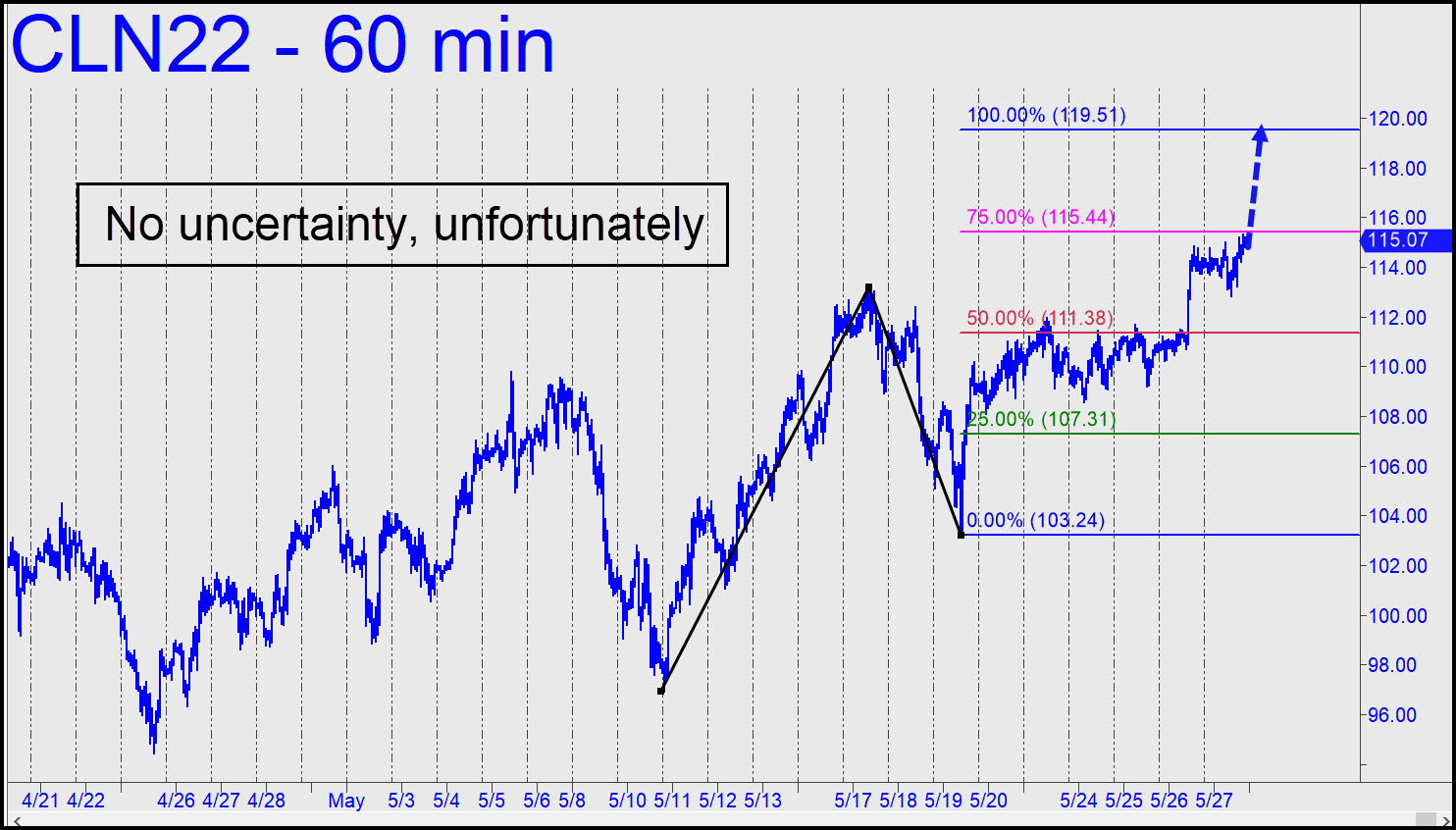

Unfortunately for the global economy, crude looks poised to move even higher, to at least the 119.51 target shown. We’ve been using an even loftier target at 140.12 that’s associated with a larger pattern tracing back to 2021. But let’s see how buyers handle the lower resistance before we try to gauge the staying power of the rally. The D resistance will be shortable, potentially with a very tight stop-loss, since it can be expected to show precise stopping power similar to what occurred at p=111.38. I recommend the trade if you’ve made money on the way to the target. _______ UPDATE (Jun 1, 1:38 p.m.): Here’s a pattern you can use to get a tradeable handle on crude over the next few days. Notice how it tripped a ‘mechanical’ winner earlier today.

