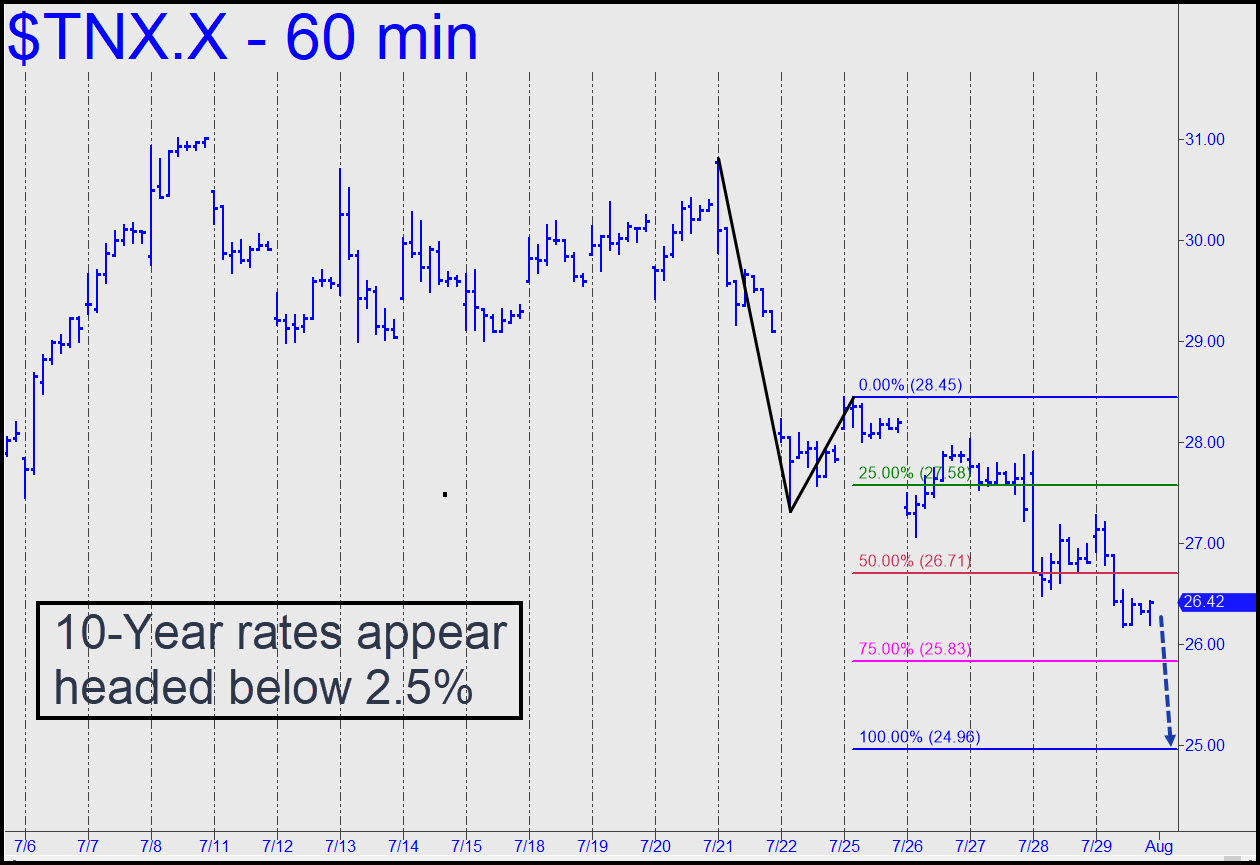

The A-B leg is sufficiently compelling that we can infer rates on the 10-Year Note are on their way down to at least 2.49%, a hair beneath the psychologically important 2.50% level. That would be a good place for a pause, but it is more likely that we’ll see a bounce. It’s too early to tell whether this would be the start of a strong, bullish reversal, but if so, it holds bullish implications for the big banks, if not for other sectors of the U.S. economy. Alternatively, if D=2.49% is easily penetrated, it would imply ore slippage down to 2.30%, or even 19.10%. Both targets come from a reverse pattern on the monthly chart.

The A-B leg is sufficiently compelling that we can infer rates on the 10-Year Note are on their way down to at least 2.49%, a hair beneath the psychologically important 2.50% level. That would be a good place for a pause, but it is more likely that we’ll see a bounce. It’s too early to tell whether this would be the start of a strong, bullish reversal, but if so, it holds bullish implications for the big banks, if not for other sectors of the U.S. economy. Alternatively, if D=2.49% is easily penetrated, it would imply ore slippage down to 2.30%, or even 19.10%. Both targets come from a reverse pattern on the monthly chart.

TNX.X – Ten-Year Note Rate (Last:2.64%)

Posted on July 31, 2022, 5:12 pm EDT

Last Updated July 30, 2022, 12:57 am EDT

Posted on July 31, 2022, 5:12 pm EDT

Last Updated July 30, 2022, 12:57 am EDT