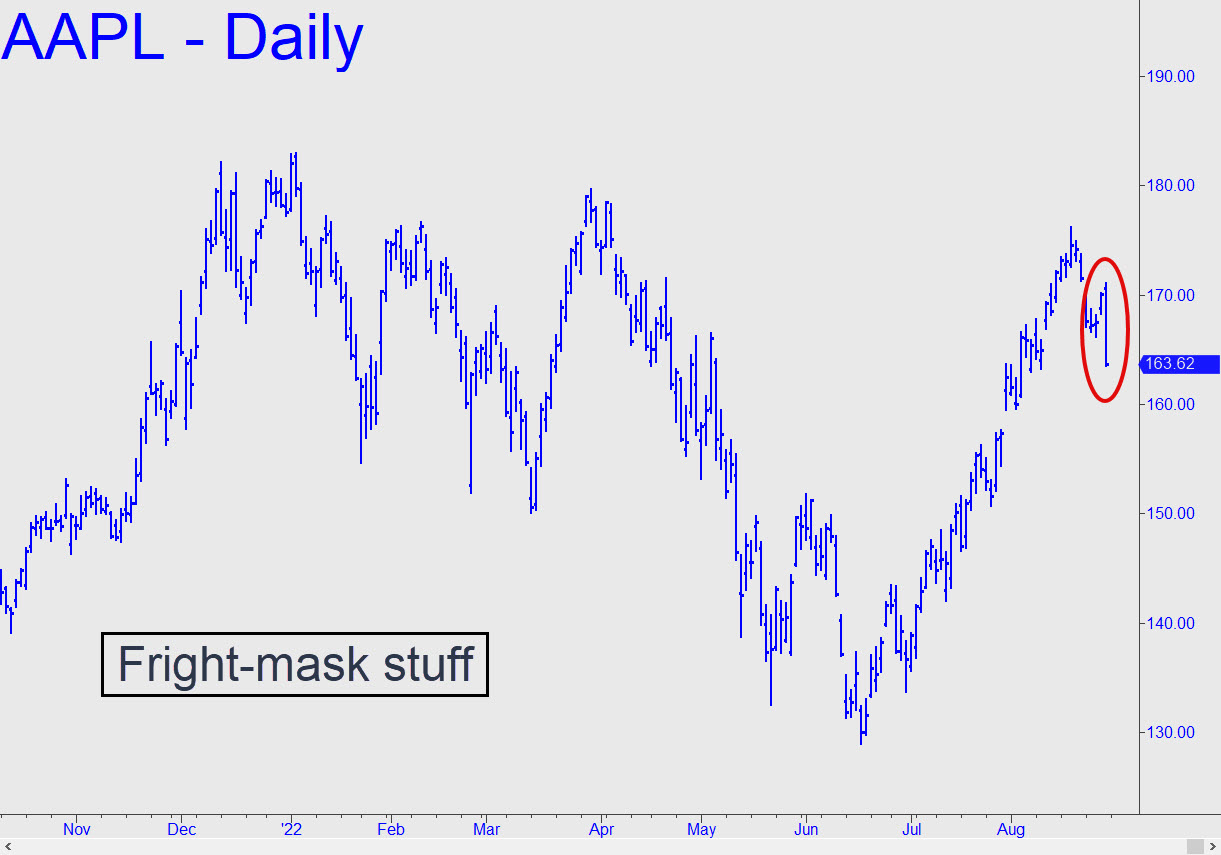

AAPL was overdue for a drubbing, especially since the stock could not have continued to hover in outer space when the broad averages finally got hit. Nor is there any compelling reason for the portfolio chimps who live off AAPL to put much effort into holding it aloft while other stocks continue to correct. You can see that a seemingly nasty fall to $150 would not change the menancingly bullish look of the chart or the likelihood of new record highs. Most immediately, there’s a 162.40 downside target we can use as a minimum projection over the near term (30-min, A=174.90 on 8/18). ________ UPDATE (Aug 30, 5:06 p.m.): The bearish pattern shown in this chart, with a 151,15 downside target, is all we’ve got to work with at the moment, The impulse leg is not legitimate and the C-D leg has yet to touch p, but we’ll give the pattern the benefit of the doubt as AAPL continues to make its way lower. Apple says iPhone sales are holding up fairly well, but with Europe headed into a possible economic depression, the market for overpriced/over-featured cell phones is about to crash along with consumer spending. ________ UPDATE (Aug 31, 11:40 p.m.): This chart revises the quite bearish target slightly upward to 151.38. Today’s low just pennies from p=157.00 says the pattern is working and will yield good odds for trading its levels ‘mechanically’. ________ UPDATE (Sep 3, 10:32 a.m.): ‘Good odds’, indeed! A straight-up ‘mechanical’ short at the green line would have produced an intraday profit of as much as $486 per round lot. The 151.38 target remains viable as a minimum downside objective for the near term. ______ UPDATE (Sep 7, 9:30 p.m.): My newly bullish outlook for the E-Mini S&Ps contrasts sharply with a still-bearish forecast for AAPL. I’ll be interested to see how this divergence is reconciled, but for now we should let each vehicle speak for itself. AAPL would get in bullish gear if it pops to 160.59. _______ UPDATE (Sep 8, 10:30 p.m.): And now it would take merely a print at 157.10, a tick above Tuesday’s ‘external’ peak, to generate a bullish impulse leg on the hour chart. That, presumably, would put AAPL at least temporarily in gear with index futures that have turned robustly bullish.

