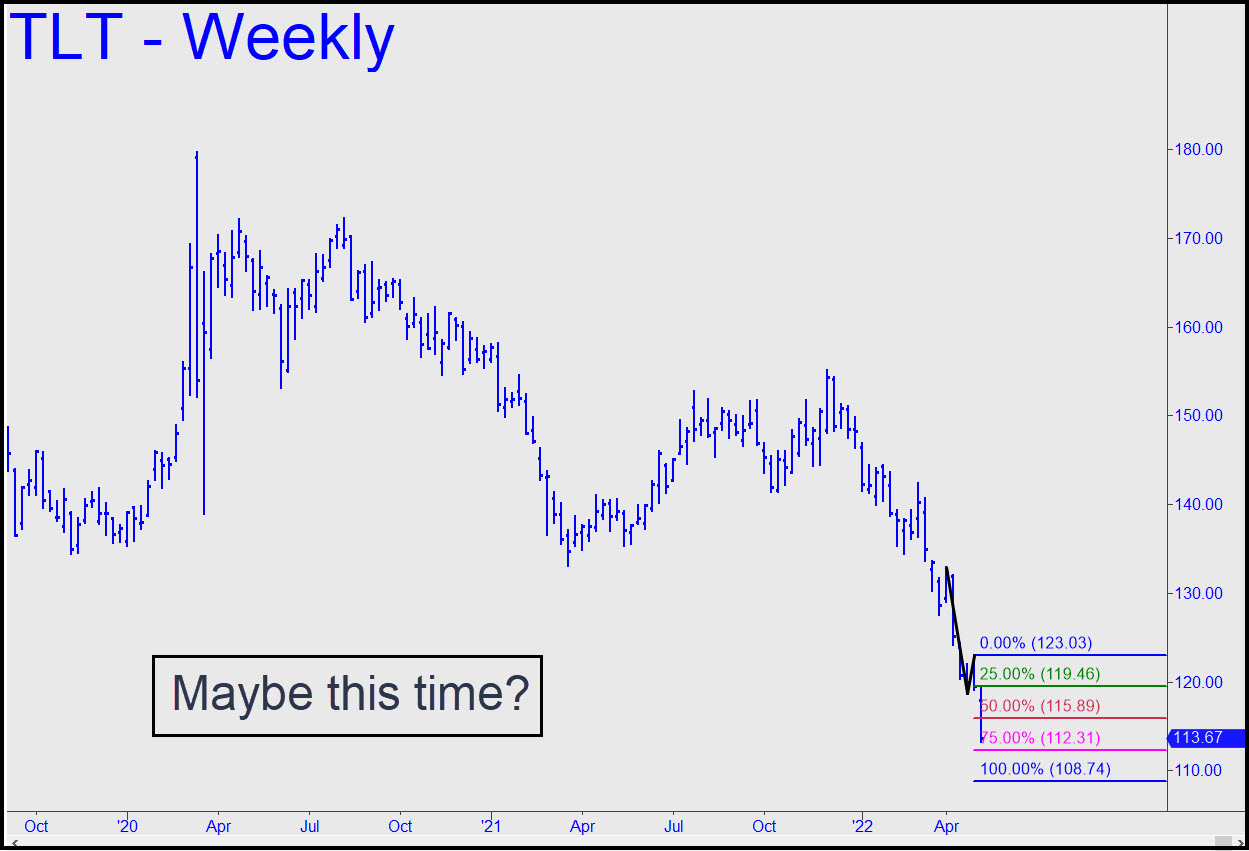

Sellers have laid waste to so many Hidden Pivot supports, both minor and major, in the past year that I hesitate to assert that the new target shown, at 108.74, will end the bear market in Treasury paper. Let’s focus for the time being on the possibility of a turn from p2=112.31, since that would be more closely congruent with my longstanding forecast for a 3.24% top in yields on the Ten-Year Note. Regardless, an easy breach of that ‘hidden’ support would portend more downside to 108.74. At that point, long-term yields would be above 3.5%, dealing a presumably fatal blow to a U.S. economy that is already arguably in recession. ______ UPDATE (May 9, 6:15 p.m.): A promising bounce has come from a low today at 112.62 that lay just an inch from the secondary pivot I’d flagged above. Let’s see what it makes. The action is yellow-bellied so far because the intraday high failed by a single tick to take out the ‘external’ peak at 114.71 recorded Friday on the way down. _______ UPDATE (May 10, 11:43 a.m.): So far so good, but the bounce would become more persuasive if it can surpass the ‘external’ peak at 119.31 recorded last Tuesday. Here’s the chart. It would be even more bullish if the rally does this without requiring a visually evident pullback on the hourly chart.

Sellers have laid waste to so many Hidden Pivot supports, both minor and major, in the past year that I hesitate to assert that the new target shown, at 108.74, will end the bear market in Treasury paper. Let’s focus for the time being on the possibility of a turn from p2=112.31, since that would be more closely congruent with my longstanding forecast for a 3.24% top in yields on the Ten-Year Note. Regardless, an easy breach of that ‘hidden’ support would portend more downside to 108.74. At that point, long-term yields would be above 3.5%, dealing a presumably fatal blow to a U.S. economy that is already arguably in recession. ______ UPDATE (May 9, 6:15 p.m.): A promising bounce has come from a low today at 112.62 that lay just an inch from the secondary pivot I’d flagged above. Let’s see what it makes. The action is yellow-bellied so far because the intraday high failed by a single tick to take out the ‘external’ peak at 114.71 recorded Friday on the way down. _______ UPDATE (May 10, 11:43 a.m.): So far so good, but the bounce would become more persuasive if it can surpass the ‘external’ peak at 119.31 recorded last Tuesday. Here’s the chart. It would be even more bullish if the rally does this without requiring a visually evident pullback on the hourly chart.

TLT – Lehman Bond ETF (Last:116.77)

Posted on May 8, 2022, 5:11 pm EDT

Last Updated May 12, 2022, 10:11 am EDT

Posted on May 8, 2022, 5:11 pm EDT

Last Updated May 12, 2022, 10:11 am EDT