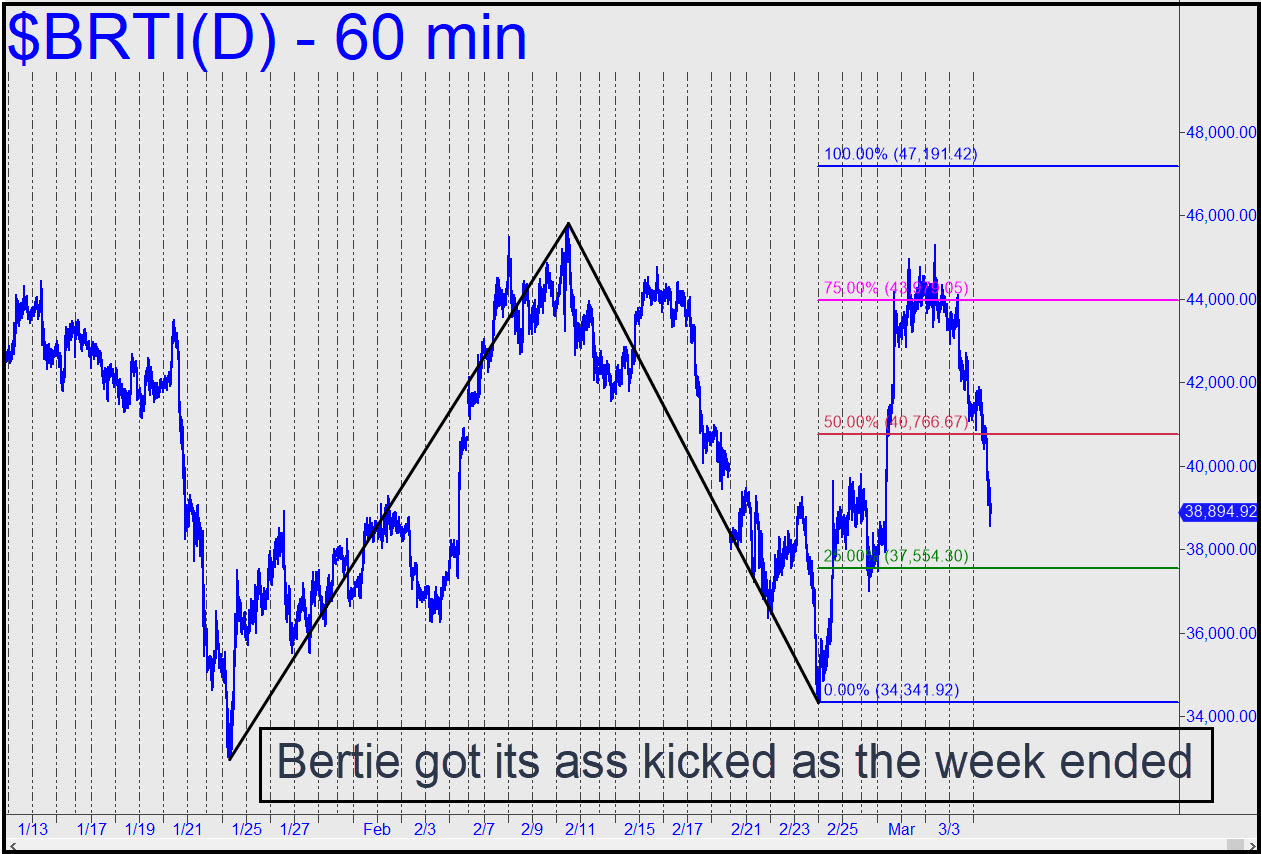

Some serious selling in the cryptos kicked in Friday afternoon after the stock market, evidently tired of falling, had shifted into idle ahead of the weekend. Was Bertie perhaps smart enough to discount the possibility that the Ukraine crisis would not improve over the weekend? Or maybe it was simply concerned that Kamala Harris, by all evidence the most brainless person ever to hold high office in the U.S., was America’s point-man in Europe? Whatever the case, for all the terror last week’s mau-mauing of crypto bulls may have caused, Bertie would still be a no-brainer ‘mechanical’ buy if the plunge continues on Monday to the green line (x=37,554). This one is for experts only, but you can still tune to the appropriate thread in the chat room for guidance. Lately, however, this vehicle seems to be attracting little attention in the room. ______ UPDATE (Mar 7, 8:14 p.m.): The trade triggered, but so what? Subscribers seem not to care even slightly, but I’ll leave Bertie on the list, at least for a while, in case visitors come to the site expecting to find bitcoin analysis. _______ UPDATE (Mar 8, 9:50 a.m.): Bertie has shriveled into a go-along vehicle, too gutless to rally unless the broad averages are moving higher. Since the broad averages are in a distributive fake-out rally today, I’ll suggest setting a stop-loss at 38,100 that would preserve a nominal gain when BRTI reverses with the tide, perhaps later today. Make it o-c-o with an order to exit half of a presumptive four round lots at p=40,766. _______ UPDATE (Mar 8, 11:15 a.m.): The trade stopped out for a theoretical gain of a little more than $500. I tightened the stop in part because the stock market looks like distributive crap, as mentioned above, but also because I wanted to preserve Rick’s Picks’ nearly flawless track record for trading this vehicle ‘mechanically’. There has been only one losing trade among perhaps a dozen winners since I began tracking bitcoin more than two years ago. Please note that the textbook stop here would be at 34,341, o-c-o with a partial exit at p=40,766 (as noted above). The trade rates around 7.3, implying I am confident it eventually will work (i.e., achieve a minimum p=40,766). I just didn’t feel like sticking with it, especially since interest in the chat room appears to be nil. _______ UPDATE (Mar 9, 9:55 p.m.): As expected, Bertie spiked to 40,766 (and then some). This is a midpoint pivot tied to a target at 47,191 that, amazingly, I neglected to mention above.

