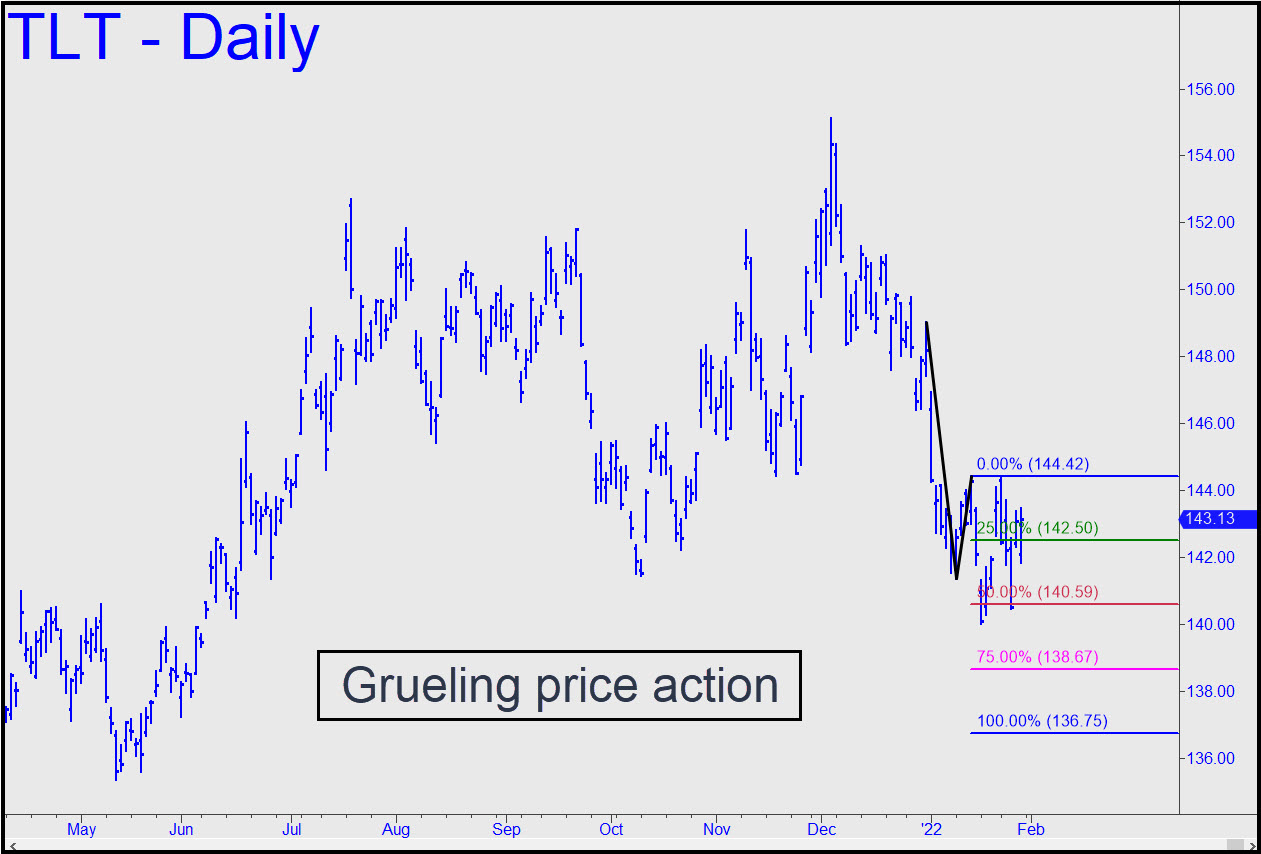

I’ve substituted TLT for T-Bond futures to give equity traders a chance to get involved. If a trade is signaled, it should be executed using TLT itself rather than puts and calls (unless they look particularly timely and opportune). There is nothing of the sort in this picture at the moment, although it may hold some small appeal for straddle sellers. A bullish resolution to this tenesmus picture is possible if TLT can rally above the pattern’s 144.42 point ‘C’ high. That would exceed two peaks, creating an impulse leg more powerful than would be apparent at a glance.

I’ve substituted TLT for T-Bond futures to give equity traders a chance to get involved. If a trade is signaled, it should be executed using TLT itself rather than puts and calls (unless they look particularly timely and opportune). There is nothing of the sort in this picture at the moment, although it may hold some small appeal for straddle sellers. A bullish resolution to this tenesmus picture is possible if TLT can rally above the pattern’s 144.42 point ‘C’ high. That would exceed two peaks, creating an impulse leg more powerful than would be apparent at a glance.

TLT – Lehman Bond ETF (Last:143.13)

Posted on January 30, 2022, 5:06 pm EST

Last Updated January 31, 2022, 12:08 pm EST

Posted on January 30, 2022, 5:06 pm EST

Last Updated January 31, 2022, 12:08 pm EST