Unfortunately for the global economy, crude looks poised to move even higher, to at least the 119.51 target shown. We’ve been using an even loftier target at 140.12 that’s associated with a larger pattern tracing back to 2021. But let’s see how buyers handle the lower resistance before we try to gauge the staying power of the rally. The D resistance will be shortable, potentially with a very tight stop-loss, since it can be expected to show precise stopping power similar to what occurred at p=111.38. I recommend the trade if you’ve made money on the way to the target. _______ UPDATE (Jun 1, 1:38 p.m.): Here’s a pattern you can use to get a tradeable handle on crude over the next few days. Notice how it tripped a ‘mechanical’ winner earlier today.

CLN22 – July Crude (Last:116.88)

Posted on May 29, 2022, 5:10 pm EDT

Last Updated June 1, 2022, 1:26 pm EDT

Posted on May 29, 2022, 5:10 pm EDT

Last Updated June 1, 2022, 1:26 pm EDT

-

May 30, 2022, 5:51 am

-

June 1, 2022, 12:49 am

E & M had some excellent charts of stocks & futures- very impressive. What just happened was a MOON SHOT in crude oil. As I recall at the moment, there might have been a chart in the E & M book back toward the back of the book – a section with just a few pages on special charts. I’ll need to go find my book to be sure.

There was a time in the 60’s & 70’s I hand charted 100 (+) stocks daily and about 100 weekly indexes (from Barron’s) and I do not recall seeing or hearing any market exploding to the extent that Crude oil did in the past 2 month’s +.

As for the recent present, I was concerned over crude oil because of its persistent upside advances and reluctant corrections. I’m not privy to any data, supplies, inventory, etc., so any opinion of mine is just that-mine. What happened “seems” to be a little beyond simple. As I wonder, it could have started with:

#1. A large # of shorts in crude including the commercials.

They do operate both short and long.

The markets do exist for their protection – (check early historical market startups.)

Therefore, commercials are almost as close to the markets as (guess who?) perhaps floor traders.

Closeness to the aroma still counts, ask the people that built a special trading exchange just across the street

from the starting exchange ( in New York City?) with copper wiring -direct-EXCLUSIVELY- from the original

building to the new building without any interruption of copper wire to computer terminals.

All this for the express purpose of being faster to enter trades than anyone else in the world. All other traders

would necessarily be a further distance away , thus their trade entry being subject to the speed of travel by

various means of communication and DISTANCE could never be faster than the direct copper wire link. That

gives new definition to the word “LINK.” (They seem to be “wired in, or at least linked in”.)#2.. Did I mention the shiploads of crude oil from Texas to Europe – it’s just for a higher price than local, ya know!

I keep hearing that there is a U. S. law allowing exports to the world. Perhaps there could be an exception in

such a time as present until normal conditions return.

Saudi’s new leadership seems to have had a change of mind relative to OPEC operations. The guy with the

chips (or Crude oil) might be holding a strong hand. WAIT: That should be us, not them! What the dickens are

we doing or allowing to take place? This is not the path I want my country to go!

Should not we consider our own national needs first? I’m for free enterprise, but for less destructive lifestyle.

Thanks, Dean Ezell

-

June 1, 2022, 12:49 am

I saw your comment that you were looking for a rule in the Edwards & McGee book on technical analysis. I have the book, but it is packed in a box as I had to make a move & it’s still packed. I do recall a discussion on the Dow Industrials & Rails that intricately discussed support & resistance. The argument was solved when support was broken by ONE CENT and eventually proved to be the forerunner of the eventual trend direction. The downtrend eventually continued down although there was a nice rally in between. A one cent break was all it took to continue the previous trend which was down. The opposing opinion was that the break was meaningless; how wrong they were.

Also in the very early pages of the same book is a discussion on retracements needing to exceed 66% to continue on to a new top/ bottom. (Perhaps in the first 8 pages; but at least in the first 20 pages.) I hope this helps you easily find the info you wanted to read. Thanks, Dean Ezell

&&&&

Thanks, Dean. I still can’t find an E&M chart anything like crude’s, but your one-tick observation is interesting nonetheless, since it accounts for impulse legs in the same way that my own system, and Elliott Wave Theory, do. I’m surprised to see that that single, measly tick made all the difference — as it should and in practice does — to E&M, too. RA