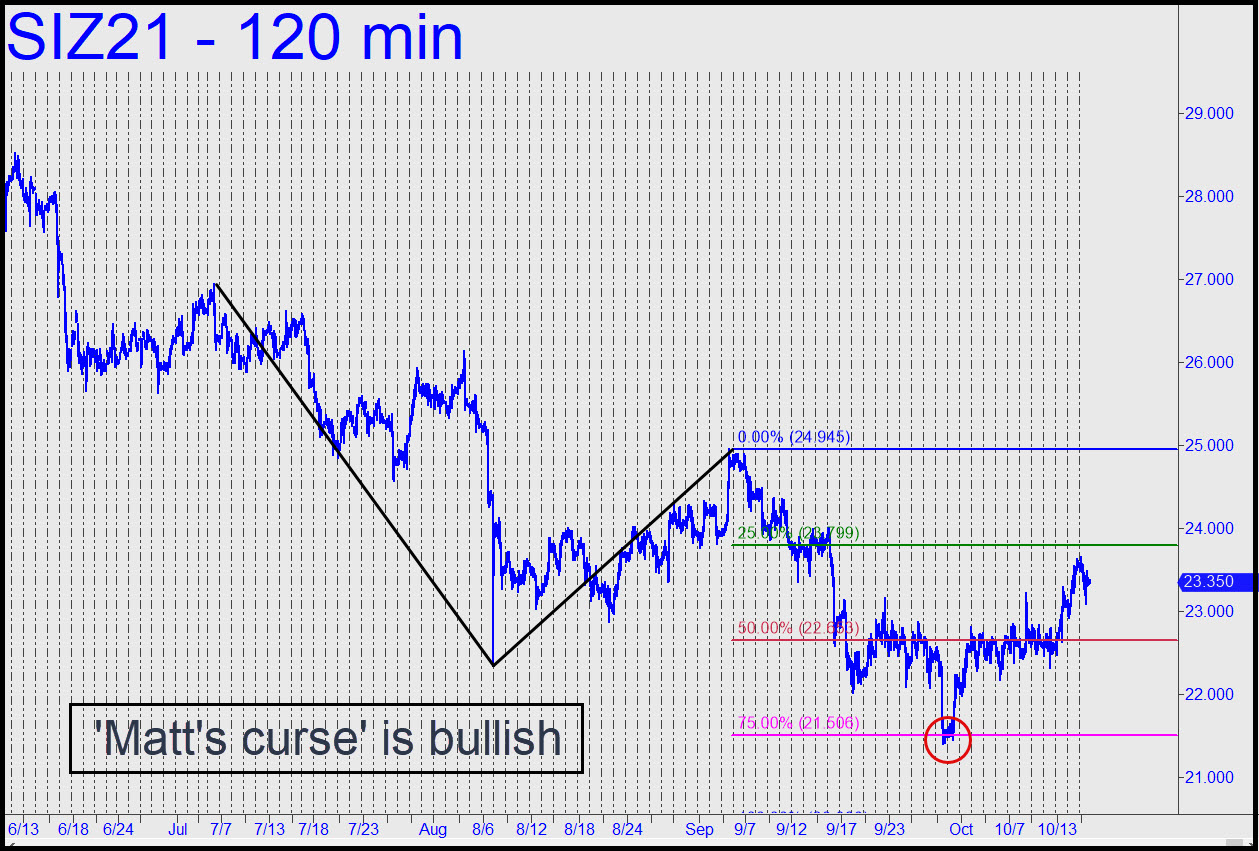

The rally from September 29’s low at 21.60 has ‘Matt’s Curse’ going for it if little else. This trading rule, formulated by subscriber Matt Barnes, holds that a reversal from very close to p2, the secondary pivot, is a good bet to stop out the pattern. I’d originally rated a ‘mechanical’ short at x=23.80 a so-so bet, but given the precise low at p2, I am no longer recommending the trade (other than via a ‘camouflage’ set-up, since that can reduce entry risk by as much as 90%, providing attractive odds for an otherwise risky speculation). We’ll see what Monday brings, but if you’re jones-ing to trade this howling banshee, stay close to the chat room. ______ UPDATE (Oct 23): The steep rally of the last three weeks came with a zillionth of an inch on Friday of validating ‘the Curse’. It would have occurred with a push above the 24.95 point ‘C’ high of the bearish pattern pictured here. The breakout we are likely to see next week will provide an opportunity to get short in the ‘discomfort zone’, but let’s do so gingerly if at all, since bulls may at long last be getting the upper hand.

The rally from September 29’s low at 21.60 has ‘Matt’s Curse’ going for it if little else. This trading rule, formulated by subscriber Matt Barnes, holds that a reversal from very close to p2, the secondary pivot, is a good bet to stop out the pattern. I’d originally rated a ‘mechanical’ short at x=23.80 a so-so bet, but given the precise low at p2, I am no longer recommending the trade (other than via a ‘camouflage’ set-up, since that can reduce entry risk by as much as 90%, providing attractive odds for an otherwise risky speculation). We’ll see what Monday brings, but if you’re jones-ing to trade this howling banshee, stay close to the chat room. ______ UPDATE (Oct 23): The steep rally of the last three weeks came with a zillionth of an inch on Friday of validating ‘the Curse’. It would have occurred with a push above the 24.95 point ‘C’ high of the bearish pattern pictured here. The breakout we are likely to see next week will provide an opportunity to get short in the ‘discomfort zone’, but let’s do so gingerly if at all, since bulls may at long last be getting the upper hand.

SIZ21 – December Silver (Last:24.45)

Posted on October 17, 2021, 5:09 pm EDT

Last Updated October 23, 2021, 4:07 pm EDT

Posted on October 17, 2021, 5:09 pm EDT

Last Updated October 23, 2021, 4:07 pm EDT