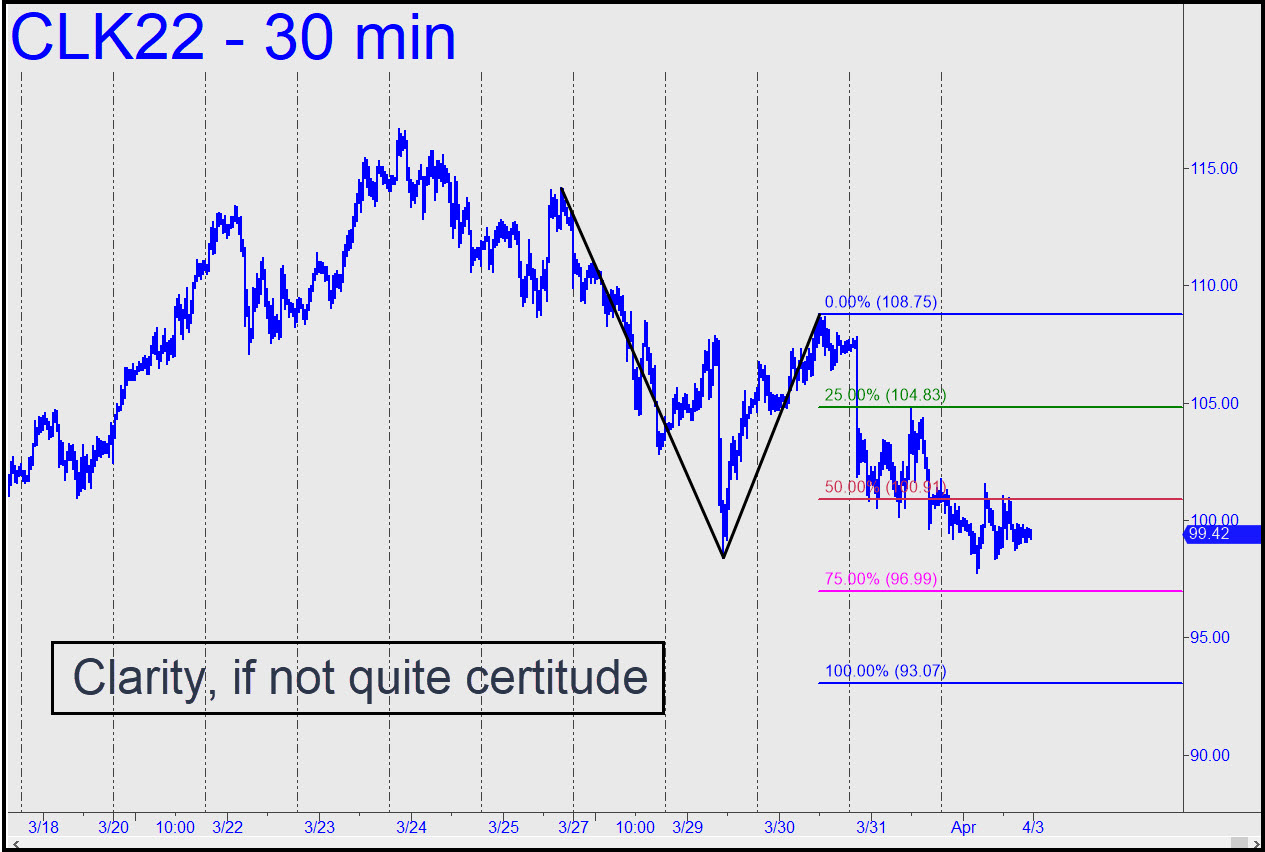

Crude is correcting a big, bullish pattern shown here last week with the potential to get it to 130.13. It is also on a weak ‘mechanical’ buy signal at the moment from 101.68, with a stop-loss at 92.19. I did not recommend the trade, since it would be ‘sloppy seconds’ in relation to an earlier buy signal that narrowly failed to produce a juicy winner. Where to next? Use the pattern shown in the inset to gauge trend strength enroute to a presumptive downside target at 93.07. The pattern looks gnarly enough to be useful for tightly stopped bottom-fishing, or even to ‘mechanically’ short a rally to x=104.83. _____ UPDATE (Apr 4, 10:21 p.m.): The short recommended above has triggered this evening, at least in theory, but because no one mentioned it in the chat room, I have not provided tracking guidance. Since theoretical entry risk was around $3,900 per contract, the trade demanded a ‘camo’ strategy that would pare that down to around $300-$400..

Crude is correcting a big, bullish pattern shown here last week with the potential to get it to 130.13. It is also on a weak ‘mechanical’ buy signal at the moment from 101.68, with a stop-loss at 92.19. I did not recommend the trade, since it would be ‘sloppy seconds’ in relation to an earlier buy signal that narrowly failed to produce a juicy winner. Where to next? Use the pattern shown in the inset to gauge trend strength enroute to a presumptive downside target at 93.07. The pattern looks gnarly enough to be useful for tightly stopped bottom-fishing, or even to ‘mechanically’ short a rally to x=104.83. _____ UPDATE (Apr 4, 10:21 p.m.): The short recommended above has triggered this evening, at least in theory, but because no one mentioned it in the chat room, I have not provided tracking guidance. Since theoretical entry risk was around $3,900 per contract, the trade demanded a ‘camo’ strategy that would pare that down to around $300-$400..

CLK22 – May Crude (Last:105.09)

Posted on April 3, 2022, 5:12 pm EDT

Last Updated April 6, 2022, 11:53 pm EDT

Posted on April 3, 2022, 5:12 pm EDT

Last Updated April 6, 2022, 11:53 pm EDT