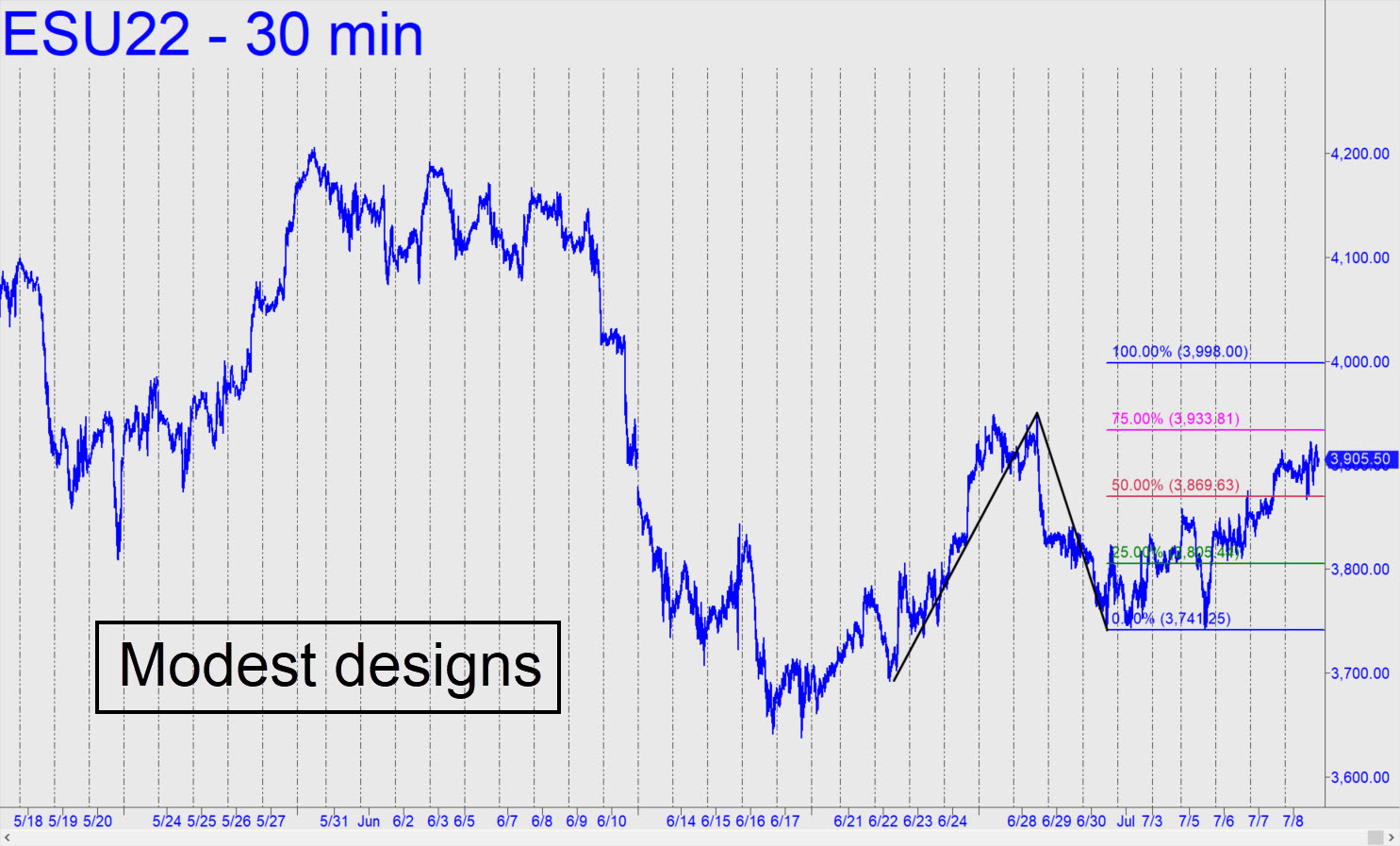

We’ll start the week with a modest rally target at 3998.00, given the futures’ tortured progress last week toward heights unknown. The next 100 points would offer little resistance, since most of it traverses a nearly crag-less El Capitan created by the steep downdraft during the second week in June. Balky as July’s uptrend has been, it has yet to provide any ‘mechanical’ buying opportunities tied to the pattern shown. A swoon on Monday to the green line (3805.25), however unlikely, would generate a ‘mechanical’ buy, stop 3741.00, but I cannot recommend the trade until I’ve seen how DaBoyz open index futures Sunday night. ______ UPDATE (Jul 11, 9:40 p.m.): The trade looks appealing enough to rate a ‘7.4’. However, with nearly $13,000 of initial risk on four contracts, it is recommended only to Pivoteers who can cut that down with ‘camouflage’ to no more than $300 theoretical per contract. If the trade is setting up during Tuesday’s Q&A ‘bonus’ session for recent ‘mechanical’ course registrants, we’ll give it a shot. ______ UPDATE (Jul 12, 5:14 p.m.): The trade triggered in the final hour, so let’s see how it goes. It will produce a theoretical profit of about $13,000 if p=3869.63 is touched before 3741.00. Here’s the chart. _______ UPDATE (Jul 13, 9:52 p.m.): The trade was a quick winner of around $11,000, since ES head-faked to 3873 on meaningless CPI news before veering sharply south. In the chat room, I’d suggested taking a partial profit just before the lunatick leap on the news, but even then the futures were up 40 points above the 3805 ‘mechanical’ entry point from a day earlier. I was unable to determine if, or how many, subscribers did the trade, so there was no tracking guidance, just a price target that worked precisely. _______ UPDATE (Jul 14, 4:29 p.m.): The next leg down should hit p=3686 and produce a tradeable bounce: https://bit.ly/3AMfIYJ The current rally has come from the wrong place — 3723.75, rather than the correct ‘discomfort-zone’ sweet spot, 3717 –and that is why I think it isn’t going very far.

