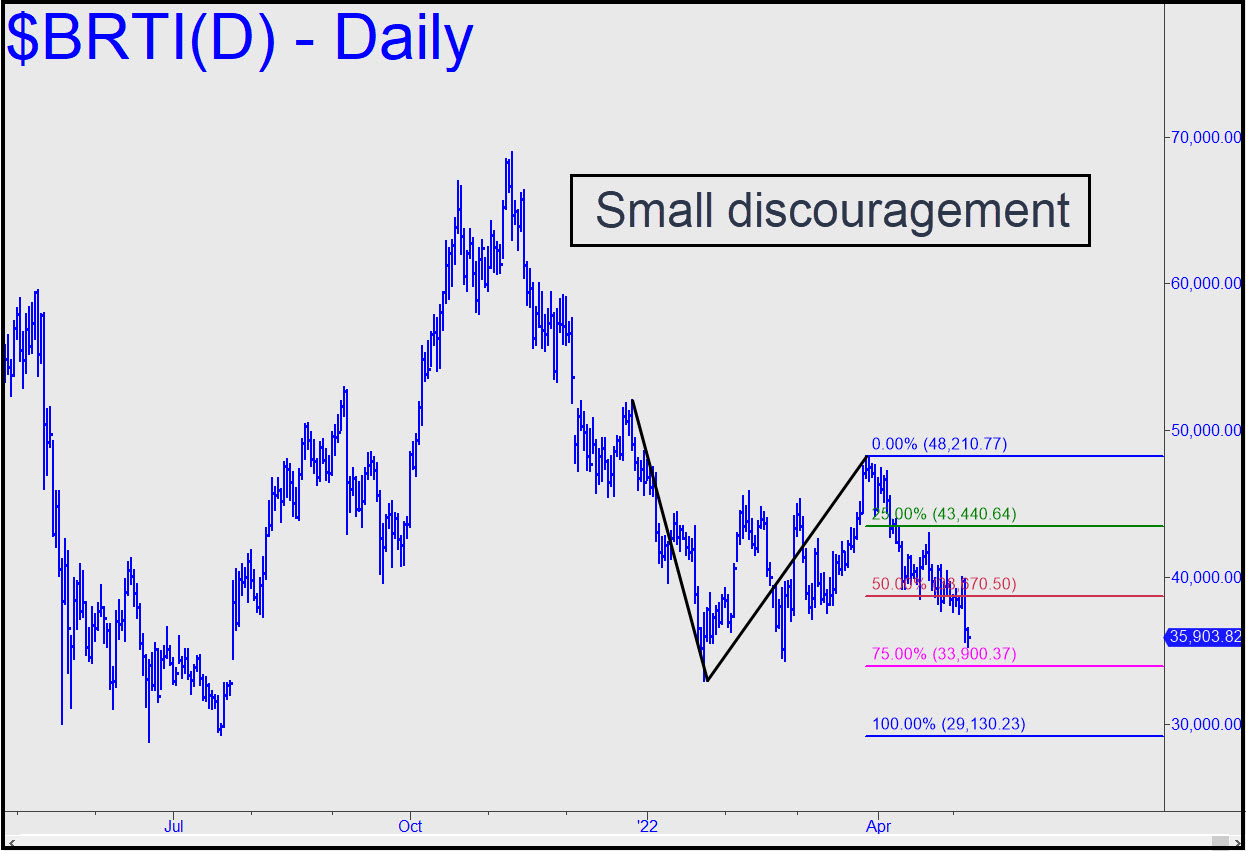

The bearish target at 29,130 is the tail end of a legitimate pattern that meets all of our rules. We’ll have a better idea of how likely the target is to be reached once we’ve seen sellers interact with p2, a secondary Hidden Pivot support at 33,900. There will be a good opportunity to bottom-fish there, but it will require some deft ‘camo’ work, since p2 is close to two prior ‘external’ lows that the droolers will be using for their own purposes. From a visual standpoint, lows made last summer ‘want’ to be tested, and that’s why my gut is going with a drop beneath 30k before bulls are likely to turn feisty again. _______ UPDATE (May 10, 6:38 p.m.): The p2 pivot barely broke Bertie’s fall, affirming the likelihood that this plunge will continue to 29,130. If you’ve made money on the way down using my two successive, very bearish targets, use it to cushion a stop-loss for bottom-fishing. _______ UPDATE (May 11, 10:42 p.m.): Bertie took a psychotic, $2800 leap from a low $54 (0.2%) beneath the 29,130 target, only to relapse to a so-far low at 27,731. This is bearish, but we should give it a day or two to generate a bullish impulse leg on the hourly chart. That would require a print at 32,132. _______ UPDATE (May 12, 10:15 p.m.); With the decisive breach of 29,120, I’ve shifted to a higher point ‘A’ to produce a new downside target at 21,947. Judging from the way sellers sliced through p=35,079, it seems likely to be reached.

The bearish target at 29,130 is the tail end of a legitimate pattern that meets all of our rules. We’ll have a better idea of how likely the target is to be reached once we’ve seen sellers interact with p2, a secondary Hidden Pivot support at 33,900. There will be a good opportunity to bottom-fish there, but it will require some deft ‘camo’ work, since p2 is close to two prior ‘external’ lows that the droolers will be using for their own purposes. From a visual standpoint, lows made last summer ‘want’ to be tested, and that’s why my gut is going with a drop beneath 30k before bulls are likely to turn feisty again. _______ UPDATE (May 10, 6:38 p.m.): The p2 pivot barely broke Bertie’s fall, affirming the likelihood that this plunge will continue to 29,130. If you’ve made money on the way down using my two successive, very bearish targets, use it to cushion a stop-loss for bottom-fishing. _______ UPDATE (May 11, 10:42 p.m.): Bertie took a psychotic, $2800 leap from a low $54 (0.2%) beneath the 29,130 target, only to relapse to a so-far low at 27,731. This is bearish, but we should give it a day or two to generate a bullish impulse leg on the hourly chart. That would require a print at 32,132. _______ UPDATE (May 12, 10:15 p.m.); With the decisive breach of 29,120, I’ve shifted to a higher point ‘A’ to produce a new downside target at 21,947. Judging from the way sellers sliced through p=35,079, it seems likely to be reached.

BRTI – CME Bitcoin Index (Last:29.462)

Posted on May 8, 2022, 5:07 pm EDT

Last Updated May 12, 2022, 10:12 pm EDT

Posted on May 8, 2022, 5:07 pm EDT

Last Updated May 12, 2022, 10:12 pm EDT