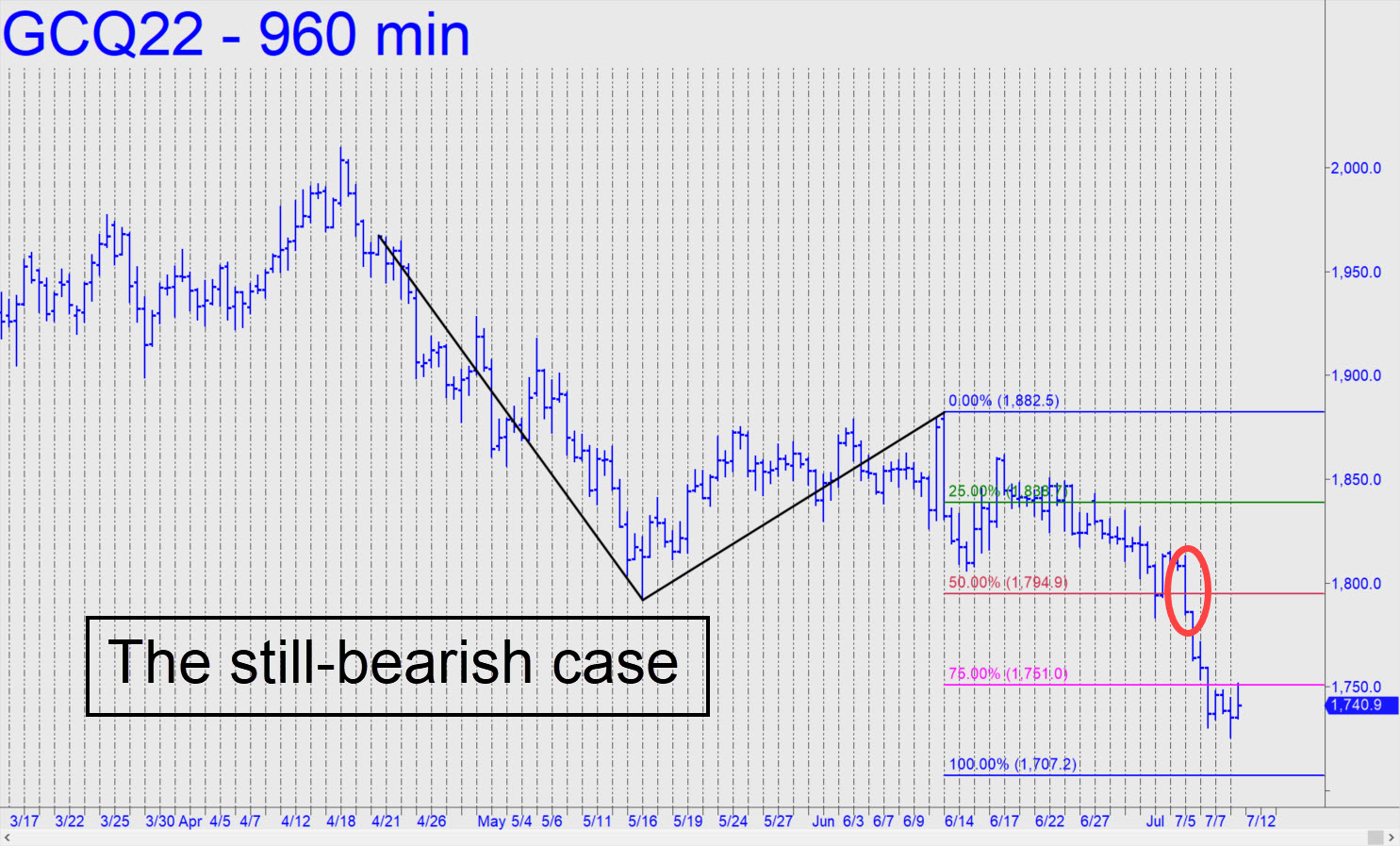

August Gold finally turned higher on the final bar of the week, a suspicious development from which some in the chat room seemed inclined nonetheless to take encouragement. My take is more skeptical, given the way sellers cracked the midpoint Hidden Pivot support at 1794.90 a week earlier. It suggested that the futures are likely to reach ‘D’ before they can make a good-faith attempt to end the long dirge begun from $2000 in April. Please note the small adjustment in the chart — a shift to a higher point ‘A’ that has lowered the target by a few dollars to 1707.20. Note as well that a two-level rally to x=1888.70 would set up a ‘mechanical’ short of a kind that has worked well for us in the past. _____ UPDATE (Jul 12, 5:38 p.m.): Chat room remonstrations have sought equal time for predictions of a 1670 low before this cinder block can turn around, so here it is: a 1665.00 Hidden Pivot target. Certainly not impossible, but I will be looking for a tradeable and potentially important turn from higher levels nonetheless. Specifically, I expect the futures to bounce from 1718.30, and thence from 1707.20 if there’s a relapse. If 1707.20 is exceeded on a closing basis for two consecutive days, however, or exceeded by more than $4 intraday, I would infer that 1670 is indeed going to be reached (and slightly exceeded). That would be a great place to back up the truck and buy ’em hand-over-fist.

August Gold finally turned higher on the final bar of the week, a suspicious development from which some in the chat room seemed inclined nonetheless to take encouragement. My take is more skeptical, given the way sellers cracked the midpoint Hidden Pivot support at 1794.90 a week earlier. It suggested that the futures are likely to reach ‘D’ before they can make a good-faith attempt to end the long dirge begun from $2000 in April. Please note the small adjustment in the chart — a shift to a higher point ‘A’ that has lowered the target by a few dollars to 1707.20. Note as well that a two-level rally to x=1888.70 would set up a ‘mechanical’ short of a kind that has worked well for us in the past. _____ UPDATE (Jul 12, 5:38 p.m.): Chat room remonstrations have sought equal time for predictions of a 1670 low before this cinder block can turn around, so here it is: a 1665.00 Hidden Pivot target. Certainly not impossible, but I will be looking for a tradeable and potentially important turn from higher levels nonetheless. Specifically, I expect the futures to bounce from 1718.30, and thence from 1707.20 if there’s a relapse. If 1707.20 is exceeded on a closing basis for two consecutive days, however, or exceeded by more than $4 intraday, I would infer that 1670 is indeed going to be reached (and slightly exceeded). That would be a great place to back up the truck and buy ’em hand-over-fist.

GCQ22 – August Gold (Last:1724.00)

Posted on July 10, 2022, 5:14 pm EDT

Last Updated July 12, 2022, 5:45 pm EDT

Posted on July 10, 2022, 5:14 pm EDT

Last Updated July 12, 2022, 5:45 pm EDT