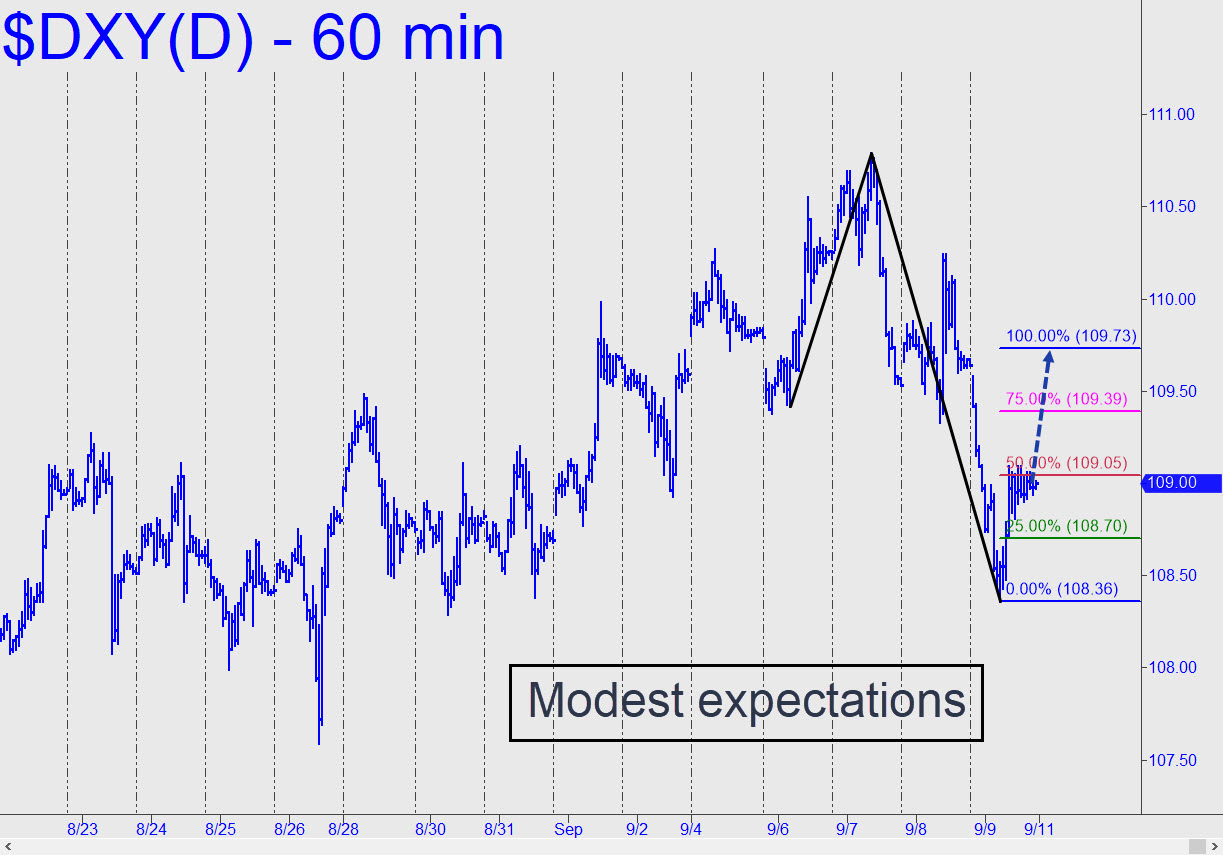

The portfolio managers who diddle the markets with our hard-earned money have limited bandwidth for the mindless ‘themes’ that determine which groups of stocks will be in or out of fashion at a given time. At the moment, simplicity rules with this theme: dollar up, sell everything else; dollar down, buy everything else. That’s the way things have been working lately — and are likely to keep working for the foreseeable future, since the dollar’s strength lies well beyond the control of the little Napoleons who run the central bank. At present, DXY is in a so-far minor correction following a run-up that culminated last week with a 20-year high at 110.79. However, if the bounce from Friday’s 108.36 low impales p=109.05 in the early going on Monday and then goes on to exceed D=109.73 of the modest pattern shown, that would signal the likely resumption of the bull trend and an imminent move to new, multi-decade highs. This will be an inflation-killer, but don’t expect to read about it in the mainstream media until after the global economy has been sucked into a black hole of bankruptcies and barter. ______ UPDATE (Sep 12, 9:55 p.m.): Here’s a serviceable new pattern to gauge trend strength and trade this symbol, since last night’s dive wiped out the point ‘c’ low of the original pattern. A decisive push past p=108.50 is needed to put the dollar back in bullish gear. ______ UPDATE (Sep 13, 6:50 p.m.): The stock market’s cascade today opposite a very strong dollar underscores the point I made above. Look for new highs on Wednesday after the rally impales D=110.88 of A=107.69 (6/26).

The portfolio managers who diddle the markets with our hard-earned money have limited bandwidth for the mindless ‘themes’ that determine which groups of stocks will be in or out of fashion at a given time. At the moment, simplicity rules with this theme: dollar up, sell everything else; dollar down, buy everything else. That’s the way things have been working lately — and are likely to keep working for the foreseeable future, since the dollar’s strength lies well beyond the control of the little Napoleons who run the central bank. At present, DXY is in a so-far minor correction following a run-up that culminated last week with a 20-year high at 110.79. However, if the bounce from Friday’s 108.36 low impales p=109.05 in the early going on Monday and then goes on to exceed D=109.73 of the modest pattern shown, that would signal the likely resumption of the bull trend and an imminent move to new, multi-decade highs. This will be an inflation-killer, but don’t expect to read about it in the mainstream media until after the global economy has been sucked into a black hole of bankruptcies and barter. ______ UPDATE (Sep 12, 9:55 p.m.): Here’s a serviceable new pattern to gauge trend strength and trade this symbol, since last night’s dive wiped out the point ‘c’ low of the original pattern. A decisive push past p=108.50 is needed to put the dollar back in bullish gear. ______ UPDATE (Sep 13, 6:50 p.m.): The stock market’s cascade today opposite a very strong dollar underscores the point I made above. Look for new highs on Wednesday after the rally impales D=110.88 of A=107.69 (6/26).

DXY – NYBOT Dollar Index (Last:110.01)

Posted on September 11, 2022, 5:24 pm EDT

Last Updated September 13, 2022, 6:48 pm EDT

Posted on September 11, 2022, 5:24 pm EDT

Last Updated September 13, 2022, 6:48 pm EDT