We’ll start the week with a modest rally target at 3998.00, given the futures’ tortured progress last week toward heights unknown. The next 100 points would offer little resistance, since most of it traverses a nearly crag-less El Capitan created by the steep downdraft during the second week in June. Balky as July’s uptrend has been, it has yet to provide any ‘mechanical’ buying opportunities tied to the pattern shown. A swoon on Monday to the green line (3805.25), however unlikely, would generate a ‘mechanical’ buy, stop 3741.00, but I cannot recommend the trade until I’ve seen how DaBoyz open index futures Sunday night. ______ UPDATE (Jul 11, 9:40 p.m.): The trade looks appealing enough to rate a ‘7.4’. However, with nearly $13,000 of initial risk on four contracts, it is recommended only to Pivoteers who can cut that down with ‘camouflage’ to no more than $300 theoretical per contract. If the trade is setting up during Tuesday’s Q&A ‘bonus’ session for recent ‘mechanical’ course registrants, we’ll give it a shot. ______ UPDATE (Jul 12, 5:14 p.m.): The trade triggered in the final hour, so let’s see how it goes. It will produce a theoretical profit of about $13,000 if p=3869.63 is touched before 3741.00. Here’s the chart. _______ UPDATE (Jul 13, 9:52 p.m.): The trade was a quick winner of around $11,000, since ES head-faked to 3873 on meaningless CPI news before veering sharply south. In the chat room, I’d suggested taking a partial profit just before the lunatick leap on the news, but even then the futures were up 40 points above the 3805 ‘mechanical’ entry point from a day earlier. I was unable to determine if, or how many, subscribers did the trade, so there was no tracking guidance, just a price target that worked precisely. _______ UPDATE (Jul 14, 4:29 p.m.): The next leg down should hit p=3686 and produce a tradeable bounce: https://bit.ly/3AMfIYJ The current rally has come from the wrong place — 3723.75, rather than the correct ‘discomfort-zone’ sweet spot, 3717 –and that is why I think it isn’t going very far.

ESU22 – Sep E-Mini S&P (Last:3794)

Posted on July 10, 2022, 5:20 pm EDT

Last Updated July 14, 2022, 4:26 pm EDT

Posted on July 10, 2022, 5:20 pm EDT

Last Updated July 14, 2022, 4:26 pm EDT