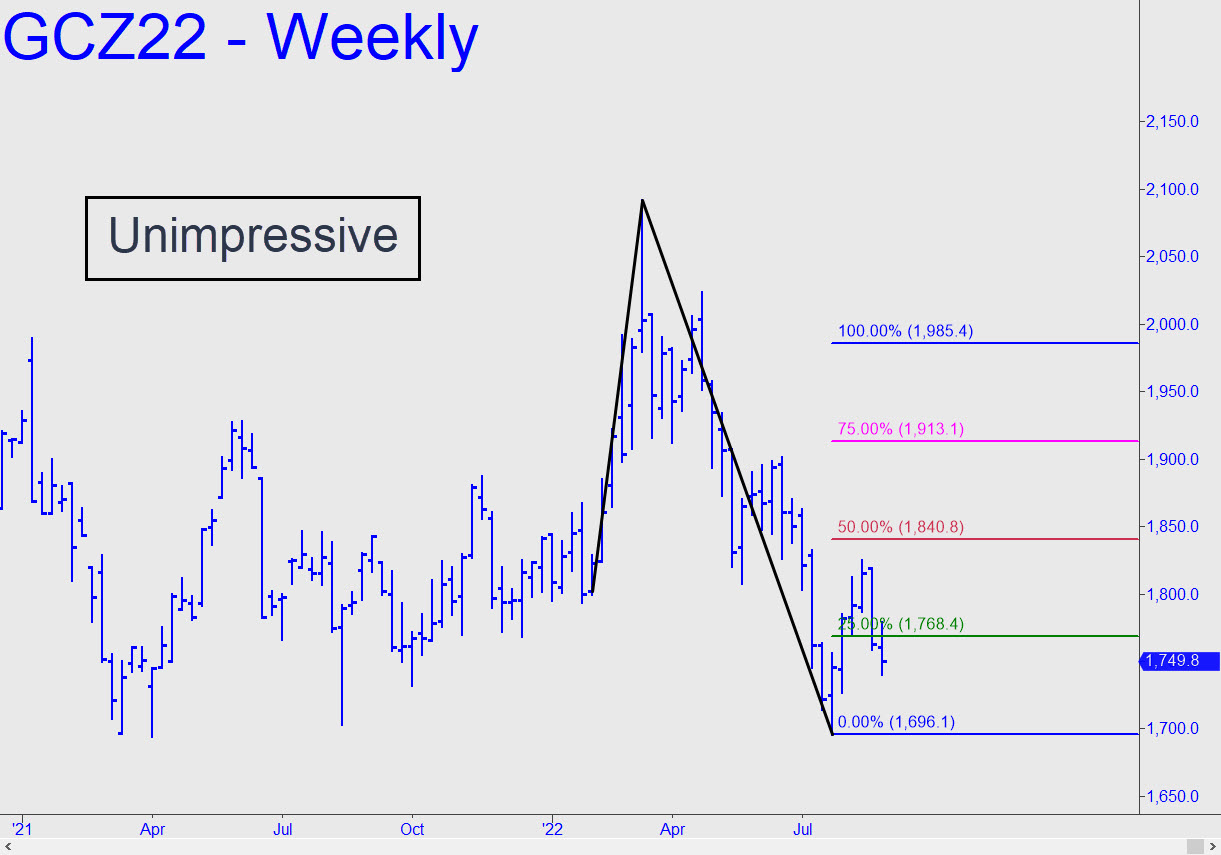

The futures did nothing last week to earn the somewhat ambitious bullish pattern shown. The 1985.40 target is theoretically viable because the green line was tagged, but the follow-through failed to reach p=1840.80, which is what we should expect at a minimum if this brick is going to have a shot at 1985.40. The selloffs have lacked vigor as well, so don’t be surprised if the Decembe contract spends the next 2-3 weeks screwing the pooch. My moderate bias calls for a marginal breakdown below C=1696.1. _______ UPDATE (Sep 3, 10:38 a.m.): The ‘C’ low at 1696.10 held, albeit barely, but I do not trust a bounce coming from such an obvious place. Brace for a relapse, and don’t get your hopes too high unless this dog vaults p=1840.80 (see inset). _______ UPDATE (Sep 7, 9:35 pm.): I’ll lower the bar for this dog, stipulating that it must leap to 1758.00 to turn the hourly chart unambiguously bullish. That would exceded a key ‘external’ peak recorded on August 29. _______ UPDATE (Sep 8, 10:36 p.m.): The lowered bar (see previous update) was too high, since today’s mere head-fake created a bullish impulse leg that cannot be ignored. Depending on how buyers handle p=1729.60, we’ll be able to judge the odds of further upside to D=1745.50 or higher.

The futures did nothing last week to earn the somewhat ambitious bullish pattern shown. The 1985.40 target is theoretically viable because the green line was tagged, but the follow-through failed to reach p=1840.80, which is what we should expect at a minimum if this brick is going to have a shot at 1985.40. The selloffs have lacked vigor as well, so don’t be surprised if the Decembe contract spends the next 2-3 weeks screwing the pooch. My moderate bias calls for a marginal breakdown below C=1696.1. _______ UPDATE (Sep 3, 10:38 a.m.): The ‘C’ low at 1696.10 held, albeit barely, but I do not trust a bounce coming from such an obvious place. Brace for a relapse, and don’t get your hopes too high unless this dog vaults p=1840.80 (see inset). _______ UPDATE (Sep 7, 9:35 pm.): I’ll lower the bar for this dog, stipulating that it must leap to 1758.00 to turn the hourly chart unambiguously bullish. That would exceded a key ‘external’ peak recorded on August 29. _______ UPDATE (Sep 8, 10:36 p.m.): The lowered bar (see previous update) was too high, since today’s mere head-fake created a bullish impulse leg that cannot be ignored. Depending on how buyers handle p=1729.60, we’ll be able to judge the odds of further upside to D=1745.50 or higher.

GCZ22 – December Gold (Last:1728.20)

Posted on August 28, 2022, 5:16 pm EDT

Last Updated September 8, 2022, 10:36 pm EDT

Posted on August 28, 2022, 5:16 pm EDT

Last Updated September 8, 2022, 10:36 pm EDT