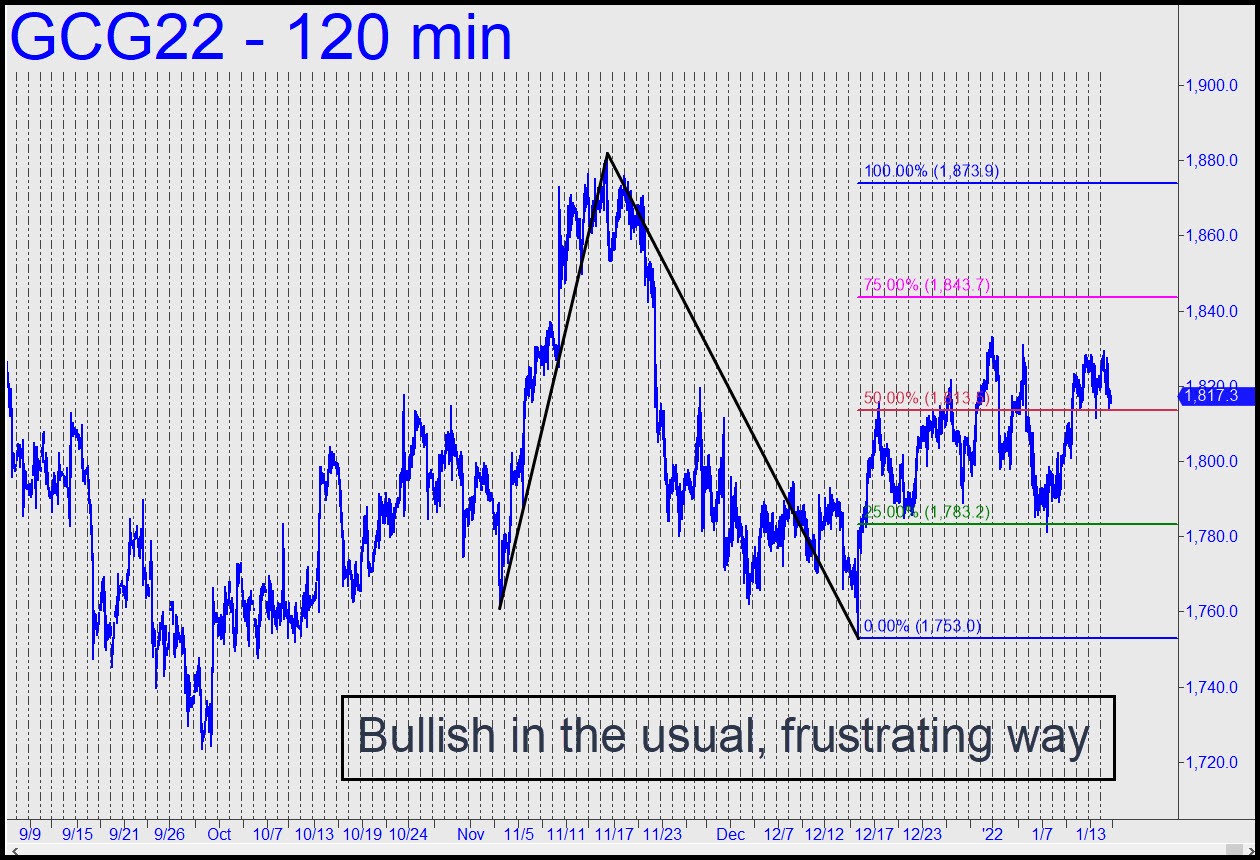

The week ended with a very real profit of as much as $8,000 for anyone who followed my explicit instructions. Can we do it again, you ask? Probably, although trading this particular vehicle successfully will always be akin to extracting opportunity from a hacking cough. Our winners are necessarily leveraged at the tops of disappointing rallies and at the bottoms of gratuitously scary dives. That, after all, is what gold does — has been doing for years. Between these extremities lies the aforementioned hacking cough, and although its volatility should make for bountiful trading in theory, it is too much work to concern ourselves with here. The pattern shown has rewarded ‘mechanical’ buyers twice, but I doubt a third winner will be so easy. Even so, you can use the ‘reverse’ pattern shown, with an 1873.90 rally target, to plot your strategy or merely assess the strength of the uptrend, such as it is. The bad guys seemingly lack the guts to push the futures below C=1753.00, but I hesitate to use this observation to greenlight any old ‘mechanical’ buy set-up that comes along. ______ UPDATE (Jan 19, 10:40 p.m. EST): This evening’s vertical spike has stalled very precisely at p2=1843.70 of the bullish pattern that has guided us for the last month. A decisive push through it would clinch more upside to the 1873.90 target, but it will be more interesting if this Hidden Pivot gives way easily. That would set up a test of the key ‘external’ peak at 1922.80 recorded on June 1.

The week ended with a very real profit of as much as $8,000 for anyone who followed my explicit instructions. Can we do it again, you ask? Probably, although trading this particular vehicle successfully will always be akin to extracting opportunity from a hacking cough. Our winners are necessarily leveraged at the tops of disappointing rallies and at the bottoms of gratuitously scary dives. That, after all, is what gold does — has been doing for years. Between these extremities lies the aforementioned hacking cough, and although its volatility should make for bountiful trading in theory, it is too much work to concern ourselves with here. The pattern shown has rewarded ‘mechanical’ buyers twice, but I doubt a third winner will be so easy. Even so, you can use the ‘reverse’ pattern shown, with an 1873.90 rally target, to plot your strategy or merely assess the strength of the uptrend, such as it is. The bad guys seemingly lack the guts to push the futures below C=1753.00, but I hesitate to use this observation to greenlight any old ‘mechanical’ buy set-up that comes along. ______ UPDATE (Jan 19, 10:40 p.m. EST): This evening’s vertical spike has stalled very precisely at p2=1843.70 of the bullish pattern that has guided us for the last month. A decisive push through it would clinch more upside to the 1873.90 target, but it will be more interesting if this Hidden Pivot gives way easily. That would set up a test of the key ‘external’ peak at 1922.80 recorded on June 1.

GCG22 – February Gold (Last:1840.70)

Posted on January 16, 2022, 5:12 pm EST

Last Updated January 19, 2022, 10:40 pm EST

Posted on January 16, 2022, 5:12 pm EST

Last Updated January 19, 2022, 10:40 pm EST