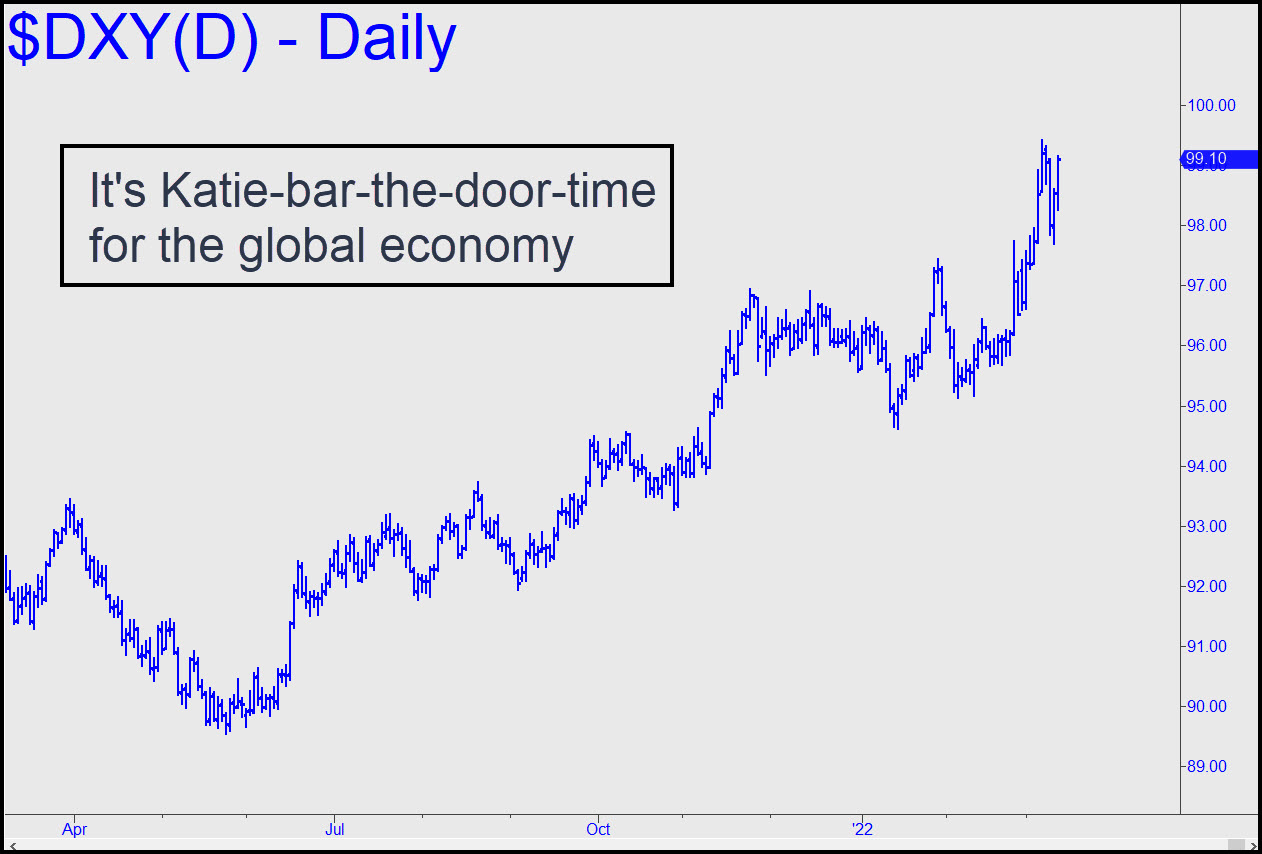

I’ve been shouting about this for many years, but let me repeat it once again: The last thing the world needs is a strong dollar, since it will lead inexorably toward ruinous deflation. Over several decades, I’ve never wavered in my hyper-bullish outlook for the dollar, even amidst current headlines screaming about inflation, and regardless of what most economists were saying. That’s because I see no resolution for the global debt bubble other than via massive liquidations that would be tantamount to deflation. A stock market bear will be the catalyst, assuming some ‘black-swan’ asteroid does not hit us first. From a technical standpoint, the dollar index is rallying sharply after the briefest of corrections. That is quite bullish, but even moreso because the recent 99.42 peak whence the correction began had hugely overshot its Hidden Pivot rally target. _______ UPDATE (Apr 7, 12:09 p.m.): This chart, too, should have been included earlier, since it shows a can’t-miss minimum rally target at 103.25. It is predicated on an easy move past p2=99.74, but I doubt that will be a problem. ______ UPDATE Apr 13, 11:012 p.m.): Here’s a pattern I somehow overlooked that shows why DXY topped exactly where it did. The weakness presumably is corrective, since we have the outstanding target at 103.25 noted above..

I’ve been shouting about this for many years, but let me repeat it once again: The last thing the world needs is a strong dollar, since it will lead inexorably toward ruinous deflation. Over several decades, I’ve never wavered in my hyper-bullish outlook for the dollar, even amidst current headlines screaming about inflation, and regardless of what most economists were saying. That’s because I see no resolution for the global debt bubble other than via massive liquidations that would be tantamount to deflation. A stock market bear will be the catalyst, assuming some ‘black-swan’ asteroid does not hit us first. From a technical standpoint, the dollar index is rallying sharply after the briefest of corrections. That is quite bullish, but even moreso because the recent 99.42 peak whence the correction began had hugely overshot its Hidden Pivot rally target. _______ UPDATE (Apr 7, 12:09 p.m.): This chart, too, should have been included earlier, since it shows a can’t-miss minimum rally target at 103.25. It is predicated on an easy move past p2=99.74, but I doubt that will be a problem. ______ UPDATE Apr 13, 11:012 p.m.): Here’s a pattern I somehow overlooked that shows why DXY topped exactly where it did. The weakness presumably is corrective, since we have the outstanding target at 103.25 noted above..

DXY – NYBOT Dollar Index (Last:99.71)

Posted on March 13, 2022, 5:21 pm EDT

Last Updated April 17, 2022, 10:30 pm EDT

Posted on March 13, 2022, 5:21 pm EDT

Last Updated April 17, 2022, 10:30 pm EDT

- March 13, 2022, 7:00 pm

Thanks Rick!

Its all about macro now. screw the FED riggers. Oil, USD, gold.

The NFT-farts-in-a-bottle pumpers are now swept aside by reality. Massive de-leveraging awaits.

( I still can’t help but assume that such illiquidity and forced redemptions will briefly pull gold down too though)

So, I’ll nibble on oil longs if it pulls back near 82. But. I can’t wait to short near Oil 141 ! tantalizing.