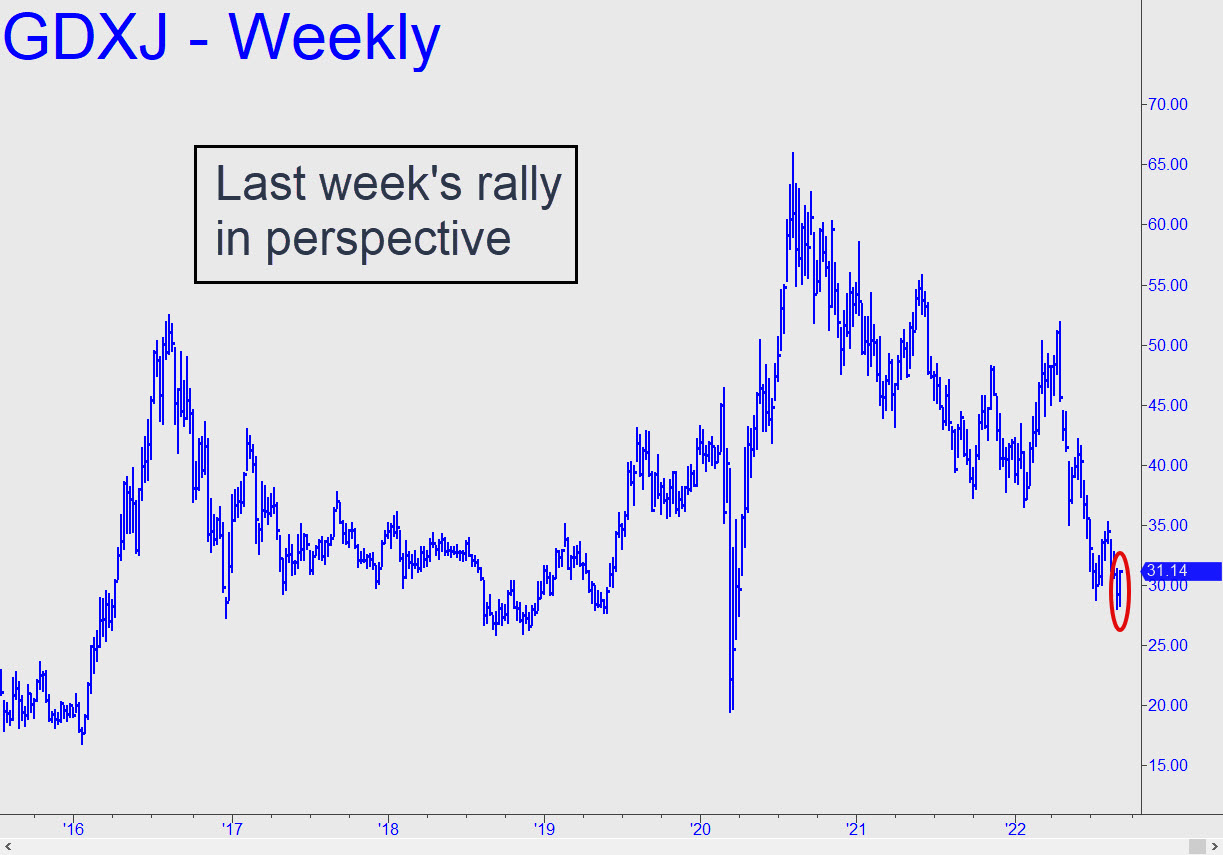

Friday’s gap-up rally exceeded by a few cents a minor ‘D’ target at 31.05 that I’d flagged here earlier. This is mildly encouraging, but check out the weekly chart (inset) for perspective. Even if the uptrend were to continue a further $4, exceeding mid-June’s ‘external’ peak at 35.26, the move would still be $7 shy of creating a bullish impulse leg on the weekly chart. That is what we should require if we’re to infer that the bear market begun from $66 two years ago is over. From a trading perspective, however, our short-term bias should wax aggressively bullish if and when buyers push this sack of lug nuts above the ‘external peak at 31.35 recorded on August 29. _______ UPDATE (Sep 16, 12:57 a.m.): This pattern, with a worst-case target at 23.60, seems to be working, although an opportune ‘mechanical’ short on the run-up to the green line failed by a hair to trigger. ______ UPDATE (Sep 28, 10:40 p.m.): The most powerful one-day rally since May was impulsive on the lesser charts but not very, since it exceeded only a single, minor ‘external’ peak on the 30-minute graph. After an engineered short squeeze on the opening bar, GDXJ spent the rest of the day slogging into a gap from last Friday, but it would need to surpass the 30.28 peak recorded two days earlier to start looking impressive.

Friday’s gap-up rally exceeded by a few cents a minor ‘D’ target at 31.05 that I’d flagged here earlier. This is mildly encouraging, but check out the weekly chart (inset) for perspective. Even if the uptrend were to continue a further $4, exceeding mid-June’s ‘external’ peak at 35.26, the move would still be $7 shy of creating a bullish impulse leg on the weekly chart. That is what we should require if we’re to infer that the bear market begun from $66 two years ago is over. From a trading perspective, however, our short-term bias should wax aggressively bullish if and when buyers push this sack of lug nuts above the ‘external peak at 31.35 recorded on August 29. _______ UPDATE (Sep 16, 12:57 a.m.): This pattern, with a worst-case target at 23.60, seems to be working, although an opportune ‘mechanical’ short on the run-up to the green line failed by a hair to trigger. ______ UPDATE (Sep 28, 10:40 p.m.): The most powerful one-day rally since May was impulsive on the lesser charts but not very, since it exceeded only a single, minor ‘external’ peak on the 30-minute graph. After an engineered short squeeze on the opening bar, GDXJ spent the rest of the day slogging into a gap from last Friday, but it would need to surpass the 30.28 peak recorded two days earlier to start looking impressive.

GDXJ – Junior Gold Miner ETF (Last:28.34)

Posted on September 11, 2022, 5:09 pm EDT

Last Updated September 28, 2022, 10:43 pm EDT

Posted on September 11, 2022, 5:09 pm EDT

Last Updated September 28, 2022, 10:43 pm EDT