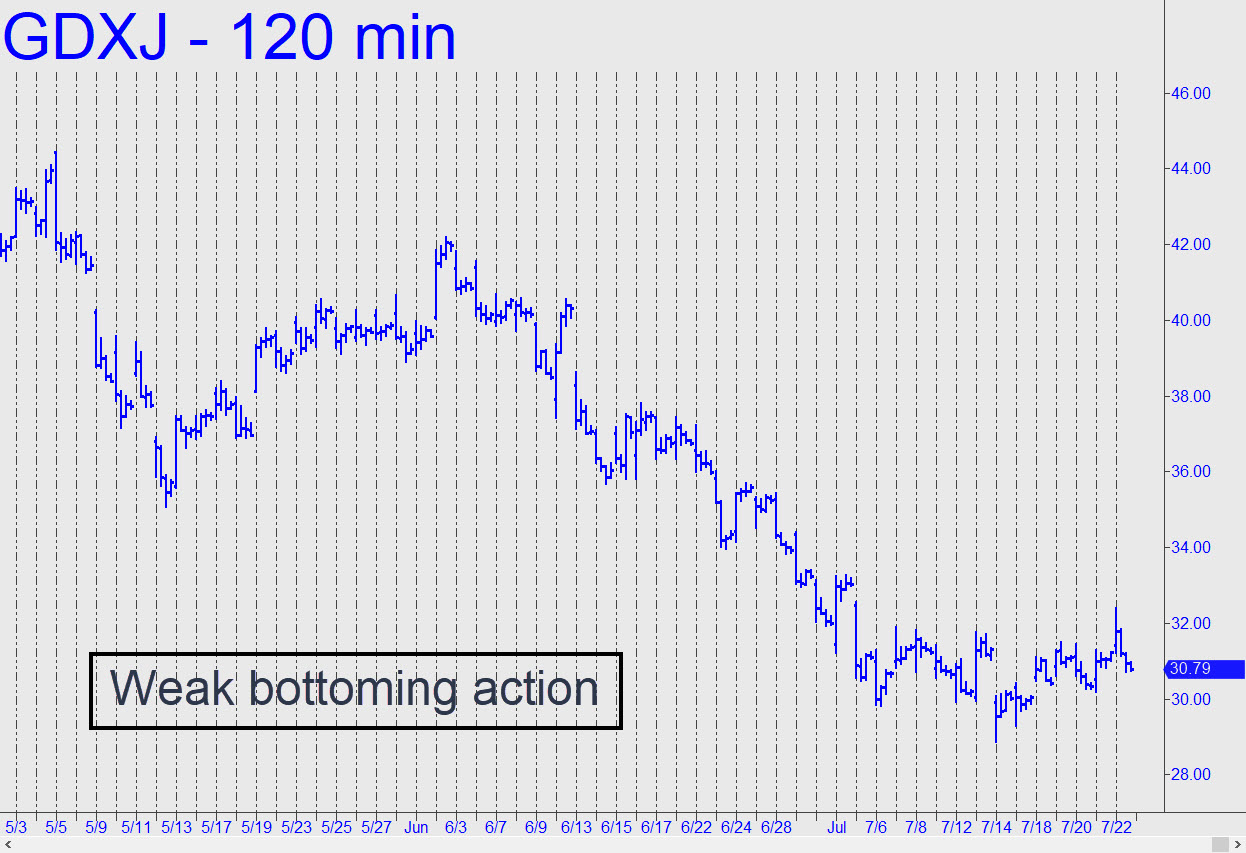

If gold is bottoming, the evidence has been somewhat more persuasive on the Comex than in ETFs reflecting growth prospects for miners and junior exploration companies. This ETF generated a weak impulse leg last week that was doubtless sufficient to pique the interest of weary bulls. but the next thrust would need to impulse above the 33.27 peak recorded on July 1 to be worthy of notice. The move would be more persuasive if there is no discernible B-C pullback once GDXJ has surpassed Friday’s dubious high at 32.29, which was achieved on the opening bar with a short-squeeze that would have trapped and soured more than a few bulls.

If gold is bottoming, the evidence has been somewhat more persuasive on the Comex than in ETFs reflecting growth prospects for miners and junior exploration companies. This ETF generated a weak impulse leg last week that was doubtless sufficient to pique the interest of weary bulls. but the next thrust would need to impulse above the 33.27 peak recorded on July 1 to be worthy of notice. The move would be more persuasive if there is no discernible B-C pullback once GDXJ has surpassed Friday’s dubious high at 32.29, which was achieved on the opening bar with a short-squeeze that would have trapped and soured more than a few bulls.

GDXJ – Junior Gold Miner ETF (Last:30.79)

Posted on July 24, 2022, 5:07 pm EDT

Last Updated July 24, 2022, 11:08 am EDT

Posted on July 24, 2022, 5:07 pm EDT

Last Updated July 24, 2022, 11:08 am EDT