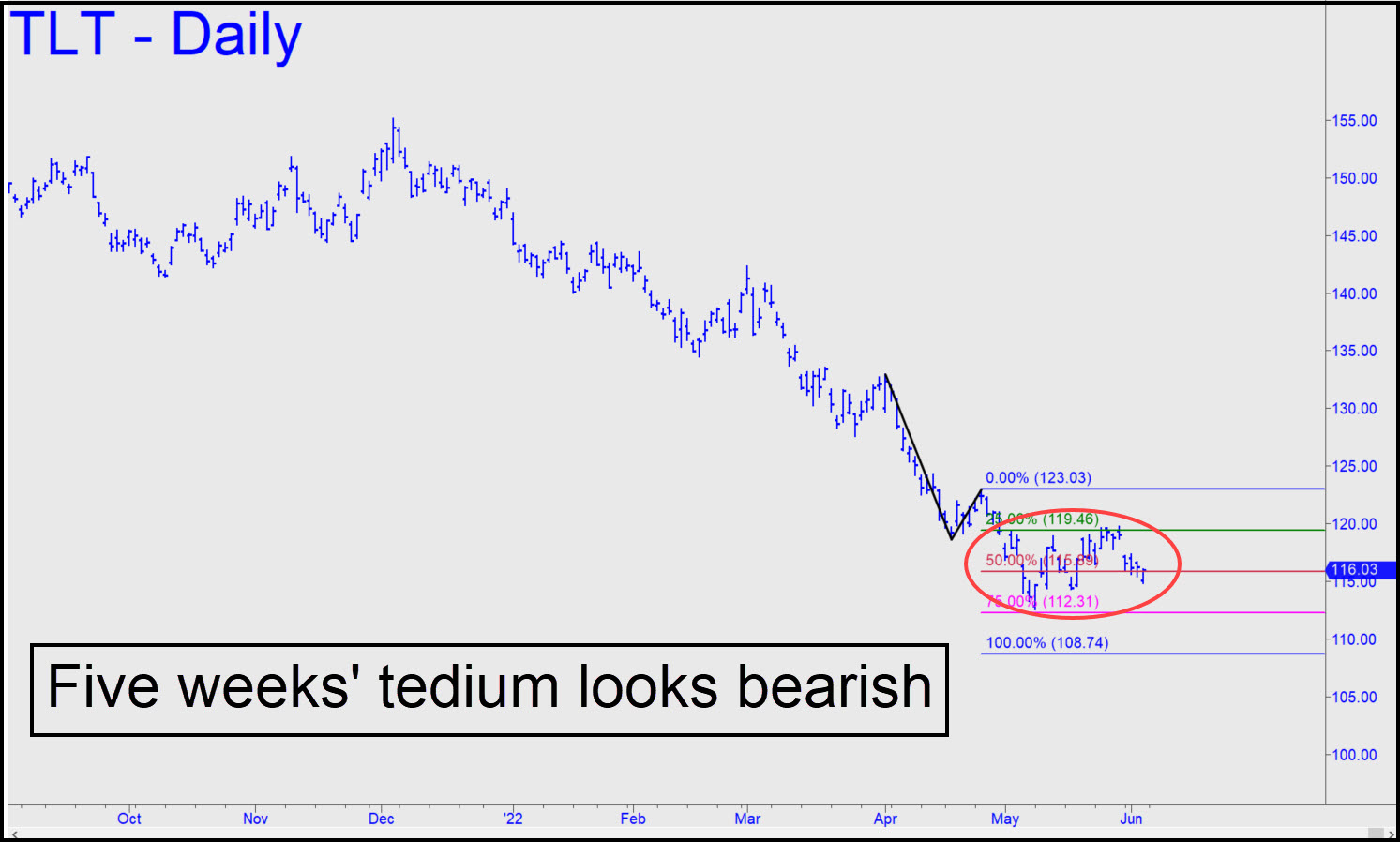

Five weeks of tedium have etched a picture of distribution on the daily chart (inset), presumably culminating with a dive at any time to the 108.74 target of the pattern shown. This suggests that my forecast for a major top in Ten Year rates at 3.24% may eventually be borne out. The so-far high at 3.17 reached on May 9 was close enough for us to have considered the target fulfilled. However, we should keep an open mind toward the possibility of a head fake corresponding to an important peak in rates. If so, it would portend deepening recession for the U.S. and the world. ______ UPDATE (Jun 13, 10:53 a.m.): I’ve adjusted the target upward to 3.56 using a less gnarly pattern in $TNX.X, a vehicle that tracks interest rates tied to the Ten-Year Note.

Five weeks of tedium have etched a picture of distribution on the daily chart (inset), presumably culminating with a dive at any time to the 108.74 target of the pattern shown. This suggests that my forecast for a major top in Ten Year rates at 3.24% may eventually be borne out. The so-far high at 3.17 reached on May 9 was close enough for us to have considered the target fulfilled. However, we should keep an open mind toward the possibility of a head fake corresponding to an important peak in rates. If so, it would portend deepening recession for the U.S. and the world. ______ UPDATE (Jun 13, 10:53 a.m.): I’ve adjusted the target upward to 3.56 using a less gnarly pattern in $TNX.X, a vehicle that tracks interest rates tied to the Ten-Year Note.

TLT – Lehman Bond ETF (Last:115.60)

Posted on June 5, 2022, 5:09 pm EDT

Last Updated June 13, 2022, 10:52 am EDT

Posted on June 5, 2022, 5:09 pm EDT

Last Updated June 13, 2022, 10:52 am EDT