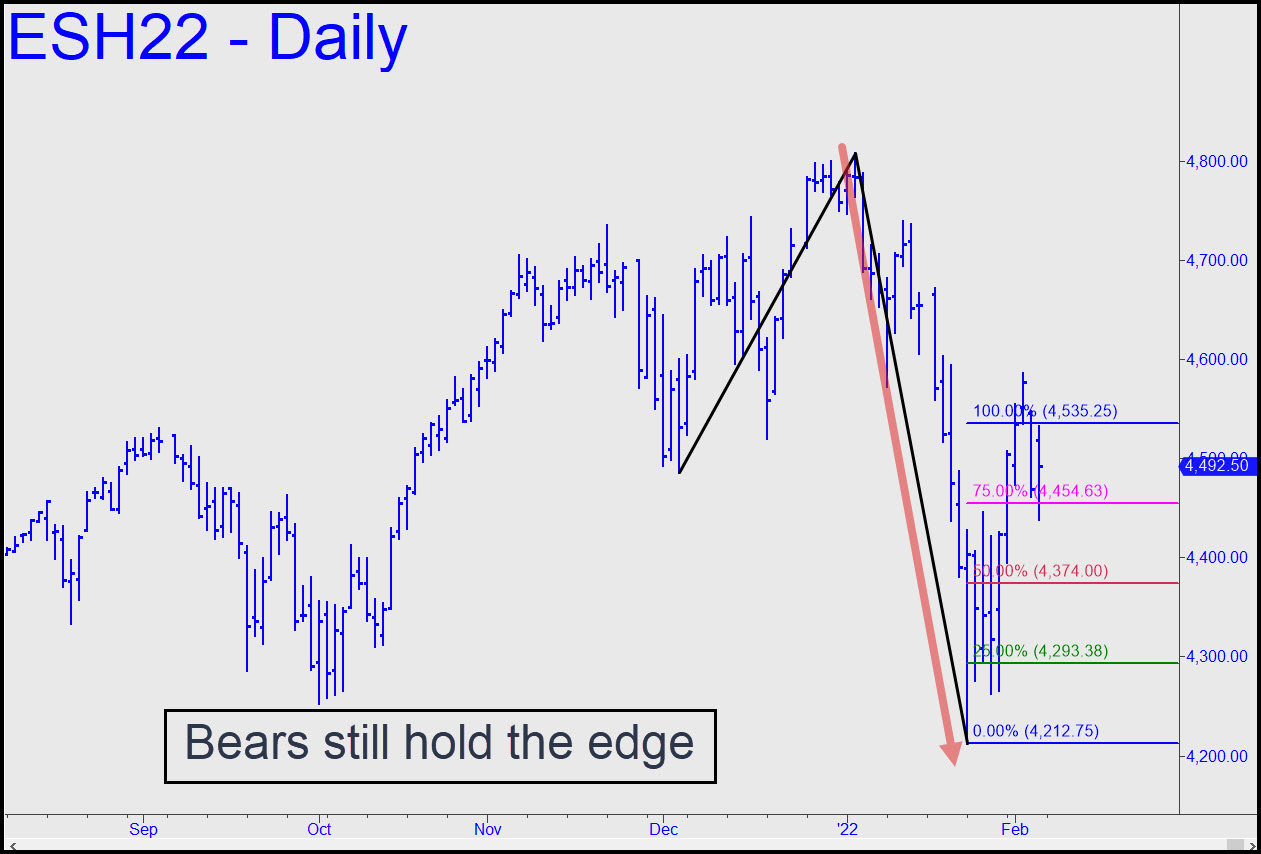

Short-covering extended the stock market’s bounce for a second week, but without generating any impulse legs on the daily chart. On balance, bears still appear to hold the edge, mainly because of the steep pitch and power of January’s sell-off. We should give bulls wide berth nonetheless, since the week ended with an earnings blowout at Amazon and a 20-1 stock split for Google shares that will enable the riff-raff to own the stock just like the big boys. Let’s greet the new week from the sidelines, until we get a clear sign of where things are headed. _______ UPDATE (Feb 9, 8:24 p.m. EST): Signs this week have been clearly bullish, which suggests that the bear rally, if that’s all it is, is doing its job effectively. If the move achieves new record highs, which looks like no worse than an even bet at the moment, we may be pondering the same question even then: is it for real, or not? Instead of worrying about it or trying to guess how and where a top might occur, we should simply trade with the trend. Nudge me in the chat room if you want further guidance during regular hours.

Short-covering extended the stock market’s bounce for a second week, but without generating any impulse legs on the daily chart. On balance, bears still appear to hold the edge, mainly because of the steep pitch and power of January’s sell-off. We should give bulls wide berth nonetheless, since the week ended with an earnings blowout at Amazon and a 20-1 stock split for Google shares that will enable the riff-raff to own the stock just like the big boys. Let’s greet the new week from the sidelines, until we get a clear sign of where things are headed. _______ UPDATE (Feb 9, 8:24 p.m. EST): Signs this week have been clearly bullish, which suggests that the bear rally, if that’s all it is, is doing its job effectively. If the move achieves new record highs, which looks like no worse than an even bet at the moment, we may be pondering the same question even then: is it for real, or not? Instead of worrying about it or trying to guess how and where a top might occur, we should simply trade with the trend. Nudge me in the chat room if you want further guidance during regular hours.

ESH22 – March E-Mini S&P (Last:4571.25)

Posted on February 6, 2022, 5:17 pm EST

Last Updated February 9, 2022, 8:23 pm EST

Posted on February 6, 2022, 5:17 pm EST

Last Updated February 9, 2022, 8:23 pm EST