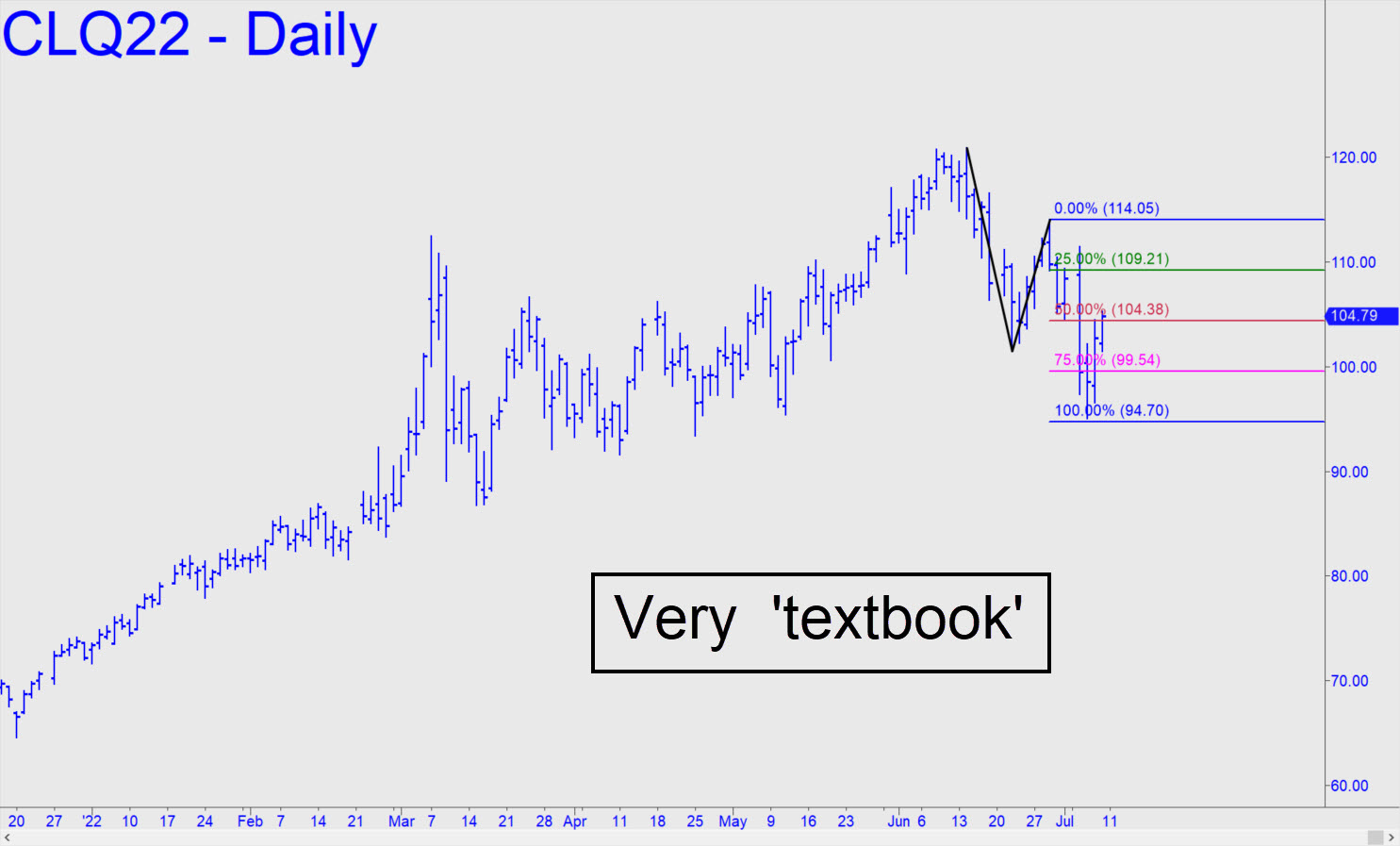

The sharp rally off the July 6 low at 95.10 does not appear bound for greatness. Although I still have a lofty outstanding target at 134.59, I’ve grown increasingly skeptical that it will be achieved. It has yet to be negated by a dip below C=86.81, but evidence grows that the bullish pattern is weakening nonetheless. Last week, for instance, we saw a corrective ABCD complete to its D target at 94.70. If the larger and still theoretically dominant, bull-market were as robust as its initial A-B impulse leg, the correction should not have exceeded p=104.38 (the red line in the chart). My hunch is that, barring an unforeseeable geopolitical shock to global supply, the June 14 top will stand and that this rally should be shorted. Stay tuned to the chat room and email ‘Notifications’ if you care. ______ UPDATE (Jul 12, 5:18 p.m.): Bombs away! I am projecting $3.00 more downside before August Crude becomes an appealing speculative buy. ______ UPDATE (Jul 13, 9:40 p.m.): The futures have bounced after bottoming $1 above where I’d predicted. The rally shows promise, but it would need to surpass an external peak at 111.46 to merit our serious attention. Getting short (or long, for that matter) will be tricky, so ‘camouflage’ is advised. ________ UPDATE (Jul 14, 9:57 a.m.): Someone asked in the chat room where I thought crude was headed. I responded as follows: $40 a barrel or lower– just a hunch. But if you are addicted to bottom-fishing, the most promising place to try it would be 88.90 (basis the August). That’s my minimum downside target for the near term, and I am confident it will be reached. The pattern is too obvious for precision, since the mouth-breathers and algos will be out in force trying to exploit it, so camouflage is suggested (60-min, a=111.45 on 7/4). _______ UPDATE (Jul 14, 4:35 p.m.): As anticipated, the mouth-breathers and algos tripped over themselves in their eagerness to front-run the 88.90 downside target, turning the futures higher from a low at 90.56. In retrospect, the pattern was too obvious to be usable, even with ‘camouflage. Let’s see how high this short-squeeze goes.

The sharp rally off the July 6 low at 95.10 does not appear bound for greatness. Although I still have a lofty outstanding target at 134.59, I’ve grown increasingly skeptical that it will be achieved. It has yet to be negated by a dip below C=86.81, but evidence grows that the bullish pattern is weakening nonetheless. Last week, for instance, we saw a corrective ABCD complete to its D target at 94.70. If the larger and still theoretically dominant, bull-market were as robust as its initial A-B impulse leg, the correction should not have exceeded p=104.38 (the red