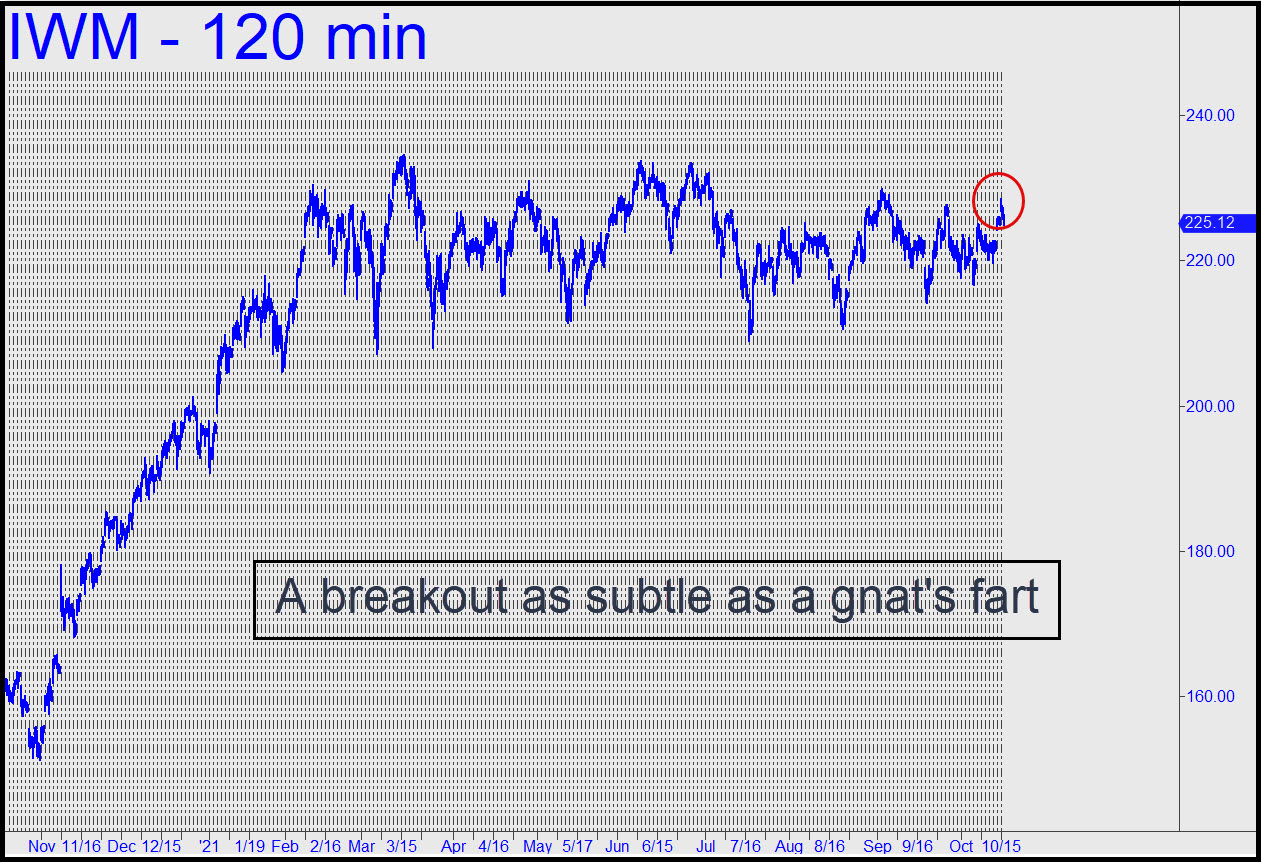

IWM’s short-squeeze gap past an ‘internal’ peak from September 27 is a weak breakout but a breakout nonetheless and therefore tradeable with a bullish bias. That’s notwithstanding the fact that Friday’s peak into a roomy discomfort zone set up a short that was nicely profitable by Friday’s close. The pullback should be seen as merely corrective, however, rather than the beginning of yet another return to the bottom of a tedious range that long ago ceased to hold our attention. I’m not going to day-trade this vehicle for you, but I’ll gladly vet any actionable trading ideas you bring to the chat room. My hunch is that a ‘mechanical’ set-up on a lesser chat will be up to the task. ______ UPDATE (Oct 27, 9:12 p.m.): If this nasty correction comes down to x=218.76, it would trip a ‘mechanical’ buy, stop 213.82. We would not be shooting for a run-up to D=233.55, only to p=223.69, at least to begin with. _______ UPDATE (Oct 28, 8:43 p.m.): The 233.25 target is where IWM is going, and there is no doubt about it.

IWM’s short-squeeze gap past an ‘internal’ peak from September 27 is a weak breakout but a breakout nonetheless and therefore tradeable with a bullish bias. That’s notwithstanding the fact that Friday’s peak into a roomy discomfort zone set up a short that was nicely profitable by Friday’s close. The pullback should be seen as merely corrective, however, rather than the beginning of yet another return to the bottom of a tedious range that long ago ceased to hold our attention. I’m not going to day-trade this vehicle for you, but I’ll gladly vet any actionable trading ideas you bring to the chat room. My hunch is that a ‘mechanical’ set-up on a lesser chat will be up to the task. ______ UPDATE (Oct 27, 9:12 p.m.): If this nasty correction comes down to x=218.76, it would trip a ‘mechanical’ buy, stop 213.82. We would not be shooting for a run-up to D=233.55, only to p=223.69, at least to begin with. _______ UPDATE (Oct 28, 8:43 p.m.): The 233.25 target is where IWM is going, and there is no doubt about it.

IWM – Russell 2000 ETF (Last:223.65)

Posted on October 17, 2021, 5:06 pm EDT

Last Updated October 28, 2021, 8:44 pm EDT

Posted on October 17, 2021, 5:06 pm EDT

Last Updated October 28, 2021, 8:44 pm EDT