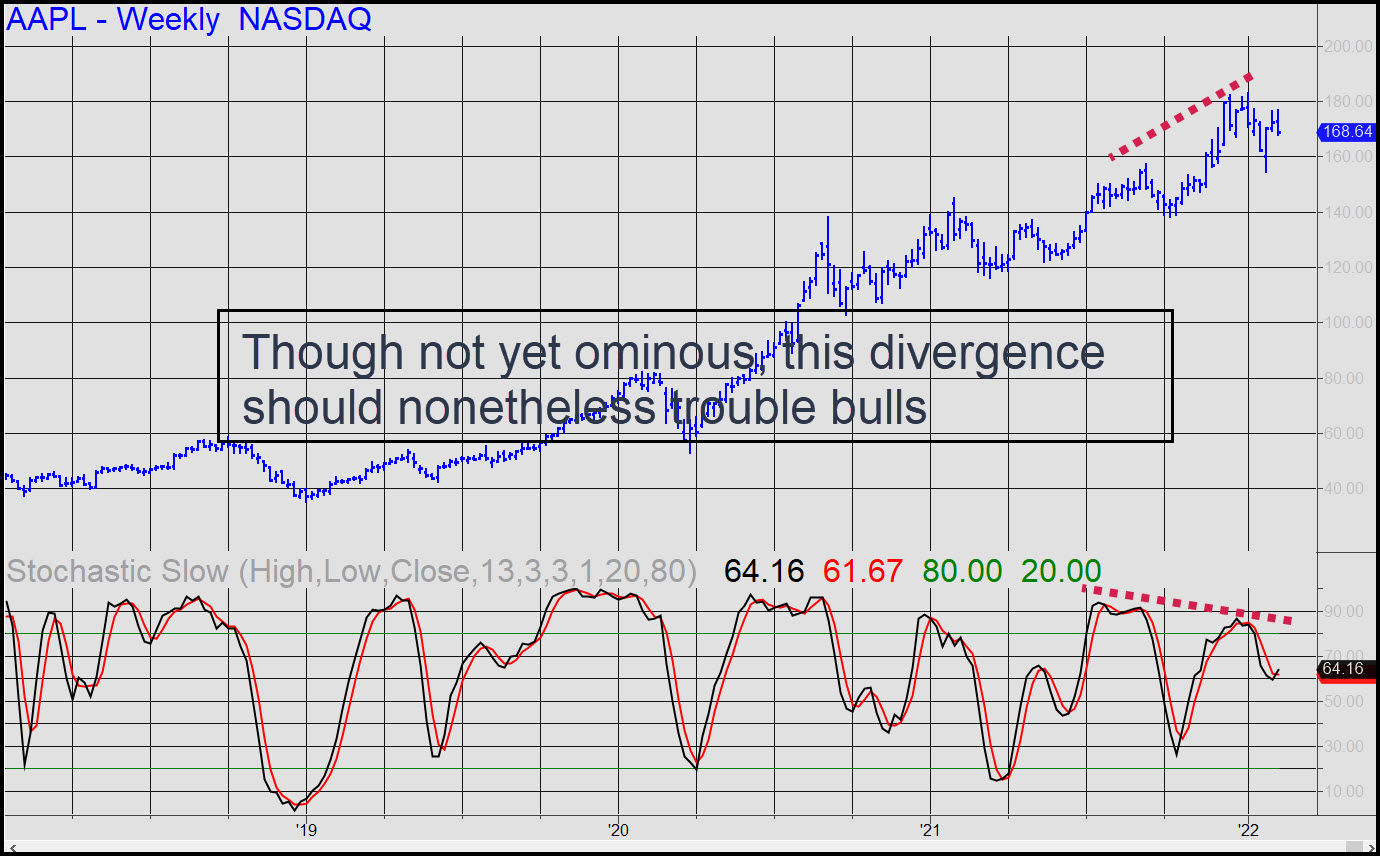

For now, allow for minimum downside to the 165.41 midpoint ‘hidden’ support of this pattern. Because of the mild gnarliness of this picture and the deep-sea location of p, you can try bottom-fishing there with a very tight stop-loss, even using out-of-the-money call options to leverage the bounce. Be sure to cash out half if they double in price! The chart shown in the inset yields a different and more troubling picture. The stochastic divergence shown is quite bearish, even if it is not yet ominous. I will continue to monitor it, since AAPL remains The Only Stock That Matters. ______ UPDATE (Feb 14, 2022): AAPL’s unwillingness to fall is what kept the stock market from continuing Friday’s refreshing slide. The Hidden Pivot at 165.41 could still get schmeissed, but that didn’t seem likely at the bell. _______ UPDATE (Feb 15, 11:04 p.m.): Even if the pattern shown in this chart doesn’t develop into a textbook head-and-shoulders, the look of it at the moment is bullish. To give bears the benefit of the doubt, however, we should hold the applause until such time as buyers push above the key peak at 177.18 recorded on January 12. _______ UPDATE (Feb 17, 6:07 p.m.): Weakness over the last several days has started to bend the head-and-shoulders pattern out of symmetry, somewhat diminishing its bullishness..

For now, allow for minimum downside to the 165.41 midpoint ‘hidden’ support of this pattern. Because of the mild gnarliness of this picture and the deep-sea location of p, you can try bottom-fishing there with a very tight stop-loss, even using out-of-the-money call options to leverage the bounce. Be sure to cash out half if they double in price! The chart shown in the inset yields a different and more troubling picture. The stochastic divergence shown is quite bearish, even if it is not yet ominous. I will continue to monitor it, since AAPL remains The Only Stock That Matters. ______ UPDATE (Feb 14, 2022): AAPL’s unwillingness to fall is what kept the stock market from continuing Friday’s refreshing slide. The Hidden Pivot at 165.41 could still get schmeissed, but that didn’t seem likely at the bell. _______ UPDATE (Feb 15, 11:04 p.m.): Even if the pattern shown in this chart doesn’t develop into a textbook head-and-shoulders, the look of it at the moment is bullish. To give bears the benefit of the doubt, however, we should hold the applause until such time as buyers push above the key peak at 177.18 recorded on January 12. _______ UPDATE (Feb 17, 6:07 p.m.): Weakness over the last several days has started to bend the head-and-shoulders pattern out of symmetry, somewhat diminishing its bullishness..

AAPL – Apple Computer (Last:168.92)

Posted on February 13, 2022, 5:21 pm EST

Last Updated February 17, 2022, 6:07 pm EST

Posted on February 13, 2022, 5:21 pm EST

Last Updated February 17, 2022, 6:07 pm EST