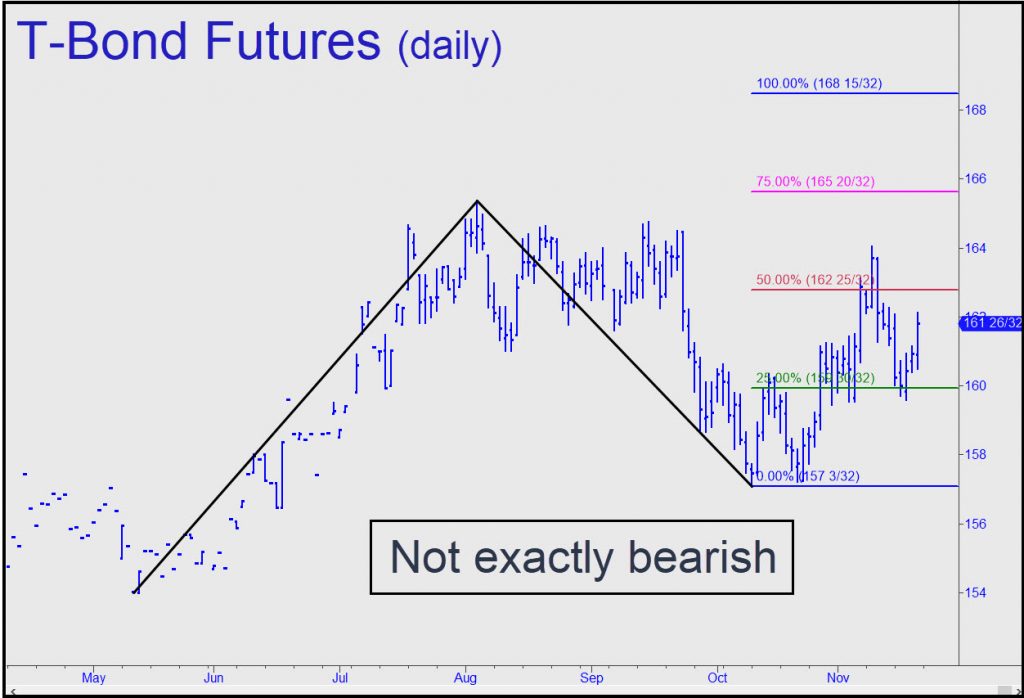

Did you notice last week’s tone change? The whole, eternally benighted world of pundits, economists, Bloomberg news producers, forecasters et al. has been disbelieving the bond rally as the Fed’s ultimately unredeemable portfolio of Treasury debt has grown from merely massive to intergalactic in size. Now the talking heads are having to change their tune in order to catch up with charts that have been no worse than neutral on T-Bonds for months. So what “story” are they telling themselves to explain what they were unwilling to see back in January? Simply that we are witnessing a global “flight to safety” as Covid threatens to tank the economies of Europe and China yet again.

Did you notice last week’s tone change? The whole, eternally benighted world of pundits, economists, Bloomberg news producers, forecasters et al. has been disbelieving the bond rally as the Fed’s ultimately unredeemable portfolio of Treasury debt has grown from merely massive to intergalactic in size. Now the talking heads are having to change their tune in order to catch up with charts that have been no worse than neutral on T-Bonds for months. So what “story” are they telling themselves to explain what they were unwilling to see back in January? Simply that we are witnessing a global “flight to safety” as Covid threatens to tank the economies of Europe and China yet again.

Of course, nothing says “safety” like the whole world piling onto the shoddy, brittle edifice of U.S. debt. Trust your instincts: This trend cannot end well. In the meantime, the technical outlook calls for at least somewhat higher T-Bond prices and correspondingly lower yields. On the long bond, that would imply a descent to 1.70% from a current 1.91%. If that level is breached we could see 1.54%. At some point, the lower rates accompanying a bear market in stocks will be seen as reflecting not a flight to safety, but as a manifestation of the catastrophic deflation that has been bearing down on the financial planet, steadily gathering size and strength since the S&L crisis of the early 1990s.

Dollar Short Squeeze = Deflation

While economists have kept busy trying not to acknowledge that T-Bonds are moving in the wrong direction, a rising dollar has equally confounded them, as well as investors who bet on inflation. Although lower yields are ostensibly benign, albeit faintly symptomatic of the coming deflationary bust, a strong dollar is capable of wrecking the global financial system overnight. I’ve written here before about the prospect of a massive short-squeeze on dollars that — to remind you — are fundamentally worthless. This could happen if something that initially will be spun as a hiccup in the banking system causes short-term lenders to stop rolling their loans. The exquisitely complex bank clearing network — the same one that enables ATMs to spit out $20 bills on demand — will seize up instantly, and everyone in need of money will discover that the digital dollars the Fed creates so effortlessly are actually quite hard to come by in tangible form. So if you’ve got that shoe box full of $5s, $10s, $20s and $100s stashed away as I’ve advised, hold onto it, since it might prove useful when the banks fail to open one day in the not-too-distant future.

Rick, agree with you wholeheartedly once this overvalued market matrix reality begins to play out

and the entranced begin to wake up with margin calls, the only sure advice from Wall Street,

ask Jon Corzine and MF Global.

Lemmings leap and moths fly into the flame.

This past week approached by long-lost friends asking for approval plunging into RIVN and SHOP at Niagara Fall highs.

Suggested they look into dollar-cost-averaging a long-term global capital cycles 25 % precious value fund taken over in 2018 by an institutional Blue Chip Boston firm since 1928 with a trillion AUM.

Their Chairman left in the 1974 Nifty Fifty Bear Market to found a firm in Valley Forge owned by shareholders with over $8 trillion AUM.

Today we have the MAGNAF’N Samurai Seven Tech Titanic.

So an ordinary two-year free market Coolidge Jackson Depression

may become a Jubilee generation Biden FDR rigged market calamity.

Biden today reappointed the most profligate Fed Chair ever.

Let us be careful what myopic pundits praise.

The 20/30 year Treasury spread has an inverted warning.

The last time this happened was the Fall of 2007,

heralding the – 57 % SPY correction from

157.52 in Sep 2007 to 67.10 in Mar 2009.

QQQ this time could illustrate Matthew 20:16, the first will be last.

TLT Target now – 33 % from 147.64 to 99

as well as Big4 COT 181% SHORT Ultra Treasury Bonds.

What do the smartest of the smart money know ?

Not everyone recalls TLT fell – 29 % from 123.15 in Dec 2008 to 87.56 in May 2009 when debts, derivatives and unfunded mandates were considerably smaller than now and most in the market left.

https://www.usdebtclock.org/

Markets fly in asymptotic orbit over our contracting hyper-leveraged subterranean economy:

http://www.shadowstats.com/

Otherwise sane men plunge into bitcoins and meme plugs

already pulled out by the world’s largest American subsidized economy

by purchasing parity, the CCP.

The world goes mad all at once, but regains its sense one by one.

More’s the pity.