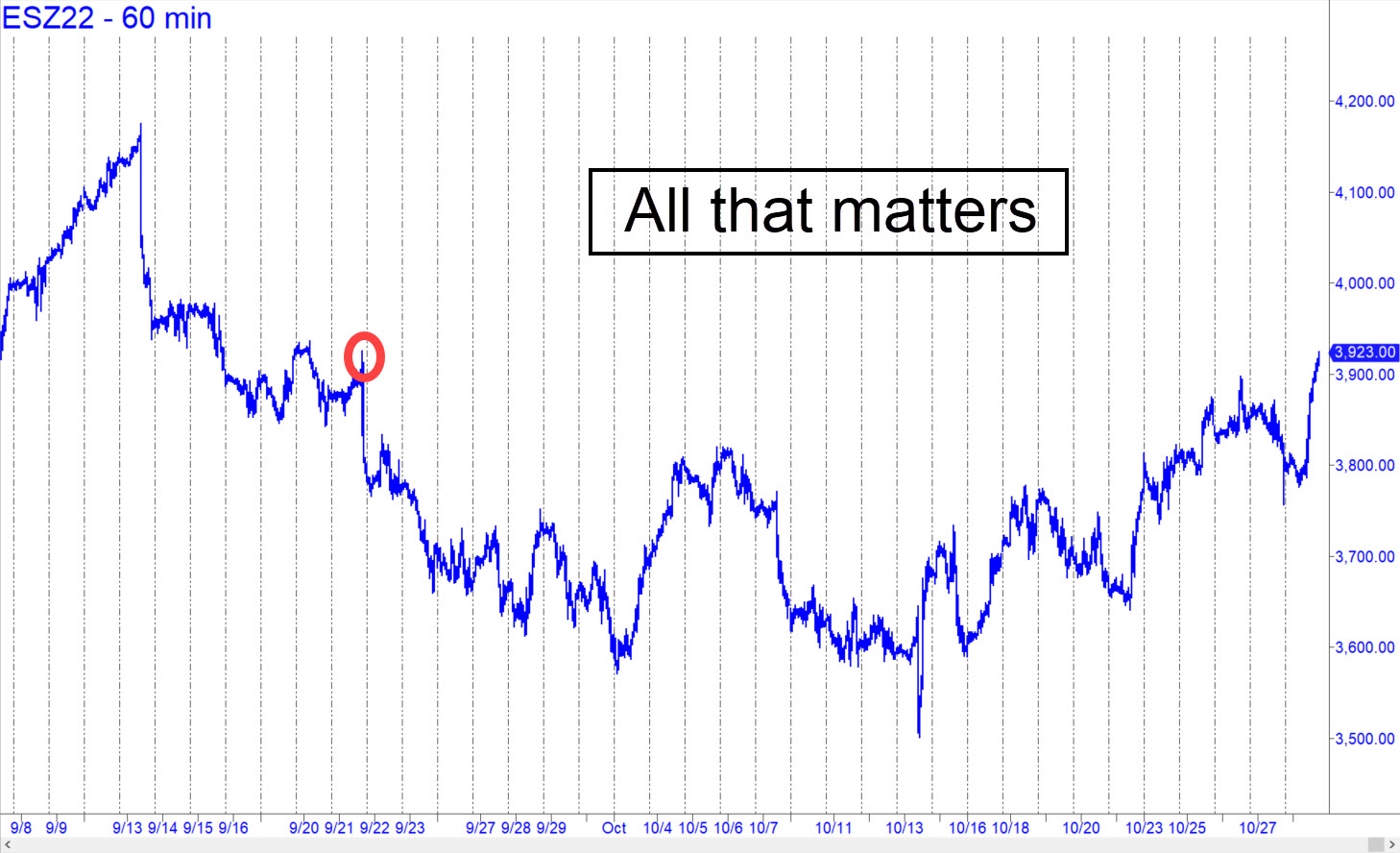

A powerful short squeeze capped the week, daring badly bloodied bears to stand their ground. The rally narrowly exceeded the 3917 target I’d drum-rolled five days earlier, when the futures were trading more than 100 points lower. Some Rick’s Picks subscribers evidently doubled down at the close, betting that the best time to get short is when conditions seem most dangerous. Friday’s close easily passed that test when the futures came to rest a single point shy of an important external peak at 3925.25 recorded September 21 on the way down. If DaBoyz can levitate this gas-bag above that structural resistance Sunday night or Monday, it would refresh the impulsive energy of the hourly chart and put the December contract on track for a finishing stroke to the 4110.75 target of this pattern. You can short there with a tight stop-loss (and at p2=3959.75), but your trading bias should be aggressively bullish otherwise. ______ UPDATE (Nov 2, 4:43 p.m.): This afternoon’s wild swings offered yet another glimpse of the two forces that animate Wall Street: fear and greed. In the context of the larger pattern shown here, the histrionics amounted to just a hiccup, albeit one that would trigger an opportune ‘mechanical’ buy if the futures plummet to x=3653.00, the green line. The $30k of entry risk this implies demands risk-averse tactics for initiating the trade, so stay tuned to the chat room if you care. _____ UPDATE (Nov 3, 8:37 p.m.): Mr Market was providing few clues concerning whether the futures were about to take out today’s low at 3704, presumably bound for the 3653 target flagged above. A breakdown would put them on course for an even lower target at 3631.50 that is shown in this chart. Note also that before ES weakened at the end of the regular session, it triggered a mechanical short at 3744.75 [corrected], the green line. The trade is showing a theoretical profit at the moment of around $1000 per contract, with half of the position to be covered at p=3707.00. If you did the trade on your own initiate, please let me know in the chat room, and I’ll create a tracking position for your further guidance._______ UPDATE (Nov 4, 10:00 a.m.): The short should have been covered at around 3712 using a ‘dynamic’ trailing stop based on the 3711.00 low. Dynamic stop-losses are created by keeping risk:reward in a 1:3 relationship as a price objective is closely approached. The idea behind them is that when a target draws close — say, six points away — you should not allow an adverse swing against you that gives up more than a third (i.e., two points) of what you stood to make. In practice, you can vary the ratio, but it should never be worse than 1:1.

