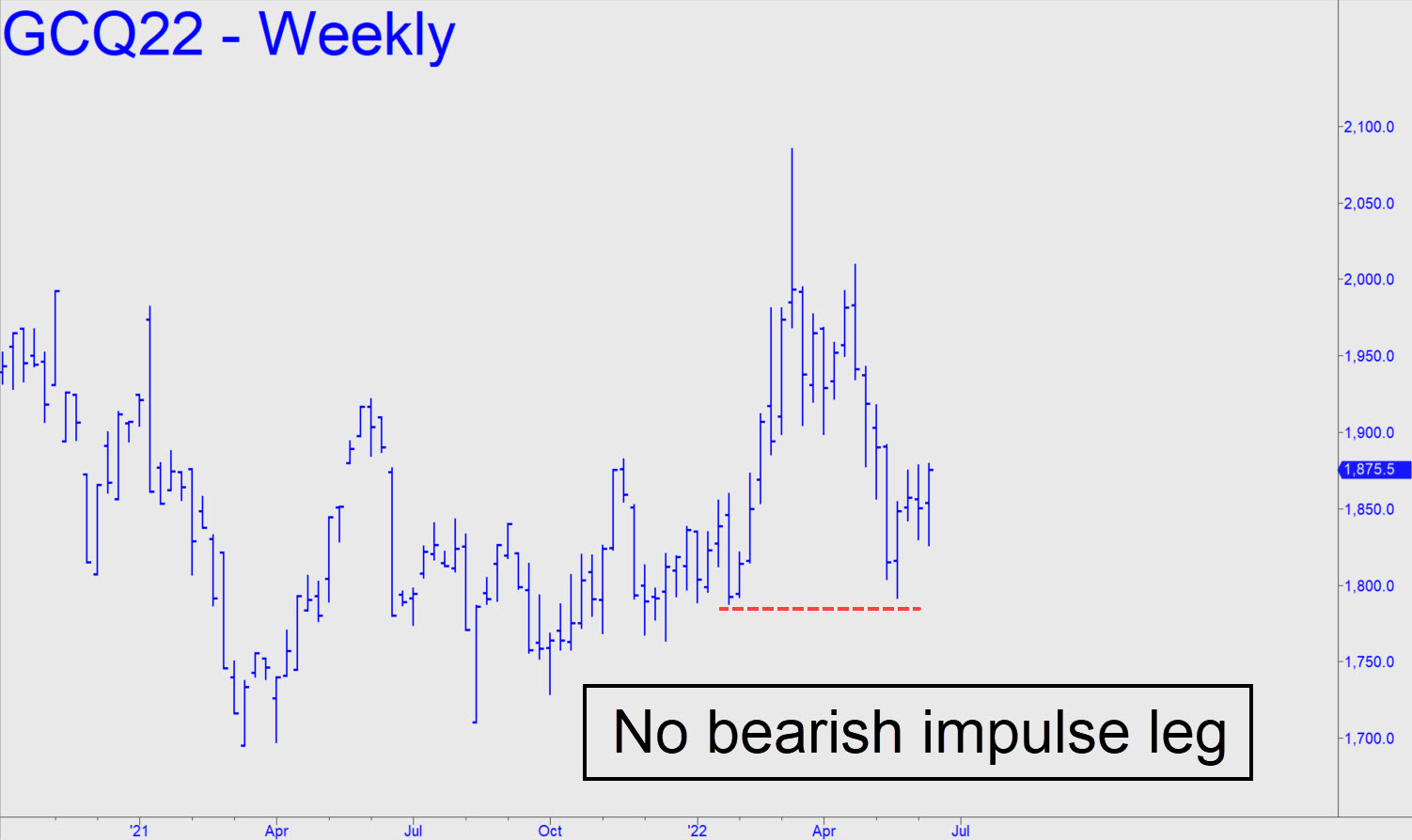

This will come as scant consolation to long-term investors who have suffered through three months of corrective pain and tedium, but the recent low failed to generate a bearish impulse leg on the weekly chart (see inset). It could still happen, but the implication of a second try would be that bears don’t have the conviction to crack 1700. Whatever happens, bullion is just a trade at the moment and nothing more, with a time horizon of perhaps 2-5 days. _______ UPDATE (Jun 13, 10:13 p.m,): Here’s a fresh chart with a 1773.70 downside target that is probably the best that bulls can hope for over the near term. A rally to x=1855.30 would trip an enticing ‘mechanical’ short, stop 1882.60, The trade is recommended for Pivoteers who are proficient with ‘camouflage’ triggers, since the initial risk on four contracts would be around $12,000 theoretical. ______ UPDATE (Jun 16, 10:32 p.m.): The rally tripped the ‘mechanical’ short noted above, but I am still recommending the trade only to subscribers proficient with ‘camouflage’ set-ups.

This will come as scant consolation to long-term investors who have suffered through three months of corrective pain and tedium, but the recent low failed to generate a bearish impulse leg on the weekly chart (see inset). It could still happen, but the implication of a second try would be that bears don’t have the conviction to crack 1700. Whatever happens, bullion is just a trade at the moment and nothing more, with a time horizon of perhaps 2-5 days. _______ UPDATE (Jun 13, 10:13 p.m,): Here’s a fresh chart with a 1773.70 downside target that is probably the best that bulls can hope for over the near term. A rally to x=1855.30 would trip an enticing ‘mechanical’ short, stop 1882.60, The trade is recommended for Pivoteers who are proficient with ‘camouflage’ triggers, since the initial risk on four contracts would be around $12,000 theoretical. ______ UPDATE (Jun 16, 10:32 p.m.): The rally tripped the ‘mechanical’ short noted above, but I am still recommending the trade only to subscribers proficient with ‘camouflage’ set-ups.

GCQ22 – August Gold (Last:1847)

Posted on June 12, 2022, 5:15 pm EDT

Last Updated June 17, 2022, 12:46 am EDT

Posted on June 12, 2022, 5:15 pm EDT

Last Updated June 17, 2022, 12:46 am EDT