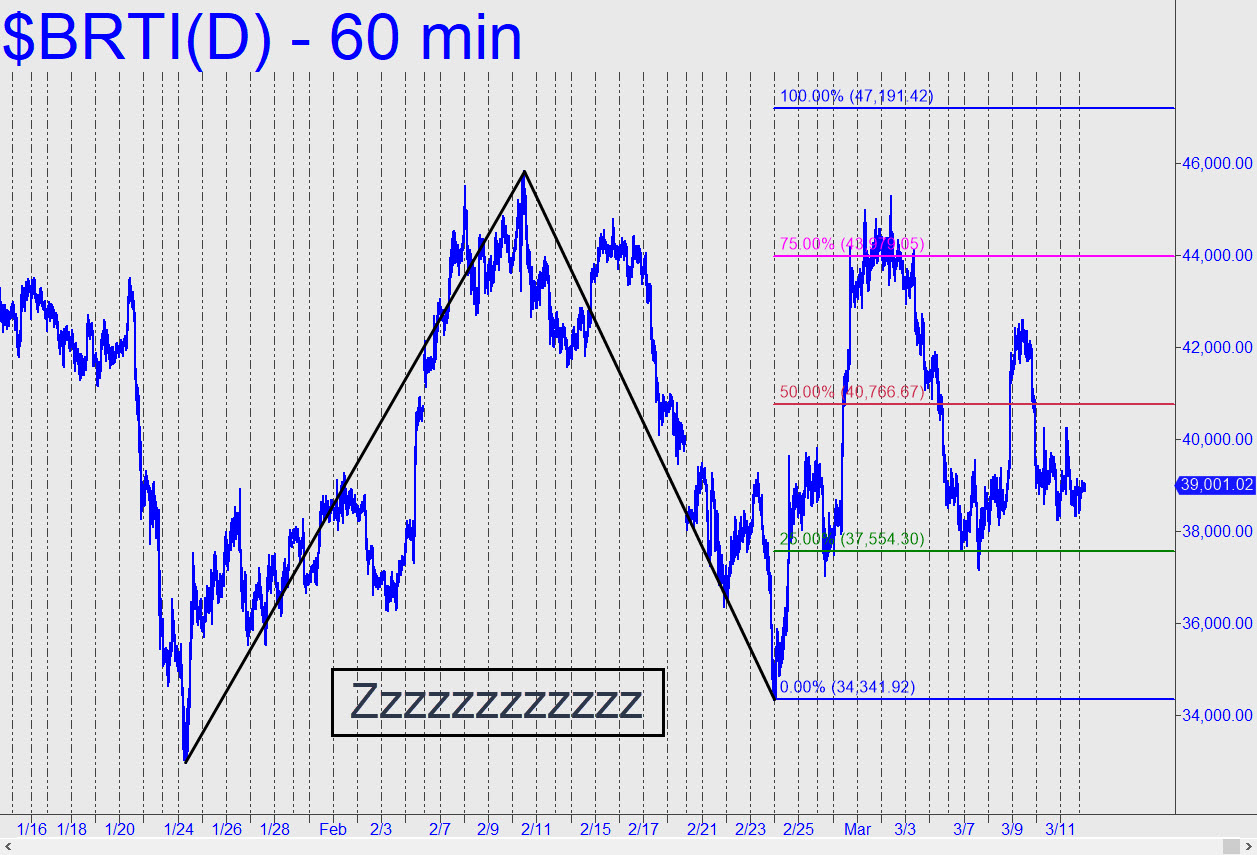

Bertie’s soporific action points toward D=47,181 within a pattern that has already generated a nice, $3,000+ ‘mechanical’ winner. It came via a buy at the green line (x=37,554) a week ago, but it is not likely to be so easy if there is a second opportunity. Interim ups and downs will always be tradeable, but I have somewhat reduced chat-room guidance for this vehicle because subscriber interest in trading bitcoin appears to have dropped off. Nevertheless, if you nudge me with an idea you’d like vetted, I’ll be happy to help. _______ UPDATE (Mar 28, 5:43 p.m.): Bertie took forever to achieve my 47,181 objective, but today’s decisive overshoot has activated a bigger, ‘reverse pattern’ with a new target at 62,317. Let’s see how much resistance p=47,647 poses to short-covering, the main source of buying power in this vehicle. Since few know about the pattern, and even fewer how to use it, you can rely on it whatever your purpose. I’ll signal if the big-picture ‘mechanical’ buy triggers at 40,312, since, although it would be a no-brainer, the more than $7,000 of theoretical initial risk would require a ‘camo’ entry strategy.

Bertie’s soporific action points toward D=47,181 within a pattern that has already generated a nice, $3,000+ ‘mechanical’ winner. It came via a buy at the green line (x=37,554) a week ago, but it is not likely to be so easy if there is a second opportunity. Interim ups and downs will always be tradeable, but I have somewhat reduced chat-room guidance for this vehicle because subscriber interest in trading bitcoin appears to have dropped off. Nevertheless, if you nudge me with an idea you’d like vetted, I’ll be happy to help. _______ UPDATE (Mar 28, 5:43 p.m.): Bertie took forever to achieve my 47,181 objective, but today’s decisive overshoot has activated a bigger, ‘reverse pattern’ with a new target at 62,317. Let’s see how much resistance p=47,647 poses to short-covering, the main source of buying power in this vehicle. Since few know about the pattern, and even fewer how to use it, you can rely on it whatever your purpose. I’ll signal if the big-picture ‘mechanical’ buy triggers at 40,312, since, although it would be a no-brainer, the more than $7,000 of theoretical initial risk would require a ‘camo’ entry strategy.

BRTI – CME Bitcoin Index (Last:47,696)

Posted on March 13, 2022, 5:04 pm EDT

Last Updated March 28, 2022, 5:43 pm EDT

Posted on March 13, 2022, 5:04 pm EDT

Last Updated March 28, 2022, 5:43 pm EDT