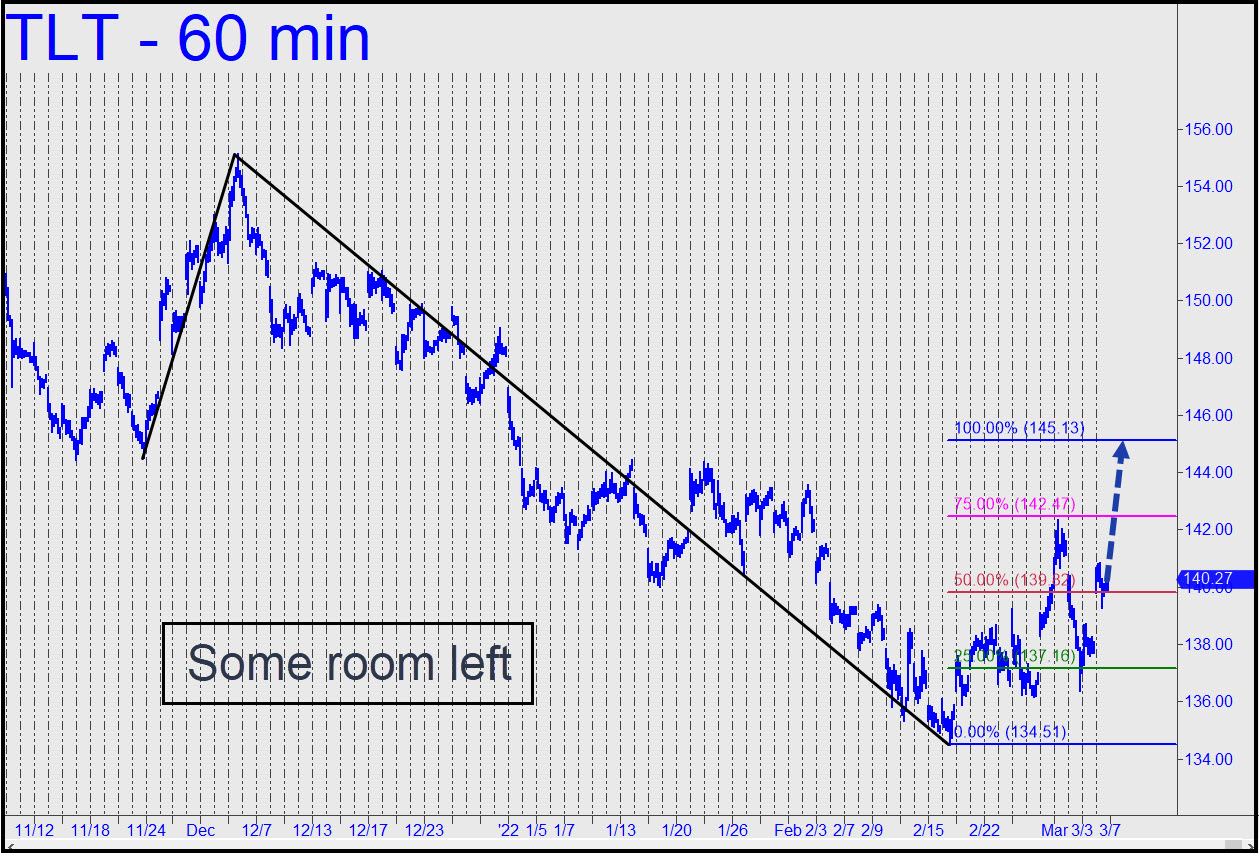

The strong leap that ended the week produced some instant quadruplers for subscribers who bought expiring at-the-money call options when TLT got bludgeoned down to the green line on Wednesday. This provided a textbook buying set-up for a ‘mechanical’ trade that, by its nature, will tend to scare the hell out of traders who act on the signal. The power of the bounce, in addition to the subsequent consolidation above p=139.32, have shortened the odds that the move will continue to at least 145.13, the ‘D’ rally target of the pattern shown. An easy move through it would be quite bullish. _______ UPDATE (Mar 7, 8:07 p.m. EST): If the pullback continues to the green line, it would trip an enticing ‘mechanical’ buy there, stop 134.50. Ask me in the chat room if you need more guidance to pare the risk. _______ UPDATE (Mar 8, 10:58 p.m. EST): Cancel the ‘mechanical’ bid, since we’ve seen a weak rally from just above it. If TLT relapses to x, it seems likely to exceed it. _____ UPDATE (Mar 10, 11:55 p.m. EST): Yuk! The selloff has exceeded Hidden Pivot supports and ‘discomfort’ zones — everything, in fact, except the key low at 113.19 recorded a year ago. Don’t count on it to hold, but its breach could still set up an appealing ‘counterintuitive’ play. For the rABC set-up, use a= 136.41 (3/2).

The strong leap that ended the week produced some instant quadruplers for subscribers who bought expiring at-the-money call options when TLT got bludgeoned down to the green line on Wednesday. This provided a textbook buying set-up for a ‘mechanical’ trade that, by its nature, will tend to scare the hell out of traders who act on the signal. The power of the bounce, in addition to the subsequent consolidation above p=139.32, have shortened the odds that the move will continue to at least 145.13, the ‘D’ rally target of the pattern shown. An easy move through it would be quite bullish. _______ UPDATE (Mar 7, 8:07 p.m. EST): If the pullback continues to the green line, it would trip an enticing ‘mechanical’ buy there, stop 134.50. Ask me in the chat room if you need more guidance to pare the risk. _______ UPDATE (Mar 8, 10:58 p.m. EST): Cancel the ‘mechanical’ bid, since we’ve seen a weak rally from just above it. If TLT relapses to x, it seems likely to exceed it. _____ UPDATE (Mar 10, 11:55 p.m. EST): Yuk! The selloff has exceeded Hidden Pivot supports and ‘discomfort’ zones — everything, in fact, except the key low at 113.19 recorded a year ago. Don’t count on it to hold, but its breach could still set up an appealing ‘counterintuitive’ play. For the rABC set-up, use a= 136.41 (3/2).

TLT – Lehman Bond ETF (Last:134.46)

Posted on March 6, 2022, 5:12 pm EST

Last Updated March 10, 2022, 11:55 pm EST

Posted on March 6, 2022, 5:12 pm EST

Last Updated March 10, 2022, 11:55 pm EST