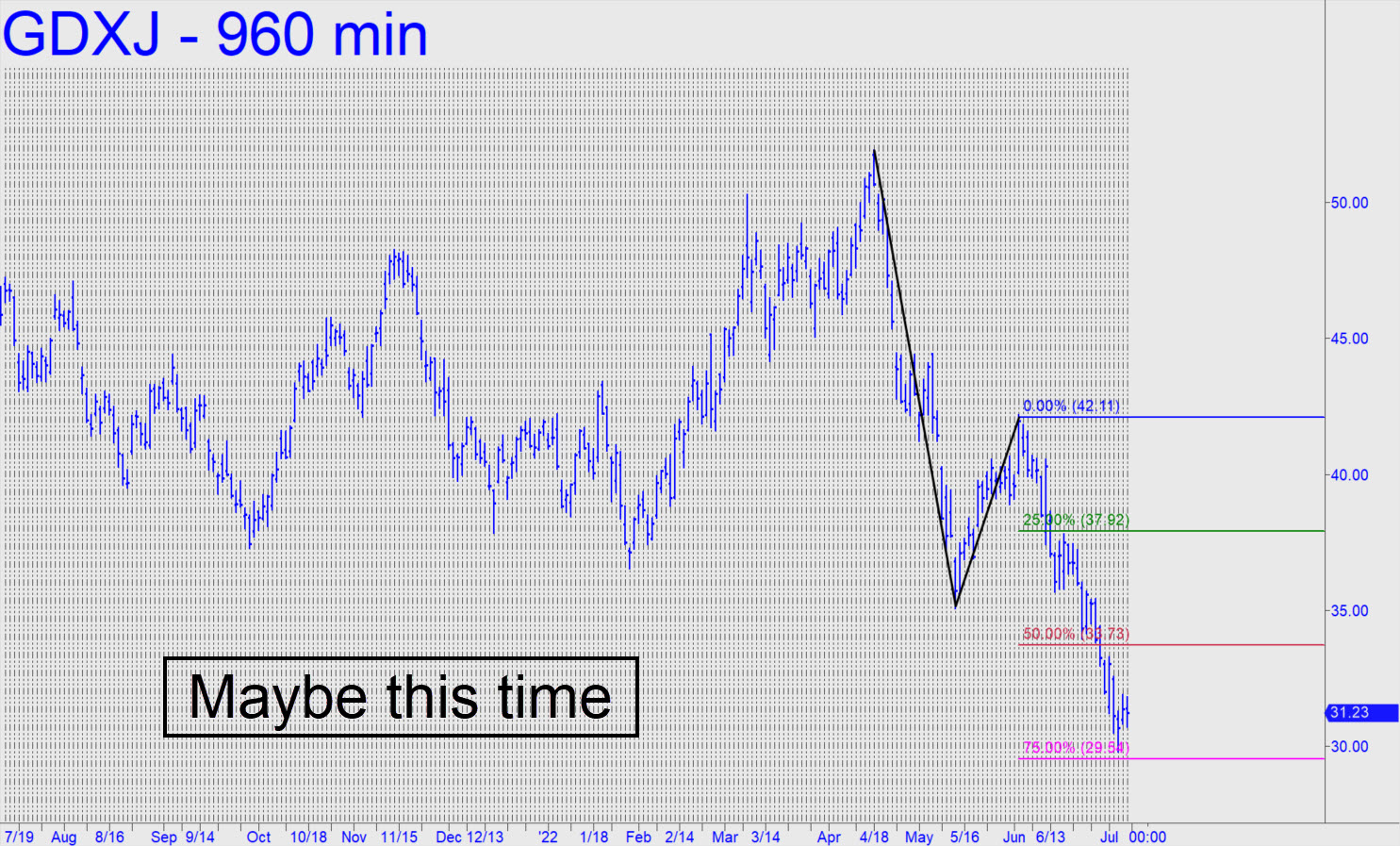

A 29.92 downside target I’d drum-rolled, albeit with a dollop of sarcasm, turned out to have been just the ticket for subscribers who have been waiting patiently for a turn. Enough of you reported getting long using my number that I’ve established a 400-share (or multiple thereof) tracking position. Assuming 50% of the position was exited near 31.35 as advised, you are holding half of the original position with a profit-adjusted cost basis of 28.49. For now, stick to the 30.52 stop-loss advised earlier. That’s where selling would generate a bearish impulse leg on the lesser charts. Make the order o-c-o with another to exit an additional 25% of the position at 32.43. ______ UPDATE (Jul 12, 5:25 p.m.): If you followed my guidance, you should have dismounted this glue horse at 30.52 for a theoretical gain of $206. We’ll go back to ignoring GDXJ until such time as it shows better behavior. Worst case is now D=25.35. yet one more place where we could back up the truck and hope to make money even if we’re wrong about a bottom there.

A 29.92 downside target I’d drum-rolled, albeit with a dollop of sarcasm, turned out to have been just the ticket for subscribers who have been waiting patiently for a turn. Enough of you reported getting long using my number that I’ve established a 400-share (or multiple thereof) tracking position. Assuming 50% of the position was exited near 31.35 as advised, you are holding half of the original position with a profit-adjusted cost basis of 28.49. For now, stick to the 30.52 stop-loss advised earlier. That’s where selling would generate a bearish impulse leg on the lesser charts. Make the order o-c-o with another to exit an additional 25% of the position at 32.43. ______ UPDATE (Jul 12, 5:25 p.m.): If you followed my guidance, you should have dismounted this glue horse at 30.52 for a theoretical gain of $206. We’ll go back to ignoring GDXJ until such time as it shows better behavior. Worst case is now D=25.35. yet one more place where we could back up the truck and hope to make money even if we’re wrong about a bottom there.

GDXJ – Junior Gold Miner ETF (Last:30.21)

Posted on July 10, 2022, 5:16 pm EDT

Last Updated July 14, 2022, 9:40 am EDT

Posted on July 10, 2022, 5:16 pm EDT

Last Updated July 14, 2022, 9:40 am EDT