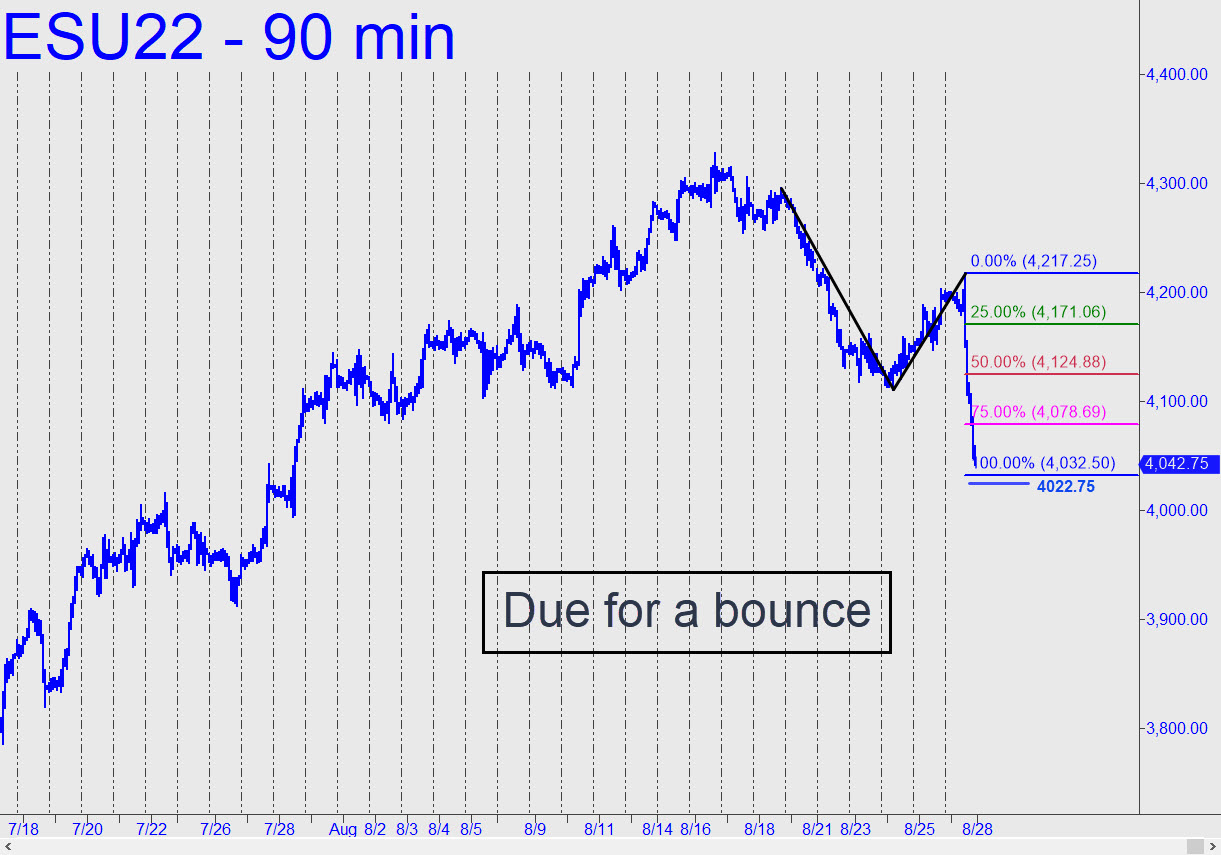

The futures were freefalling to the 4032.50 target shown when the closing bell left them a split-hair shy of it. Look for a tradeable turn from the pivot, although not necessarily an enduring one. Sliding point ‘A’ a step higher yields a slightly lower target at 4022.75 that might also work for bottom-fishing. As always, a decisive move through either of these ‘hidden’ supports on first contact would suggest the trend is likely to persist, even if there’s an intervening bounce. The selloff damaged the intraday charts, but because it was tied ostensibly to news, there is no reason to think it will continue for much longer. ________ UPDATE (Aug 30, 4:45 p.m.): Sellers spent the entire day frolicking at p=3967.50 of this pattern, with a 3862.25 downside target. They’ll need to crack p to drive this brick lower, but the pattern should continue to work unless stopped out above C. _______ UPDATE (Sep 1, 11:15 p.m. ET): One subscriber reported shorting this brick at 3967.50, per my 10:34 chat room instruction. The 4001.75 stop-loss advised implies entry risk of $6800 on four contracts, but you’ll be on your own in any event. ________ UPDATE (Sep 2, 9:04 a.m.): The trade was stopped out by a lunatic leap ahead of the bell to 4002.00. Cool trick, wasn’t it?

The futures were freefalling to the 4032.50 target shown when the closing bell left them a split-hair shy of it. Look for a tradeable turn from the pivot, although not necessarily an enduring one. Sliding point ‘A’ a step higher yields a slightly lower target at 4022.75 that might also work for bottom-fishing. As always, a decisive move through either of these ‘hidden’ supports on first contact would suggest the trend is likely to persist, even if there’s an intervening bounce. The selloff damaged the intraday charts, but because it was tied ostensibly to news, there is no reason to think it will continue for much longer. ________ UPDATE (Aug 30, 4:45 p.m.): Sellers spent the entire day frolicking at p=3967.50 of this pattern, with a 3862.25 downside target. They’ll need to crack p to drive this brick lower, but the pattern should continue to work unless stopped out above C. _______ UPDATE (Sep 1, 11:15 p.m. ET): One subscriber reported shorting this brick at 3967.50, per my 10:34 chat room instruction. The 4001.75 stop-loss advised implies entry risk of $6800 on four contracts, but you’ll be on your own in any event. ________ UPDATE (Sep 2, 9:04 a.m.): The trade was stopped out by a lunatic leap ahead of the bell to 4002.00. Cool trick, wasn’t it?

ESU22 – Sep E-Mini S&P (Last:3994.25)

Posted on August 28, 2022, 5:20 pm EDT

Last Updated September 2, 2022, 9:04 am EDT

Posted on August 28, 2022, 5:20 pm EDT

Last Updated September 2, 2022, 9:04 am EDT