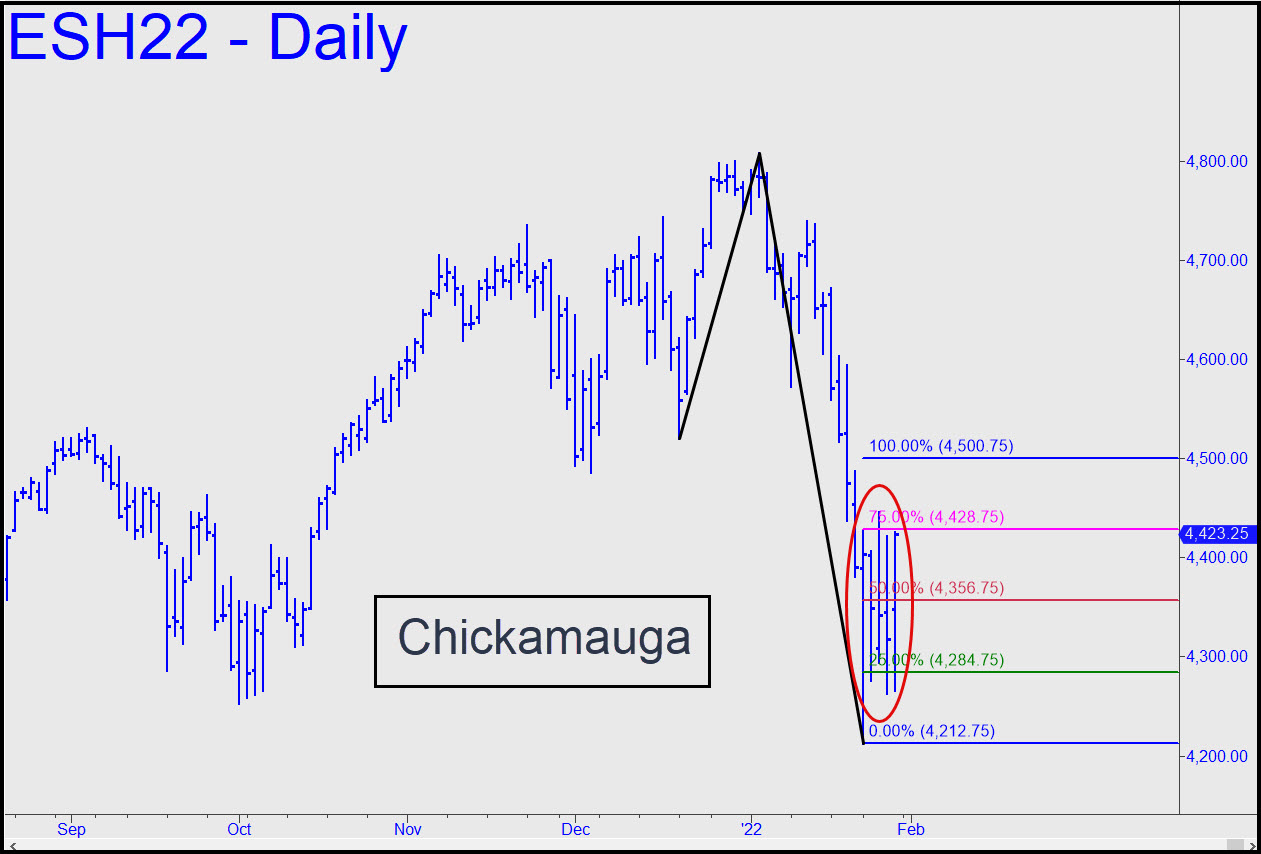

Last week’s elongated bars imply bulls and bears were more or less evenly divided as they fought for their respective lives near the bottom of January’s plunge. You can use the 4500.75 ‘D’ target of the reverse pattern shown as an upside target as the week begins, but I am not recommending shorting there unless with ‘camouflage’ cover limiting your risk to no more than relative pocket change. The pattern worked well for ‘mechanical’ bids at the green line, but using it again will likely be pushing your luck. ______ UPDATE (Jan 31, 7:43 p.m.): ES poked its snout above the 4500 target for a few minutes, then pulled back to cruising altitude so that DaBoyz can await further instruction. It will come via the desertion of sellers, short-covering bears uncomfortable with the recalcitrance of the pullback or, most likely, a combination of both. ______ UPDATE (Feb 1, 5:40 p.m.): The way bears have obligingly placed their testicles in Mr. Market’s vise could make one wonder how on earth the bull market will ever end. DaBoyz twiddled their thumbs for most of the session, effortlessly holding stocks aloft until shorts capitulated in the final hour. The latter now look like dead ducks — worse than dead ducks, actually, since they are probably hoping tomorrow will somehow be different. _______ UPDATE (Feb 2, 8:56 p.m.): Use this sumptuously gnarly pattern for all purposes — and yes, it does imply a ‘mechanical’ bid at x=4503.25 is warranted if you know how to ‘camo’ your way aboard for no more than $800 of theoretical entry risk (on four contracts). ______ UPDATE (Feb 3, 9:35 p.m.): The futures are in a steep short-squeeze following after-hours news that business is just hunky-dory at Amazon. Wall Street is crazy for companies that show sufficient pricing power to sodomize their customers, and so traders lost no time bidding up Amazon shares on word that Prime will soon cost $139, up very substantially from the current $119. Even so, don’t expect this rally to get very far, since news-driven, criminally managed price spikes almost never do.

Last week’s elongated bars imply bulls and bears were more or less evenly divided as they fought for their respective lives near the bottom of January’s plunge. You can use the 4500.75 ‘D’ target of the reverse pattern shown as an upside target as the week begins, but I am not recommending shorting there unless with ‘camouflage’ cover limiting your risk to no more than relative pocket change. The pattern worked well for ‘mechanical’ bids at the green line, but using it again will likely be pushing your luck. ______ UPDATE (Jan 31, 7:43 p.m.): ES poked its snout above the 4500 target for a few minutes, then pulled back to cruising altitude so that DaBoyz can await further instruction. It will come via the desertion of sellers, short-covering bears uncomfortable with the recalcitrance of the pullback or, most likely, a combination of both. ______ UPDATE (Feb 1, 5:40 p.m.): The way bears have obligingly placed their testicles in Mr. Market’s vise could make one wonder how on earth the bull market will ever end. DaBoyz twiddled their thumbs for most of the session, effortlessly holding stocks aloft until shorts capitulated in the final hour. The latter now look like dead ducks — worse than dead ducks, actually, since they are probably hoping tomorrow will somehow be different. _______ UPDATE (Feb 2, 8:56 p.m.): Use this sumptuously gnarly pattern for all purposes — and yes, it does imply a ‘mechanical’ bid at x=4503.25 is warranted if you know how to ‘camo’ your way aboard for no more than $800 of theoretical entry risk (on four contracts). ______ UPDATE (Feb 3, 9:35 p.m.): The futures are in a steep short-squeeze following after-hours news that business is just hunky-dory at Amazon. Wall Street is crazy for companies that show sufficient pricing power to sodomize their customers, and so traders lost no time bidding up Amazon shares on word that Prime will soon cost $139, up very substantially from the current $119. Even so, don’t expect this rally to get very far, since news-driven, criminally managed price spikes almost never do.

ESH22 – March E-Mini S&P (Last:4515.00)

Posted on January 30, 2022, 5:13 pm EST

Last Updated February 4, 2022, 8:27 am EST

Posted on January 30, 2022, 5:13 pm EST

Last Updated February 4, 2022, 8:27 am EST