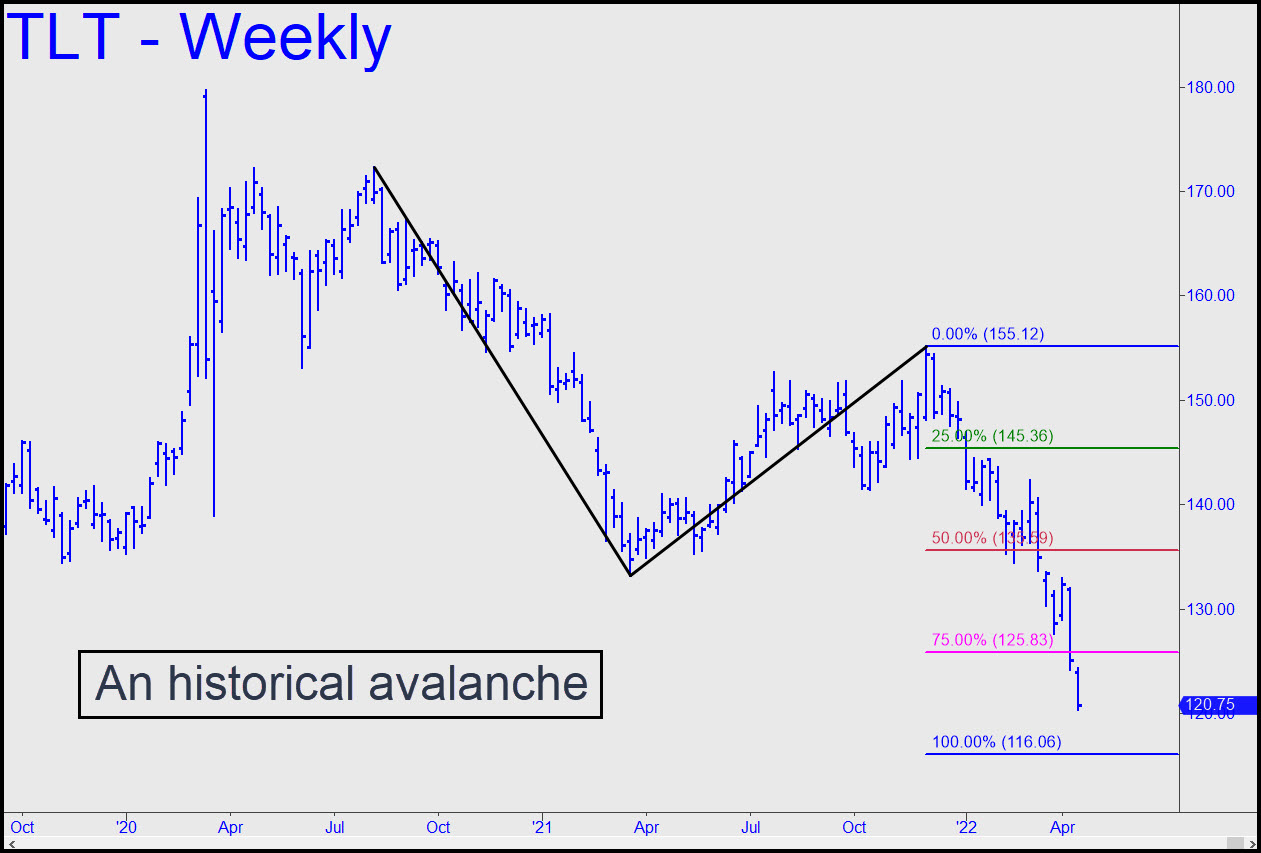

The hellish collapse of the last two weeks has brought TLT within easy distance of a 116.06 target that has been in play since January. Given the size of the Treasury bond market, a fall of this magnitude will hold very significant implications for the global banking system. It is also a thumb in the eye for the charlatans who run the central bank, since market action has pre-empted the Fed’s need to tighten much of anything. Given the clarity of the pattern, it seems extremely unlikely the downtrend will significantly overshoot D=116.06. That means skyrocketing yields on the long bond are about to level off or possibly reverse. _______ UPDATE (May 5, 10:26 a.m.): TLT has breached the 116.06 pivot and traded as low as 115.36 this morning, but I doubt this can go much farther without a substantial bounce. Without divulging proprietary details, a ‘reverse-pattern’ buy would trigger with a bounce of 1.33 points from any low between the so-far low at 115.36 and no lower than 114.80. (That implies a trigger currently and tentatively at 116.70). The initial target for profit-taking would be 1.33 points above the entry price. I am still forecasting an important top in the 10-Year Note, currently trading near 3.04%, at 3.24%. ______ UPDATE (May 5, 9:35 p.m.): In the chat room this afternoon, I suggested using the 113.21 downside target of a lesser pattern now that the granite pivot at 116.06 has been pulverized. It would take a print at 119.32, however, to suggest a serious turn is under way.

The hellish collapse of the last two weeks has brought TLT within easy distance of a 116.06 target that has been in play since January. Given the size of the Treasury bond market, a fall of this magnitude will hold very significant implications for the global banking system. It is also a thumb in the eye for the charlatans who run the central bank, since market action has pre-empted the Fed’s need to tighten much of anything. Given the clarity of the pattern, it seems extremely unlikely the downtrend will significantly overshoot D=116.06. That means skyrocketing yields on the long bond are about to level off or possibly reverse. _______ UPDATE (May 5, 10:26 a.m.): TLT has breached the 116.06 pivot and traded as low as 115.36 this morning, but I doubt this can go much farther without a substantial bounce. Without divulging proprietary details, a ‘reverse-pattern’ buy would trigger with a bounce of 1.33 points from any low between the so-far low at 115.36 and no lower than 114.80. (That implies a trigger currently and tentatively at 116.70). The initial target for profit-taking would be 1.33 points above the entry price. I am still forecasting an important top in the 10-Year Note, currently trading near 3.04%, at 3.24%. ______ UPDATE (May 5, 9:35 p.m.): In the chat room this afternoon, I suggested using the 113.21 downside target of a lesser pattern now that the granite pivot at 116.06 has been pulverized. It would take a print at 119.32, however, to suggest a serious turn is under way.

TLT – Lehman Bond ETF (Last:115.42)

Posted on April 17, 2022, 5:15 pm EDT

Last Updated May 5, 2022, 9:44 pm EDT

Posted on April 17, 2022, 5:15 pm EDT

Last Updated May 5, 2022, 9:44 pm EDT