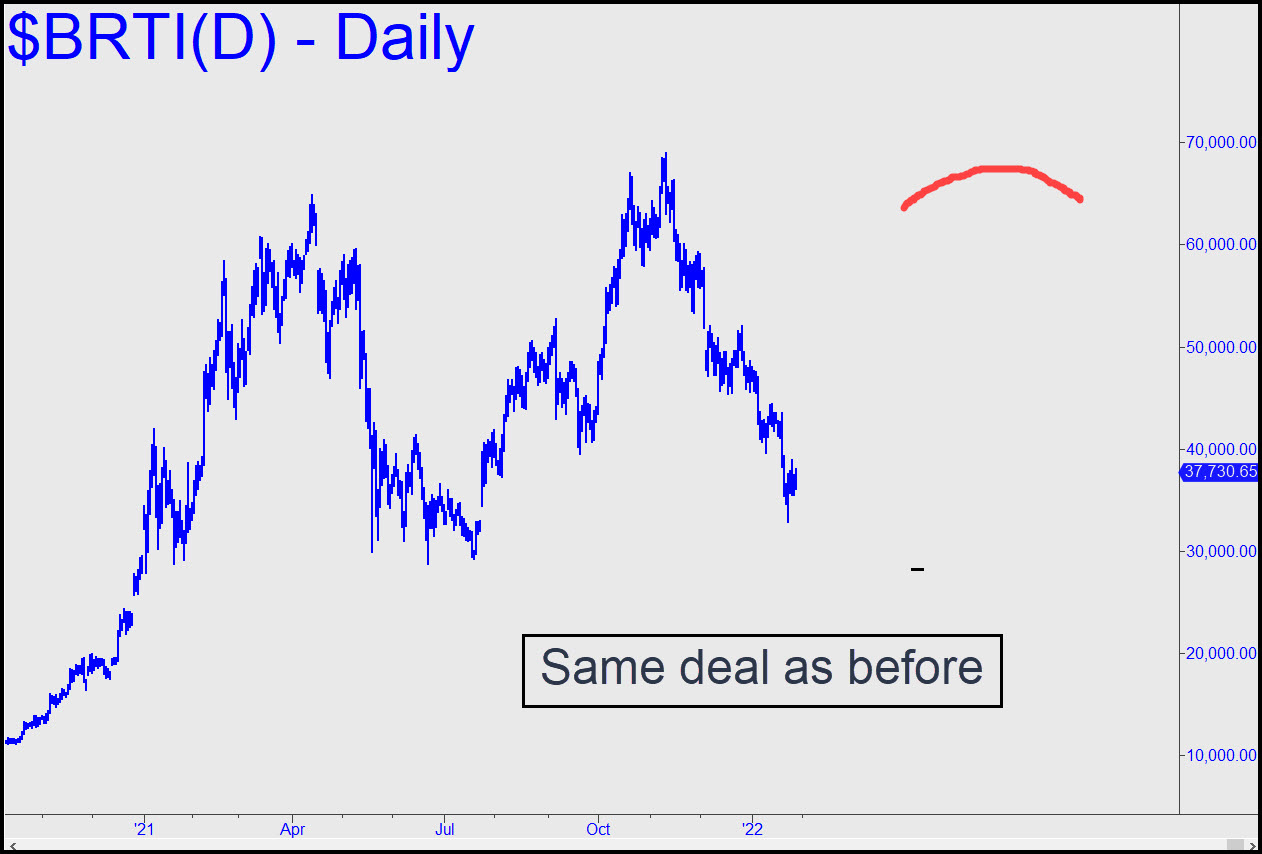

Bertie’s constipated price action does not warrant any changes in the chart previously shown here. We see a large, potentially gorgeous head-and-shoulders top forming that could continue to evolve until April or May. It’s hard to believe the bull market will last that long, but we’ll give this scenario the benefit of the doubt, since what else do we have to sustain our interest in bitcoin when it is in a cooling-off period that is about to enter its second year? I will supply trading guidance in the chat room if the interest is there. For now, use the neckline just below 30,000 as a minimum downside objective for the bear cycle begun from 69,000 in November. _______ UPDATE (Feb 1, 5:55 p.m.): Bertie has become gutless — a go-along trading vehicle that at the moment is docilely trailing the short squeeze in the broad averages. ______ UPDATE (Feb 2, 9:03 p.m.): …and now it is following index futures lower, in high-beta fashion. ______ UPDATE (Feb 3, 10:05 a.m.): Bertie has triggered a ‘conventional’ short down to 28,742, but bears shouldn’t look for a quick payoff. There are no sellers, only a relative dearth of buyers, so any bleed-out will necessarily come from an accretion of paper cuts.

Bertie’s constipated price action does not warrant any changes in the chart previously shown here. We see a large, potentially gorgeous head-and-shoulders top forming that could continue to evolve until April or May. It’s hard to believe the bull market will last that long, but we’ll give this scenario the benefit of the doubt, since what else do we have to sustain our interest in bitcoin when it is in a cooling-off period that is about to enter its second year? I will supply trading guidance in the chat room if the interest is there. For now, use the neckline just below 30,000 as a minimum downside objective for the bear cycle begun from 69,000 in November. _______ UPDATE (Feb 1, 5:55 p.m.): Bertie has become gutless — a go-along trading vehicle that at the moment is docilely trailing the short squeeze in the broad averages. ______ UPDATE (Feb 2, 9:03 p.m.): …and now it is following index futures lower, in high-beta fashion. ______ UPDATE (Feb 3, 10:05 a.m.): Bertie has triggered a ‘conventional’ short down to 28,742, but bears shouldn’t look for a quick payoff. There are no sellers, only a relative dearth of buyers, so any bleed-out will necessarily come from an accretion of paper cuts.

BRTI – CME Bitcoin Index (Last:36,520)

Posted on January 30, 2022, 5:10 pm EST

Last Updated February 3, 2022, 10:06 am EST

Posted on January 30, 2022, 5:10 pm EST

Last Updated February 3, 2022, 10:06 am EST