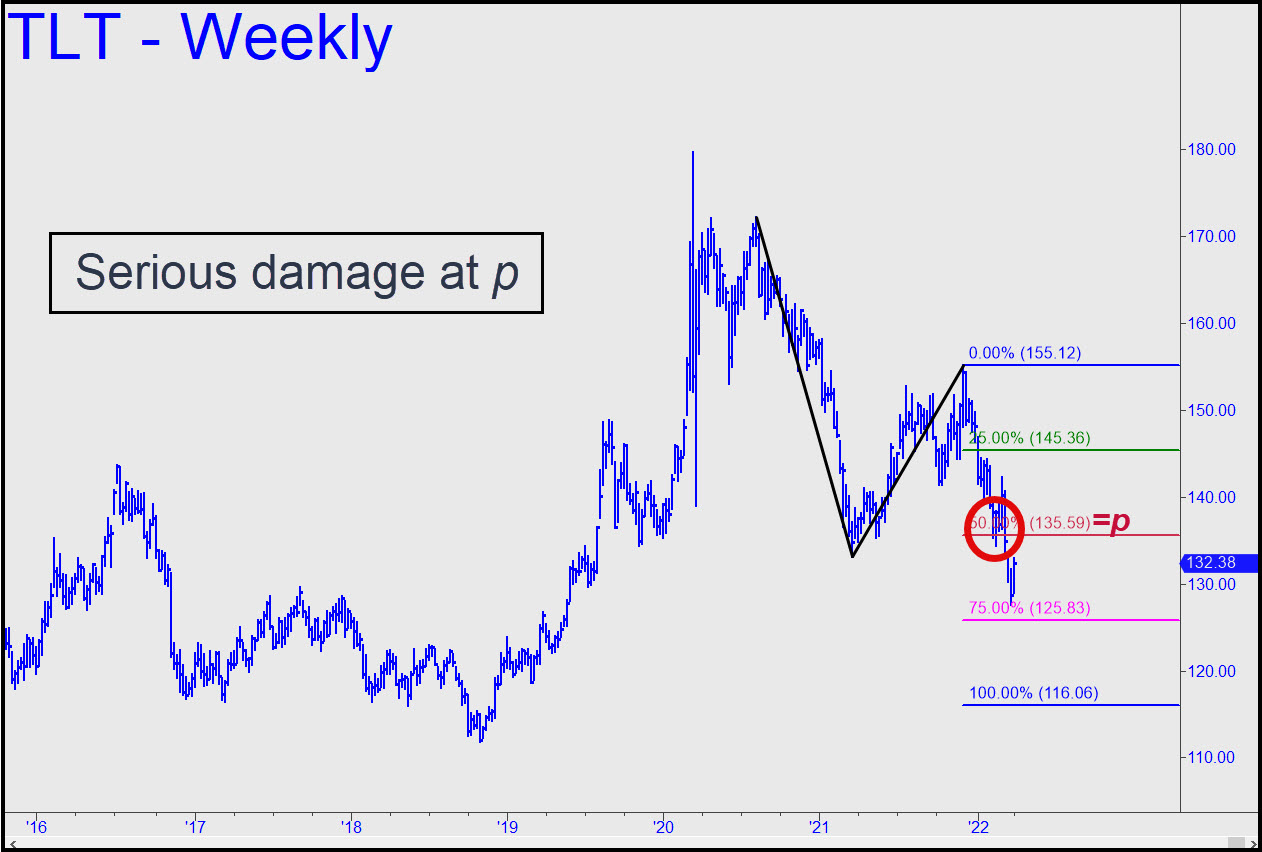

The rally is almost certainly corrective and would trigger an enticing ‘mechanical short even if it were to soar to the green line (x=145.26). More likely is that the downtrend will resume well before then and fall to at least p2=125.83, the minimum downside target we’ve been using for the last several weeks. Further weakness to D=116.06 is unpredictable as yet, since the initial encounter with midpoint support at 135.59 on the way did not feature its impalement. _______ UPDATE (Apr 6. 11:53 p.m.): This week’s mini-crash has brought TLT down to within four-tenths of a percentage point of the 125.83 Hidden Pivot we’ve been using as a minimum downside target. If this number fails to produce a strong bounce, that will shorten the odds of further slippage to D=116.06.

The rally is almost certainly corrective and would trigger an enticing ‘mechanical short even if it were to soar to the green line (x=145.26). More likely is that the downtrend will resume well before then and fall to at least p2=125.83, the minimum downside target we’ve been using for the last several weeks. Further weakness to D=116.06 is unpredictable as yet, since the initial encounter with midpoint support at 135.59 on the way did not feature its impalement. _______ UPDATE (Apr 6. 11:53 p.m.): This week’s mini-crash has brought TLT down to within four-tenths of a percentage point of the 125.83 Hidden Pivot we’ve been using as a minimum downside target. If this number fails to produce a strong bounce, that will shorten the odds of further slippage to D=116.06.

TLT – Lehman Bond ETF (Last:127.45)

Posted on April 3, 2022, 5:13 pm EDT

Last Updated April 6, 2022, 11:52 pm EDT

Posted on April 3, 2022, 5:13 pm EDT

Last Updated April 6, 2022, 11:52 pm EDT