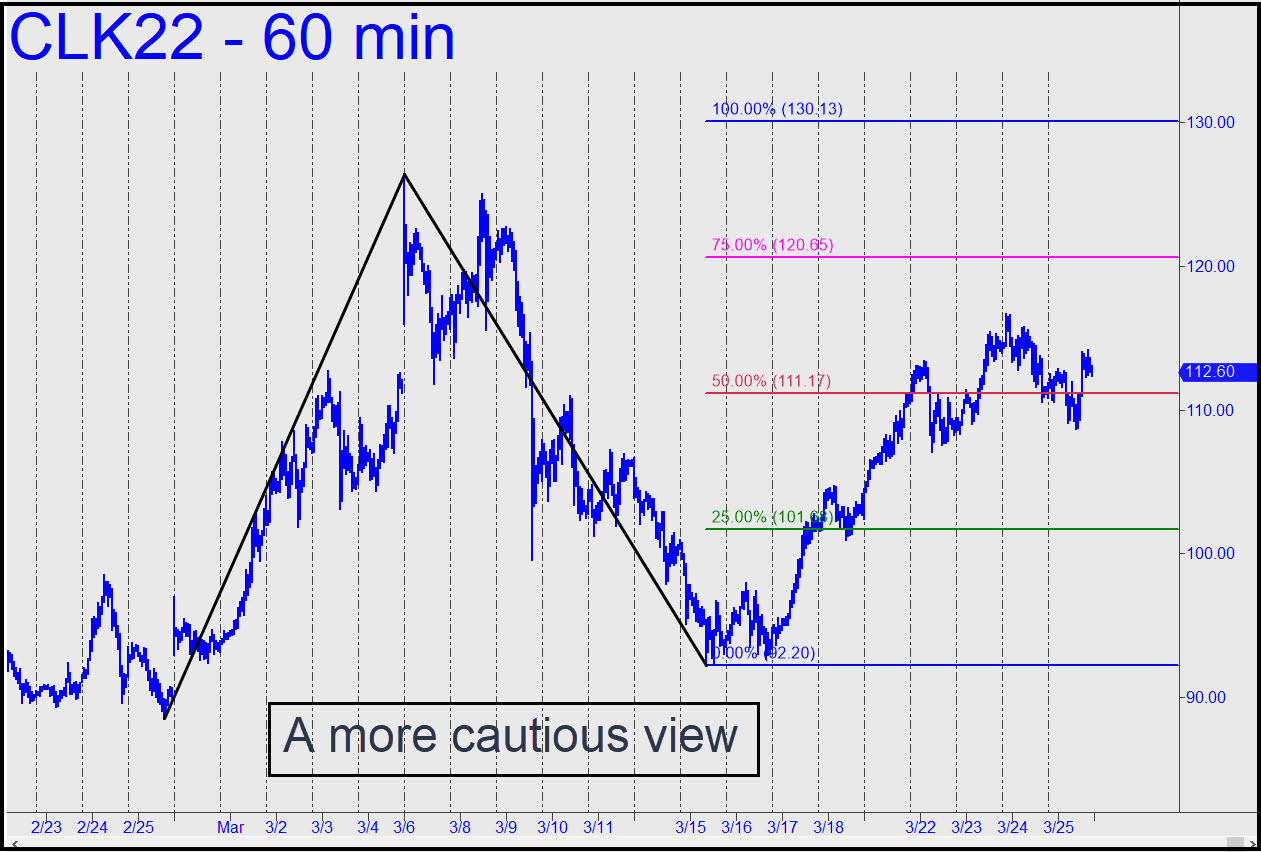

We’ve got targets as high as 158, but I’ve switched to a more cautious view with one at 130.13 because crude struggled so hard last week to break free of p=111.17‘s gravity. Note that I have shifted to the May contract and that it is somewhat more bullish than the April one that we’ve been using. A swoon to the green line could be bought ‘mechanically’, stop 92.19, but only if you know how to set up the trade on the very lesser charts to pare the implied entry risk of nearly $40,000 on four contracts down to something closer to $1,000. There doesn’t seem to be much interest in this vehicle in the chat room, but I will continue to track it nonetheless, and if I’m in the room, I’ll gladly provide real time guidance for any subscriber with a potentially tradeable idea. _______ UPDATE (Mar 29, 11:45 p.m.): The ‘mechanical’ trade triggered and is currently in-the-black. No one mentioned it in the chat room, confirming my remark above about there being little interest in this vehicle. Oh well. Here’s the chart.

We’ve got targets as high as 158, but I’ve switched to a more cautious view with one at 130.13 because crude struggled so hard last week to break free of p=111.17‘s gravity. Note that I have shifted to the May contract and that it is somewhat more bullish than the April one that we’ve been using. A swoon to the green line could be bought ‘mechanically’, stop 92.19, but only if you know how to set up the trade on the very lesser charts to pare the implied entry risk of nearly $40,000 on four contracts down to something closer to $1,000. There doesn’t seem to be much interest in this vehicle in the chat room, but I will continue to track it nonetheless, and if I’m in the room, I’ll gladly provide real time guidance for any subscriber with a potentially tradeable idea. _______ UPDATE (Mar 29, 11:45 p.m.): The ‘mechanical’ trade triggered and is currently in-the-black. No one mentioned it in the chat room, confirming my remark above about there being little interest in this vehicle. Oh well. Here’s the chart.

CLK22 – May Crude (Last:104.72)

Posted on March 27, 2022, 5:09 pm EDT

Last Updated March 29, 2022, 11:45 pm EDT

Posted on March 27, 2022, 5:09 pm EDT

Last Updated March 29, 2022, 11:45 pm EDT

- March 30, 2022, 3:28 am

I trade OOEA Brent Crude, so your chart is important for me, thank you

&&&&

Thanks. Always happy to oblige. RA