A powerful short squeeze capped the week, daring badly bloodied bears to stand their ground. The rally narrowly exceeded the 3917 target I’d drum-rolled five days earlier, when the futures were trading more than 100 points lower. Some Rick’s Picks subscribers evidently doubled down at the close, betting that the best time to get short is when conditions seem most dangerous. Friday’s close easily passed that test when the futures came to rest a single point shy of an important external peak at 3925.25 recorded September 21 on the way down. If DaBoyz can levitate this gas-bag above that structural resistance Sunday night or Monday, it would refresh the impulsive energy of the hourly chart and put the December contract on track for a finishing stroke to the 4110.75 target of this pattern. You can short there with a tight stop-loss (and at p2=3959.75), but your trading bias should be aggressively bullish otherwise. ______ UPDATE (Nov 2, 4:43 p.m.): This afternoon’s wild swings offered yet another glimpse of the two forces that animate Wall Street: fear and greed. In the context of the larger pattern shown here, the histrionics amounted to just a hiccup, albeit one that would trigger an opportune ‘mechanical’ buy if the futures plummet to x=3653.00, the green line. The $30k of entry risk this implies demands risk-averse tactics for initiating the trade, so stay tuned to the chat room if you care. _____ UPDATE (Nov 3, 8:37 p.m.): Mr Market was providing few clues concerning whether the futures were about to take out today’s low at 3704, presumably bound for the 3653 target flagged above. A breakdown would put them on course for an even lower target at 3631.50 that is shown in this chart. Note also that before ES weakened at the end of the regular session, it triggered a mechanical short at 3744.75 [corrected], the green line. The trade is showing a theoretical profit at the moment of around $1000 per contract, with half of the position to be covered at p=3707.00. If you did the trade on your own initiate, please let me know in the chat room, and I’ll create a tracking position for your further guidance._______ UPDATE (Nov 4, 10:00 a.m.): The short should have been covered at around 3712 using a ‘dynamic’ trailing stop based on the 3711.00 low. Dynamic stop-losses are created by keeping risk:reward in a 1:3 relationship as a price objective is closely approached. The idea behind them is that when a target draws close — say, six points away — you should not allow an adverse swing against you that gives up more than a third (i.e., two points) of what you stood to make. In practice, you can vary the ratio, but it should never be worse than 1:1.

ESZ22 – Dec E-Mini S&Ps (Last:3768.00)

Posted on October 30, 2022, 5:20 pm EDT

Last Updated November 4, 2022, 10:00 am EDT

Posted on October 30, 2022, 5:20 pm EDT

Last Updated November 4, 2022, 10:00 am EDT

- November 4, 2022, 12:23 pm

Is now a good time to buy stocks in utility,apple msft, etc.