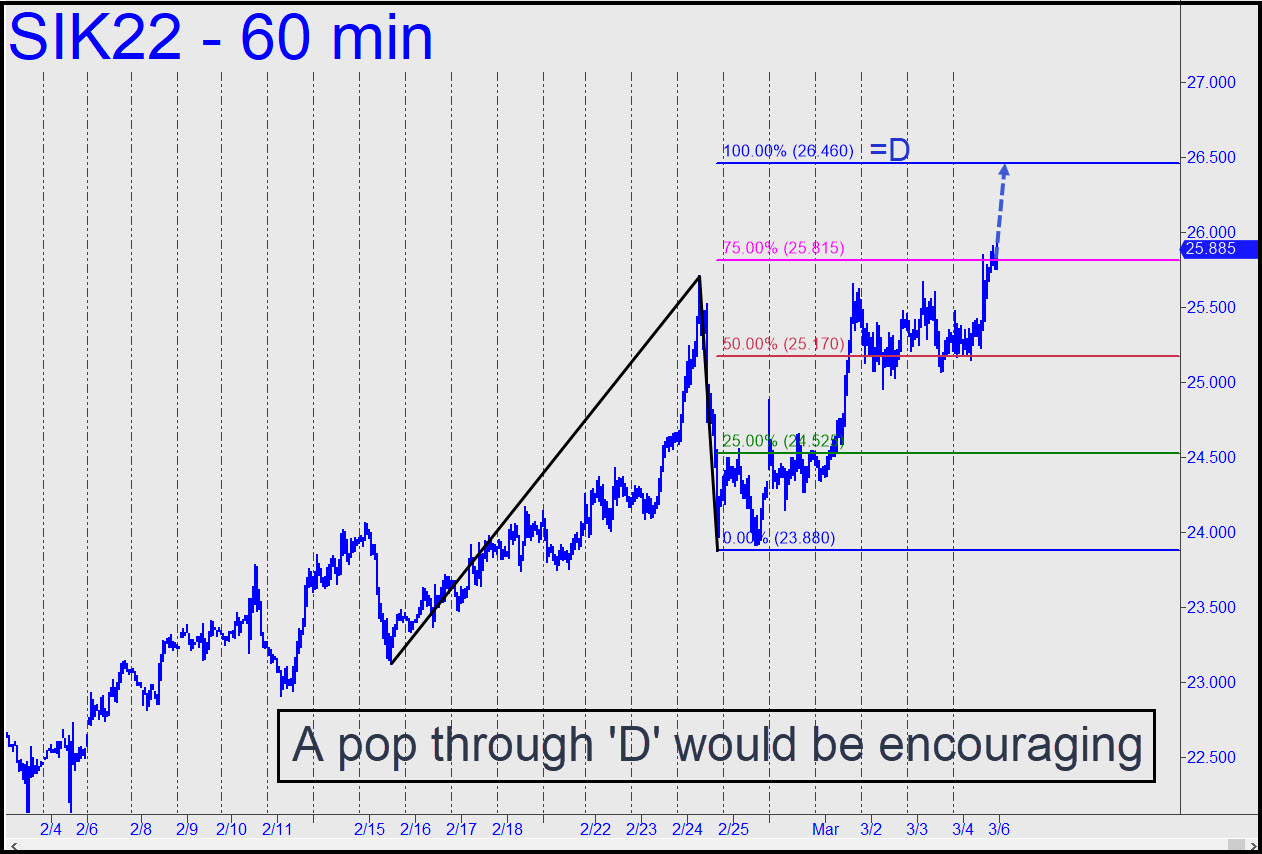

Silver spent a couple of days last week building a base for an easy move to the 26.46 target shown. It has kept us confidently on the right side of the trend, even if the pattern from which it was derived yielded no opportune ‘mechanical’ buying opportunities on the hourly chart. The target can be shorted if you’ve made some bucks on the way up, but we should be more interested in how bulls handle the implied ‘hidden’ supply there. As always, a decisive move past ‘D’, particularly on first contact, would imply the trend is likely to continue. In the meantime, a pullback to the red line would trip an appealing ‘mechanical’ buy, stop 24.74. We’ll deal with risk-cutting if and when the requisite pullback occurs. _______ UPDATE (Mar 7, 10:01 a.m. EST): The futures topped overnight (suh-prize, suh-prize!) three tenths of a percent from the target flagged above, exhausting tradeable opportunities for the moment. Let’s see how long it takes for bulls to reverse the correction and shred past the inconveniently timed high. _______ UPDATE (Mar 8, 8:54 p.m.): Not long at all, as it happens. You can use 27.54 as a minimum upside projection now, calculated by sliding ‘A’ down to Feb 3’s 22.05 low. _______ UPDATE (Mar 8, 10:52 p.m.): The ‘reverse’ pattern shown in this chart gives silver an easy path to at least 29.75, but there are bigger conventional patterns that project even higher. A pullback to the green line (x=23.49), however unlikely, would trigger a juicy ‘mechanical’ buy. _______ UPDATE (Mar 9, 9:48 p.m.): Note to a chat-room denizen posted this evening: “Artie, are you or anyone else following Silver? The May futures fell nearly $2 after coming within a nickel of the 27.54 target flagged above, but no one seems to have noticed. I’d like to remove SI from the permanent list of touts, but whenever I mention it, a small but vocal group of alleged silver-lovers riots.”

Silver spent a couple of days last week building a base for an easy move to the 26.46 target shown. It has kept us confidently on the right side of the trend, even if the pattern from which it was derived yielded no opportune ‘mechanical’ buying opportunities on the hourly chart. The target can be shorted if you’ve made some bucks on the way up, but we should be more interested in how bulls handle the implied ‘hidden’ supply there. As always, a decisive move past ‘D’, particularly on first contact, would imply the trend is likely to continue. In the meantime, a pullback to the red line would trip an appealing ‘mechanical’ buy, stop 24.74. We’ll deal with risk-cutting if and when the requisite pullback occurs. _______ UPDATE (Mar 7, 10:01 a.m. EST): The futures topped overnight (suh-prize, suh-prize!) three tenths of a percent from the target flagged above, exhausting tradeable opportunities for the moment. Let’s see how long it takes for bulls to reverse the correction and shred past the inconveniently timed high. _______ UPDATE (Mar 8, 8:54 p.m.): Not long at all, as it happens. You can use 27.54 as a minimum upside projection now, calculated by sliding ‘A’ down to Feb 3’s 22.05 low. _______ UPDATE (Mar 8, 10:52 p.m.): The ‘reverse’ pattern shown in this chart gives silver an easy path to at least 29.75, but there are bigger conventional patterns that project even higher. A pullback to the green line (x=23.49), however unlikely, would trigger a juicy ‘mechanical’ buy. _______ UPDATE (Mar 9, 9:48 p.m.): Note to a chat-room denizen posted this evening: “Artie, are you or anyone else following Silver? The May futures fell nearly $2 after coming within a nickel of the 27.54 target flagged above, but no one seems to have noticed. I’d like to remove SI from the permanent list of touts, but whenever I mention it, a small but vocal group of alleged silver-lovers riots.”

SIK22 – May Silver (Last:25.78)

Posted on March 6, 2022, 5:14 pm EST

Last Updated March 9, 2022, 9:49 pm EST

Posted on March 6, 2022, 5:14 pm EST

Last Updated March 9, 2022, 9:49 pm EST

- March 10, 2022, 1:46 am

Please keep Silver, Platinum and Palladium