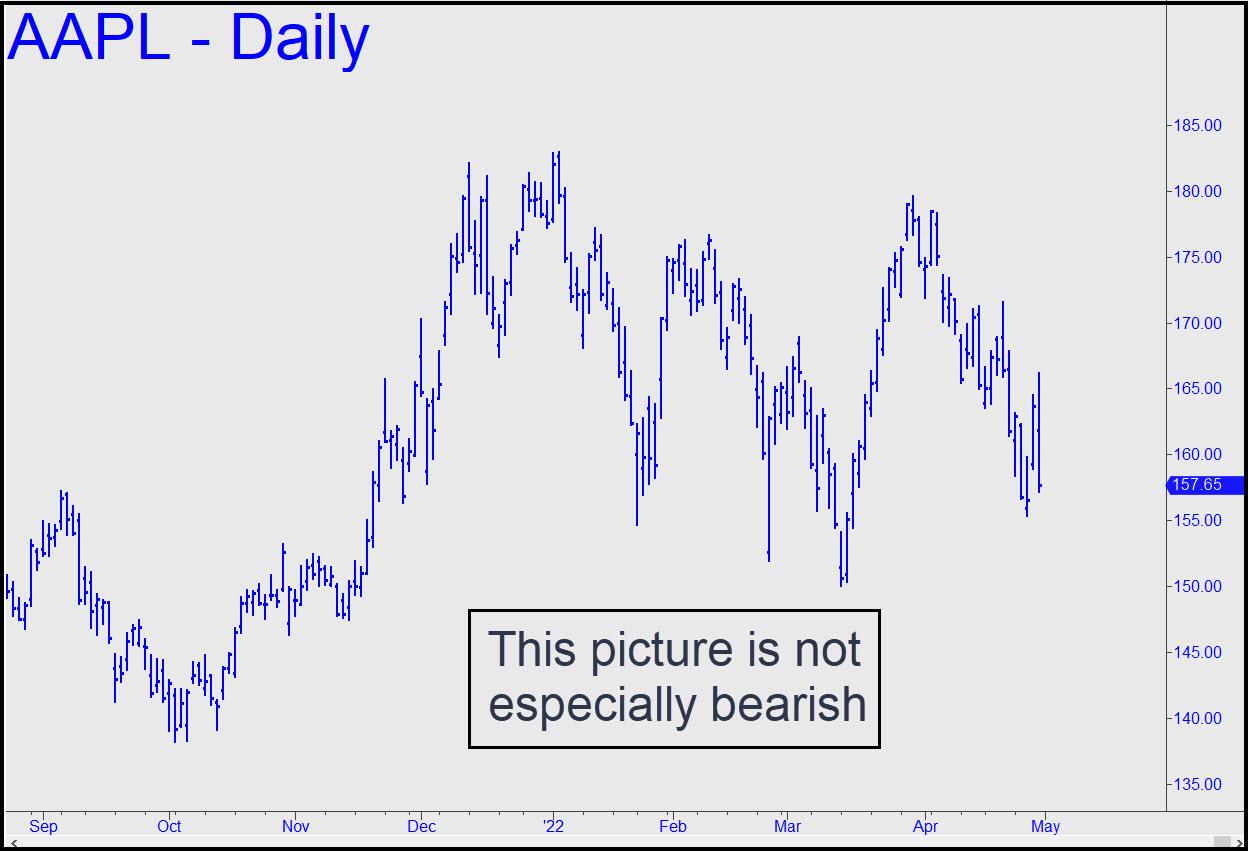

As pleasant as it may have been to see AAPL get its ass kicked last week, this didn’t make the chart any more bearish. For the time being, that’s why we will continue to use the nastier but more predictable chart of the E-Mini S&Ps to tell us exactly what’s going on. I don’t want to count on the rightmost 7 or 8 bars of the chart to give us a pattern and a downside target, since the would-be A-B leg did not exceed any prior lows. However, it is good enough for government work, and that’s why I expect D=150.06 to synch up with the 3994 target we are using in the E-Mini S&Ps. Moreover, it can be bottom-fished, and the ersatz pattern used to get short ‘mechanically’, since this particular entry tactic has so much forgiveness built into it. ______ UPDATE (May 4, 11:08 p.m.): We shouldn’t expect the thieves, pederasts and carnival geeks who have worked this stock since 2009 to go quietly into the night. The current, rip-your-face-off short squeeze has been impressive over the last three days, but it would still need to take out the 171.53 peak shown in this chart before it becomes a serious menace to bears’ well-being. _______ UPDATE (May 5, 9:37 p.m.): Today’s relapse took the menace out of AAPL’s ferocious short-squeeze earlier in the week. Now, look for a test of the 150.10 low recorded on March 14.

As pleasant as it may have been to see AAPL get its ass kicked last week, this didn’t make the chart any more bearish. For the time being, that’s why we will continue to use the nastier but more predictable chart of the E-Mini S&Ps to tell us exactly what’s going on. I don’t want to count on the rightmost 7 or 8 bars of the chart to give us a pattern and a downside target, since the would-be A-B leg did not exceed any prior lows. However, it is good enough for government work, and that’s why I expect D=150.06 to synch up with the 3994 target we are using in the E-Mini S&Ps. Moreover, it can be bottom-fished, and the ersatz pattern used to get short ‘mechanically’, since this particular entry tactic has so much forgiveness built into it. ______ UPDATE (May 4, 11:08 p.m.): We shouldn’t expect the thieves, pederasts and carnival geeks who have worked this stock since 2009 to go quietly into the night. The current, rip-your-face-off short squeeze has been impressive over the last three days, but it would still need to take out the 171.53 peak shown in this chart before it becomes a serious menace to bears’ well-being. _______ UPDATE (May 5, 9:37 p.m.): Today’s relapse took the menace out of AAPL’s ferocious short-squeeze earlier in the week. Now, look for a test of the 150.10 low recorded on March 14.