the green line and waited for the pullback from p2=1759.70 to trigger the trade, stop 1758.50. Looking ahead, December Gold looks like crap this morning, presumably headed for a test of ‘structural’ support at 1747.70 ‘Camouflage’ set-ups can be used in conjunction with any other trading system, not just the Hidden Pivot Method. The technique is covered in detail in a mini-course available to Rick’s Picks subscribers. ______ UPDATE (Oct 5, 5:50 p.m.): The 1792.40 rally target will remain viable as long as C=1747.70 holds. It did so today, barely. ______ UPDATE (Oct 6, 7:38): Gold gratuitously stopped out the low — then whipped around and sprinted higher, of course. This headless-chicken, grind-’em-up-and-spit-em-out price action is getting so tiresome, solipsistic and annoying that I will avert my eyes for a while. I will lean bullish nonetheless because bulls have gotten the worst of it lately, a condition that often precedes significant rallies.

GCZ21 – December Gold (Last:1755.10)

Posted on October 3, 2021, 5:07 pm EDT

Last Updated October 6, 2021, 8:28 pm EDT

Posted on October 3, 2021, 5:07 pm EDT

Last Updated October 6, 2021, 8:28 pm EDT