line in the chart). My hunch is that, barring an unforeseeable geopolitical shock to global supply, the June 14 top will stand and that this rally should be shorted. Stay tuned to the chat room and email ‘Notifications’ if you care. ______ UPDATE (Jul 12, 5:18 p.m.): Bombs away! I am projecting $3.00 more downside before August Crude becomes an appealing speculative buy. ______ UPDATE (Jul 13, 9:40 p.m.): The futures have bounced after bottoming $1 above where I’d predicted. The rally shows promise, but it would need to surpass an external peak at 111.46 to merit our serious attention. Getting short (or long, for that matter) will be tricky, so ‘camouflage’ is advised. ________ UPDATE (Jul 14, 9:57 a.m.): Someone asked in the chat room where I thought crude was headed. I responded as follows: $40 a barrel or lower– just a hunch. But if you are addicted to bottom-fishing, the most promising place to try it would be 88.90 (basis the August). That’s my minimum downside target for the near term, and I am confident it will be reached. The pattern is too obvious for precision, since the mouth-breathers and algos will be out in force trying to exploit it, so camouflage is suggested (60-min, a=111.45 on 7/4). _______ UPDATE (Jul 14, 4:35 p.m.): As anticipated, the mouth-breathers and algos tripped over themselves in their eagerness to front-run the 88.90 downside target, turning the futures higher from a low at 90.56. In retrospect, the pattern was too obvious to be usable, even with ‘camouflage. Let’s see how high this short-squeeze goes.

CLQ22 – August Crude (Last:96.42)

Posted on July 10, 2022, 5:22 pm EDT

Last Updated July 14, 2022, 4:35 pm EDT

Posted on July 10, 2022, 5:22 pm EDT

Last Updated July 14, 2022, 4:35 pm EDT

-

July 10, 2022, 9:13 pm

-

July 12, 2022, 11:54 pm

Thanks for the reply. My guess was close to your answer and viola the opposite just happened- an overshot of your target by $1.09. That smells of weakness to me. Could $60.00 be in the works? We will see; all we need do is wait!

Thanks again, Dean

-

July 12, 2022, 11:54 pm

From above: “Last week, for instance, we saw a corrective ABCD complete to its D target at 94.70.”

Do you mean this in general? Your target was 94.70, yet the low as stated above was 95.10. Is this a common slip or truth as stated?

That is a 40 cent differential and your projections tend to be very close, as in less than a nickel.

Thanks for your great work.

Dean

&&&&&

The 40-cemt undershoot amounted to just 0.4%. That’s close enough for the target to be considered fulfilled, but the assumption was clinched when gold bounced $10 off the low. My forecast was not quite ‘bullseye’ enough, however, to set up an easy trade for bottom-fishing. RA