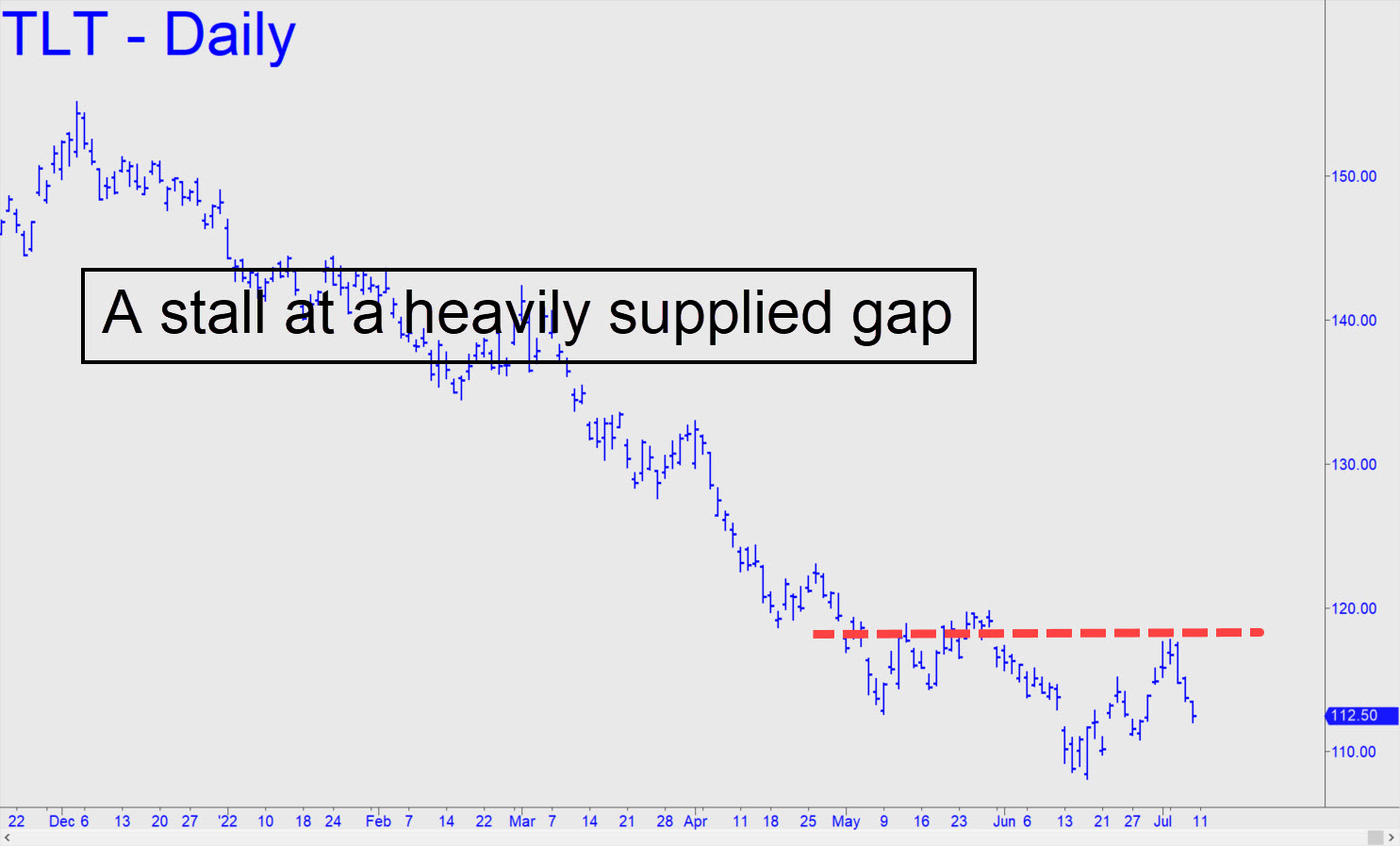

T-Bond prices fell last week not for reasons of weakness, but because the bonds got winded after pushing into heavy supply created by a last-ditch distribution over the last three weeks in May. The possibility of an important bottom in Treasurys is corroborated by interst rates on the Ten-Year Note’s having reached a corresponding rally target at 3.56% when the bonds were cratering. TLT looks like it needs a little more corrective action to base for a sustained rally, and my hunch is that it will occur closer to 110. A retest of the 108.12 low is also possible, but I would expect only a marginal breach at worst if one occurs.

T-Bond prices fell last week not for reasons of weakness, but because the bonds got winded after pushing into heavy supply created by a last-ditch distribution over the last three weeks in May. The possibility of an important bottom in Treasurys is corroborated by interst rates on the Ten-Year Note’s having reached a corresponding rally target at 3.56% when the bonds were cratering. TLT looks like it needs a little more corrective action to base for a sustained rally, and my hunch is that it will occur closer to 110. A retest of the 108.12 low is also possible, but I would expect only a marginal breach at worst if one occurs.

TLT – Lehman Bond ETF (Last:112.50)

Posted on July 10, 2022, 5:18 pm EDT

Last Updated July 9, 2022, 9:08 am EDT

Posted on July 10, 2022, 5:18 pm EDT

Last Updated July 9, 2022, 9:08 am EDT