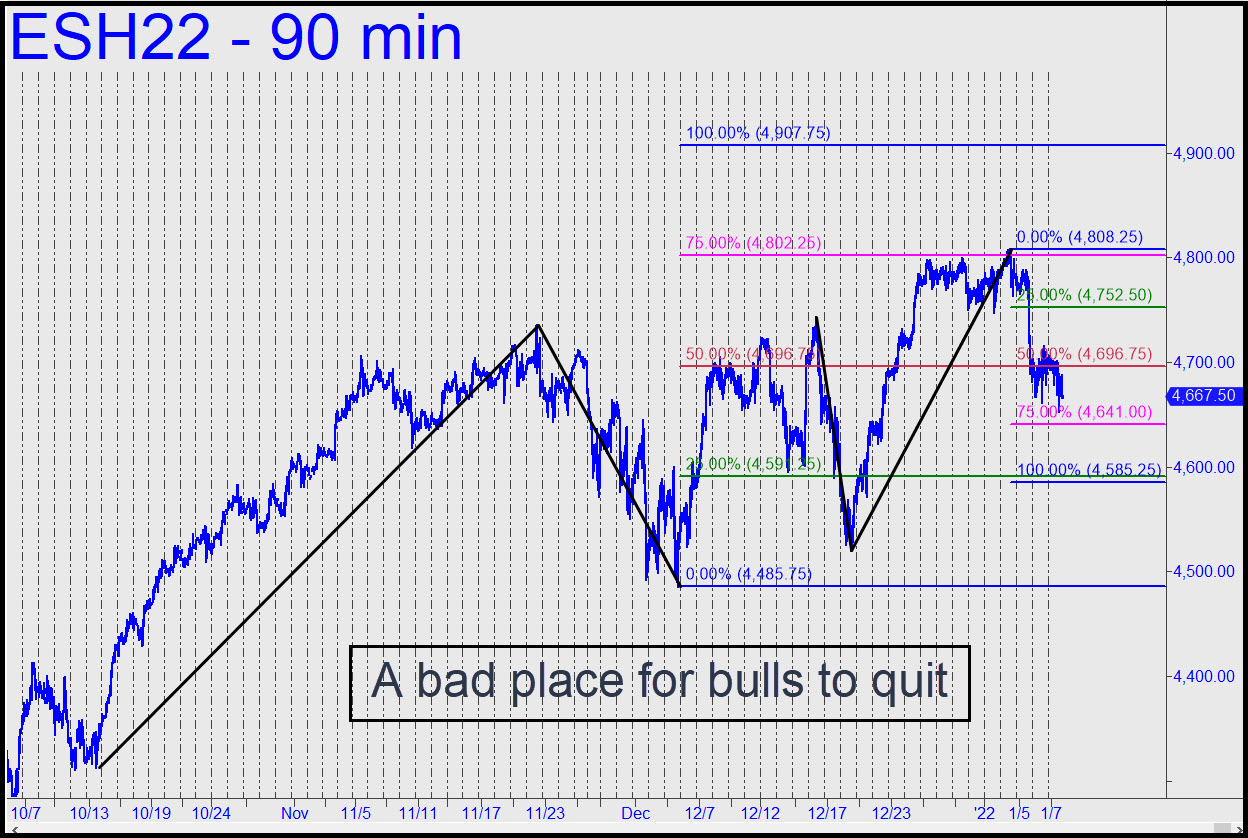

We’ll treat last week’s stall-n-dive as just an annoying detour on the way to a 4907.75 rally target that still looks likely to be reached. It is odd nonetheless that sellers were unable to put this gas bag down on Friday with a concerted push toward D=4585.25 of the small ‘reverse’ pattern shown. Powell had ratcheted up his tapeworm twaddle to the max earlier in the week, and although T-Bonds acted as though they actually believe the guy, stocks evidently know better. Still, ES is in the throes of a ‘Matt’s Curse’, having peaked almost precisely at the 4803 secondary pivot, When this happens, odds of a corrective crash through the ‘C’ low — in this case 4485.75 — supposedly rise. _______ UPDATE (Jan 10, 5:33 pm.): It took two tries, but a trade I recommended in the chat room at 10:53 got traction just ahead of today’s 90-point rally. Several subscribers appeared to have jumped on it, so I tracked the position and provided detailed suggestions for managing the risk as the day wore on. Check it out and see whether you could have followed my advice. It included the use of a ‘dynamic’ trailing stop, a concept explained in my running commentary. I’d suggest moving to the sidelines for now, since the session ended with bears hanging on the ropes.

We’ll treat last week’s stall-n-dive as just an annoying detour on the way to a 4907.75 rally target that still looks likely to be reached. It is odd nonetheless that sellers were unable to put this gas bag down on Friday with a concerted push toward D=4585.25 of the small ‘reverse’ pattern shown. Powell had ratcheted up his tapeworm twaddle to the max earlier in the week, and although T-Bonds acted as though they actually believe the guy, stocks evidently know better. Still, ES is in the throes of a ‘Matt’s Curse’, having peaked almost precisely at the 4803 secondary pivot, When this happens, odds of a corrective crash through the ‘C’ low — in this case 4485.75 — supposedly rise. _______ UPDATE (Jan 10, 5:33 pm.): It took two tries, but a trade I recommended in the chat room at 10:53 got traction just ahead of today’s 90-point rally. Several subscribers appeared to have jumped on it, so I tracked the position and provided detailed suggestions for managing the risk as the day wore on. Check it out and see whether you could have followed my advice. It included the use of a ‘dynamic’ trailing stop, a concept explained in my running commentary. I’d suggest moving to the sidelines for now, since the session ended with bears hanging on the ropes.

ESH22 – March E-MIni S&P (Last:4662.50)

Posted on January 9, 2022, 5:18 pm EST

Last Updated January 10, 2022, 5:32 pm EST

Posted on January 9, 2022, 5:18 pm EST

Last Updated January 10, 2022, 5:32 pm EST