AAPL was overdue for a drubbing, especially since the stock could not have continued to hover in outer space when the broad averages finally got hit. Nor is there any compelling reason for the portfolio chimps who live off AAPL to put much effort into holding it aloft while other stocks continue to correct. You can see that a seemingly nasty fall to $150 would not change the menancingly bullish look of the chart or the likelihood of new record highs. Most immediately, there’s a 162.40 downside target we can use as a minimum projection over the near term (30-min, A=174.90 on 8/18). ________ UPDATE (Aug 30, 5:06 p.m.): The bearish pattern shown in this chart, with a 151,15 downside target, is all we’ve got to work with at the moment, The impulse leg is not legitimate and the C-D leg has yet to touch p, but we’ll give the pattern the benefit of the doubt as AAPL continues to make its way lower. Apple says iPhone sales are holding up fairly well, but with Europe headed into a possible economic depression, the market for overpriced/over-featured cell phones is about to crash along with consumer spending. ________ UPDATE (Aug 31, 11:40 p.m.): This chart revises the quite bearish target slightly upward to 151.38. Today’s low just pennies from p=157.00 says the pattern is working and will yield good odds for trading its levels ‘mechanically’. ________ UPDATE (Sep 3, 10:32 a.m.): ‘Good odds’, indeed! A straight-up ‘mechanical’ short at the green line would have produced an intraday profit of as much as $486 per round lot. The 151.38 target remains viable as a minimum downside objective for the near term. ______ UPDATE (Sep 7, 9:30 p.m.): My newly bullish outlook for the E-Mini S&Ps contrasts sharply with a still-bearish forecast for AAPL. I’ll be interested to see how this divergence is reconciled, but for now we should let each vehicle speak for itself. AAPL would get in bullish gear if it pops to 160.59. _______ UPDATE (Sep 8, 10:30 p.m.): And now it would take merely a print at 157.10, a tick above Tuesday’s ‘external’ peak, to generate a bullish impulse leg on the hour chart. That, presumably, would put AAPL at least temporarily in gear with index futures that have turned robustly bullish.

AAPL – Apple Computer (Last:154.47)

Posted on August 28, 2022, 5:17 pm EDT

Last Updated September 8, 2022, 10:28 pm EDT

Posted on August 28, 2022, 5:17 pm EDT

Last Updated September 8, 2022, 10:28 pm EDT