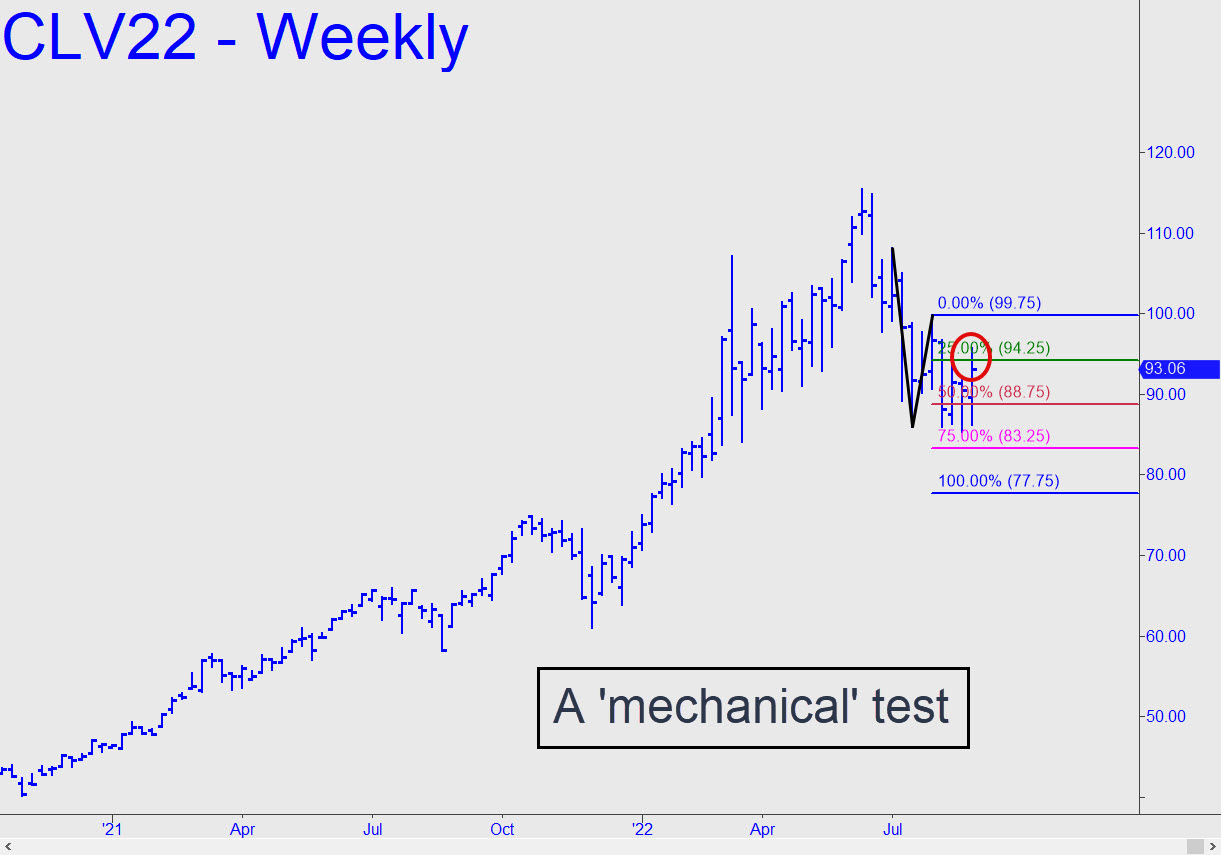

Last week’s rally could provide a crucial test for my bearish outlook, since it triggered an attractive ‘mechanical’ short at the green line after bouncing from a low in the pattern’s sweet spot. The theoretical position was slightly profitable at the bell, but we are paper trading it in any event because the entry risk is about $22,000 on four contracts. To qualify the word ‘attractive’, it implies that a short from 94.24 has a better than 50% chance of producing a profit by falling to p=88.75, at least, before popping above C=99.75 to stop out the position. ________ UPDATE (Aug 31, 11:50 p.m.): So far so good. The futures produced a $22,000 profit on the paper trade with today’s dive to p=88.75. Assuming half the position has been covered, let’s shoot for p2= 83.25 on the third of four contracts shorted. Note the D target at 77.75, which, as noted here earlier, would imply pump prices below $3 gallon. _______ UPDATE (Sep 1, 11:24 p.m.): Use a stop-loss at 91.43 for the two contracts that remain. This should be worked o-c-o with an order to cover one contracts at p2=83.25. _______ UPDATE (Sep 7, 10:16 p.m.): The trade has been a monster, producing one of the biggest gains ever for an explictly actionable tout. The trend forecast itself went sharply against the crowd, with an extremely bearish forecast at a time when most other seers were expecting a run-up to above $100. That said, there has been almost no discussion of the trade, or even of crude oil, in the tradng room, so NYMEX futures will be eliminated from the core list of touts. However, I will still provide coverage of this vehicle and energy proxies on-demand in the trading room.

Last week’s rally could provide a crucial test for my bearish outlook, since it triggered an attractive ‘mechanical’ short at the green line after bouncing from a low in the pattern’s sweet spot. The theoretical position was slightly profitable at the bell, but we are paper trading it in any event because the entry risk is about $22,000 on four contracts. To qualify the word ‘attractive’, it implies that a short from 94.24 has a better than 50% chance of producing a profit by falling to p=88.75, at least, before popping above C=99.75 to stop out the position. ________ UPDATE (Aug 31, 11:50 p.m.): So far so good. The futures produced a $22,000 profit on the paper trade with today’s dive to p=88.75. Assuming half the position has been covered, let’s shoot for p2= 83.25 on the third of four contracts shorted. Note the D target at 77.75, which, as noted here earlier, would imply pump prices below $3 gallon. _______ UPDATE (Sep 1, 11:24 p.m.): Use a stop-loss at 91.43 for the two contracts that remain. This should be worked o-c-o with an order to cover one contracts at p2=83.25. _______ UPDATE (Sep 7, 10:16 p.m.): The trade has been a monster, producing one of the biggest gains ever for an explictly actionable tout. The trend forecast itself went sharply against the crowd, with an extremely bearish forecast at a time when most other seers were expecting a run-up to above $100. That said, there has been almost no discussion of the trade, or even of crude oil, in the tradng room, so NYMEX futures will be eliminated from the core list of touts. However, I will still provide coverage of this vehicle and energy proxies on-demand in the trading room.

CLV22 – October Crude (Last:82.60)

Posted on August 28, 2022, 5:09 pm EDT

Last Updated September 7, 2022, 10:15 pm EDT

Posted on August 28, 2022, 5:09 pm EDT

Last Updated September 7, 2022, 10:15 pm EDT

- September 7, 2022, 11:09 pm

Thanks to you, I have a $1,000 gain on my micro crude. : )