Some serious selling in the cryptos kicked in Friday afternoon after the stock market, evidently tired of falling, had shifted into idle ahead of the weekend. Was Bertie perhaps smart enough to discount the possibility that the Ukraine crisis would not improve over the weekend? Or maybe it was simply concerned that Kamala Harris, by all evidence the most brainless person ever to hold high office in the U.S., was America’s point-man in Europe? Whatever the case, for all the terror last week’s mau-mauing of crypto bulls may have caused, Bertie would still be a no-brainer ‘mechanical’ buy if the plunge continues on Monday to the green line (x=37,554). This one is for experts only, but you can still tune to the appropriate thread in the chat room for guidance. Lately, however, this vehicle seems to be attracting little attention in the room. ______ UPDATE (Mar 7, 8:14 p.m.): The trade triggered, but so what? Subscribers seem not to care even slightly, but I’ll leave Bertie on the list, at least for a while, in case visitors come to the site expecting to find bitcoin analysis. _______ UPDATE (Mar 8, 9:50 a.m.): Bertie has shriveled into a go-along vehicle, too gutless to rally unless the broad averages are moving higher. Since the broad averages are in a distributive fake-out rally today, I’ll suggest setting a stop-loss at 38,100 that would preserve a nominal gain when BRTI reverses with the tide, perhaps later today. Make it o-c-o with an order to exit half of a presumptive four round lots at p=40,766. _______ UPDATE (Mar 8, 11:15 a.m.): The trade stopped out for a theoretical gain of a little more than $500. I tightened the stop in part because the stock market looks like distributive crap, as mentioned above, but also because I wanted to preserve Rick’s Picks’ nearly flawless track record for trading this vehicle ‘mechanically’. There has been only one losing trade among perhaps a dozen winners since I began tracking bitcoin more than two years ago. Please note that the textbook stop here would be at 34,341, o-c-o with a partial exit at p=40,766 (as noted above). The trade rates around 7.3, implying I am confident it eventually will work (i.e., achieve a minimum p=40,766). I just didn’t feel like sticking with it, especially since interest in the chat room appears to be nil. _______ UPDATE (Mar 9, 9:55 p.m.): As expected, Bertie spiked to 40,766 (and then some). This is a midpoint pivot tied to a target at 47,191 that, amazingly, I neglected to mention above.

BRTI – CME Bitcoin Index (Last:40,866)

Posted on March 6, 2022, 5:09 pm EST

Last Updated March 9, 2022, 9:54 pm EST

Posted on March 6, 2022, 5:09 pm EST

Last Updated March 9, 2022, 9:54 pm EST

- March 7, 2022, 5:19 am

What has Kamela Harris said or done to earn her such a bad reputation?

&&&&

C’mon, Leiv! You’re spoofing us, right? RA