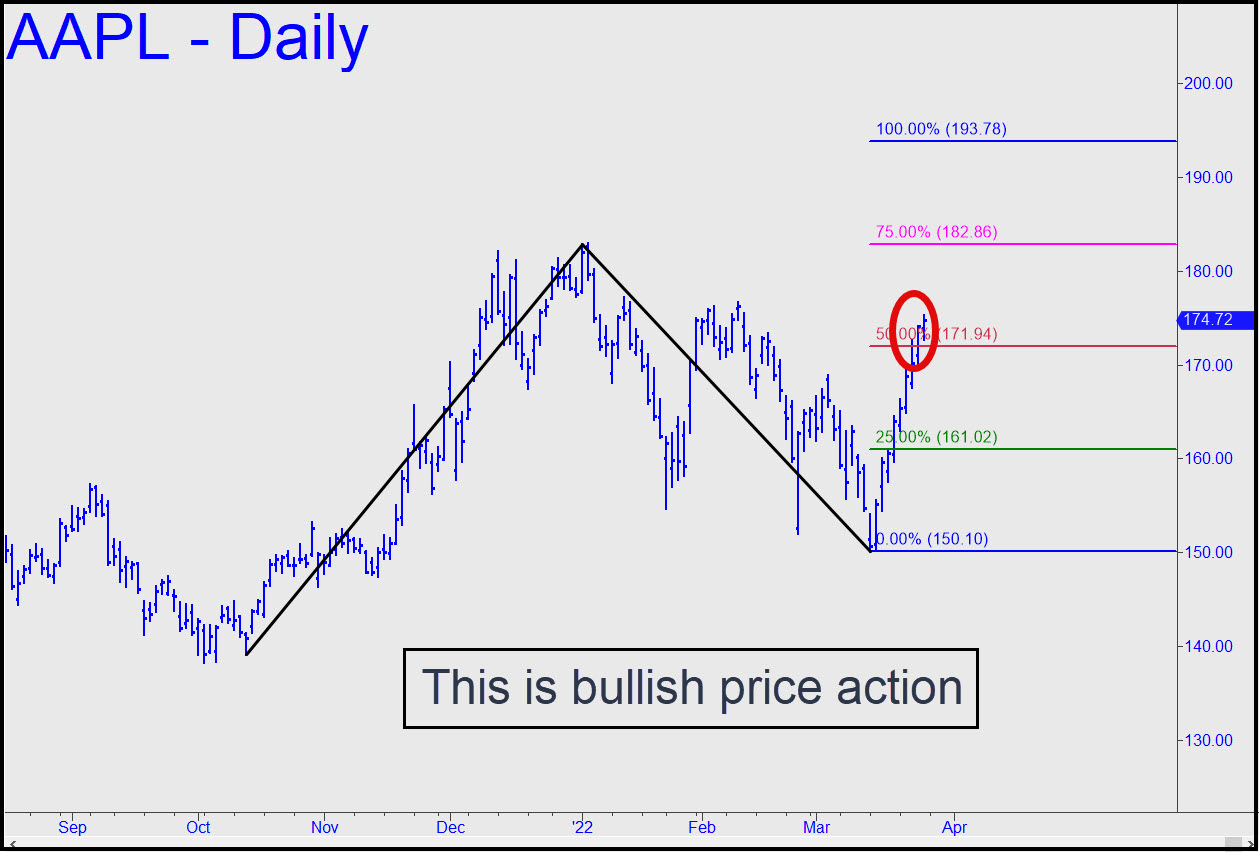

The institutional chimps who went all-in on AAPL 13 year ago can scarcely conceal their giddiness at the ease with which short-covering has been propelling the most bloated-pig-of-a-stock in history steeply higher. Last week they pushed AAPL decisively past p=171.94 in the chart shown, significantly shortening the odds that the squeeze will ultimately produce a new all-time high at 193.78. This is a more bullish picture than the one I’ve proffered for the E-Mini S&Ps, but it is AAPL we should watch, since it is the stock singularly responsible for making portfolio managers look like geniuses and for buttering their bread. A swoon to the green line, however unlikely, should not be regarded as the resumption of a bear market presumed by many to have begun on January 4, but as a fabulous buying opportunity. _______ UPDATE (Mar 29, 11:17 p.m.): The secondary (p2) pivot at 182.86 shown in the chart (inset) can be used as a minimum rally projection for now. It can also be used to get short with a tight ‘camouflage’ set-up. _______ UPDATE (Mar 31, 6:27): Today’s selloff was another fake. DaBoyz will pull their bids for a day or two, then reload at lower levels. The only thing to notice is that Wednesday’s stab higher blew past p2=176.65 and two daunting ‘external’ peaks made, respectively, at 176.65 (2/9) and 177.18 (1/12). That is quite bullish.

The institutional chimps who went all-in on AAPL 13 year ago can scarcely conceal their giddiness at the ease with which short-covering has been propelling the most bloated-pig-of-a-stock in history steeply higher. Last week they pushed AAPL decisively past p=171.94 in the chart shown, significantly shortening the odds that the squeeze will ultimately produce a new all-time high at 193.78. This is a more bullish picture than the one I’ve proffered for the E-Mini S&Ps, but it is AAPL we should watch, since it is the stock singularly responsible for making portfolio managers look like geniuses and for buttering their bread. A swoon to the green line, however unlikely, should not be regarded as the resumption of a bear market presumed by many to have begun on January 4, but as a fabulous buying opportunity. _______ UPDATE (Mar 29, 11:17 p.m.): The secondary (p2) pivot at 182.86 shown in the chart (inset) can be used as a minimum rally projection for now. It can also be used to get short with a tight ‘camouflage’ set-up. _______ UPDATE (Mar 31, 6:27): Today’s selloff was another fake. DaBoyz will pull their bids for a day or two, then reload at lower levels. The only thing to notice is that Wednesday’s stab higher blew past p2=176.65 and two daunting ‘external’ peaks made, respectively, at 176.65 (2/9) and 177.18 (1/12). That is quite bullish.

AAPL – Apple Computer (Last:174.61)

Posted on March 27, 2022, 5:21 pm EDT

Last Updated March 31, 2022, 6:27 pm EDT

Posted on March 27, 2022, 5:21 pm EDT

Last Updated March 31, 2022, 6:27 pm EDT

- April 3, 2022, 1:16 pm

These updates are most helpful and is what I feel is most helpful to me to make adjustments in my trading. You ARE a guru with your respected insights. I am not a technical person but manage my trades more with market sentiment with professionals such as you who provide insight, guidance and prospective.