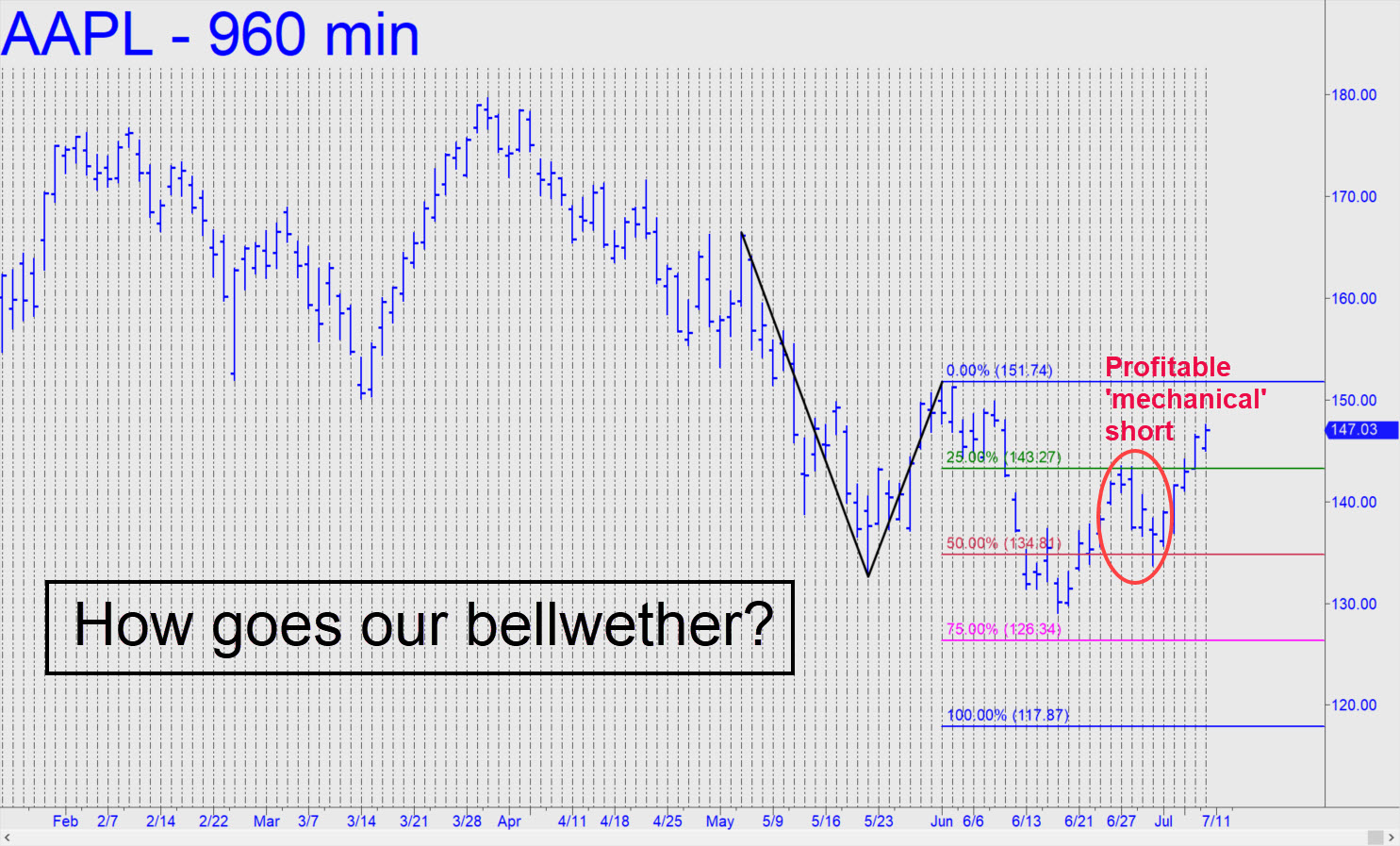

Our favorite stock-market bellwether had a decent week, with a 6% rally sufficiently lacking in excitement to suggest the stock’s handlers are quietly planning more of the same. The rally came on the heels of a successful ‘mechanical’ short from x=143.27 that I had recommended paper trading. The winning pullback did not so much suggest weakness as restfulness, and that’s why we should expect the current uptrend to take out C=151.74, even if there’s not much follow-through. Indeed, it would be a shocker — at least for me — if this bear squeeze makes it to 166.48 peak that I’ve used as the point ‘A’ high shown in the chart. _______ UPDATE (Jul 13, 10:01 p.m.): Portfolio managers who have lived effortlessly off AAPL over the years are prepared to move heaven and earth to stop out shorts above C=151.74. They will have their work cut out for them, since iPhone sales have never faced a global downturn remotely as menacing as the one that has already begun.

Our favorite stock-market bellwether had a decent week, with a 6% rally sufficiently lacking in excitement to suggest the stock’s handlers are quietly planning more of the same. The rally came on the heels of a successful ‘mechanical’ short from x=143.27 that I had recommended paper trading. The winning pullback did not so much suggest weakness as restfulness, and that’s why we should expect the current uptrend to take out C=151.74, even if there’s not much follow-through. Indeed, it would be a shocker — at least for me — if this bear squeeze makes it to 166.48 peak that I’ve used as the point ‘A’ high shown in the chart. _______ UPDATE (Jul 13, 10:01 p.m.): Portfolio managers who have lived effortlessly off AAPL over the years are prepared to move heaven and earth to stop out shorts above C=151.74. They will have their work cut out for them, since iPhone sales have never faced a global downturn remotely as menacing as the one that has already begun.

AAPL – Apple Computer (Last:145.45)

Posted on July 10, 2022, 5:17 pm EDT

Last Updated July 14, 2022, 4:37 pm EDT

Posted on July 10, 2022, 5:17 pm EDT

Last Updated July 14, 2022, 4:37 pm EDT