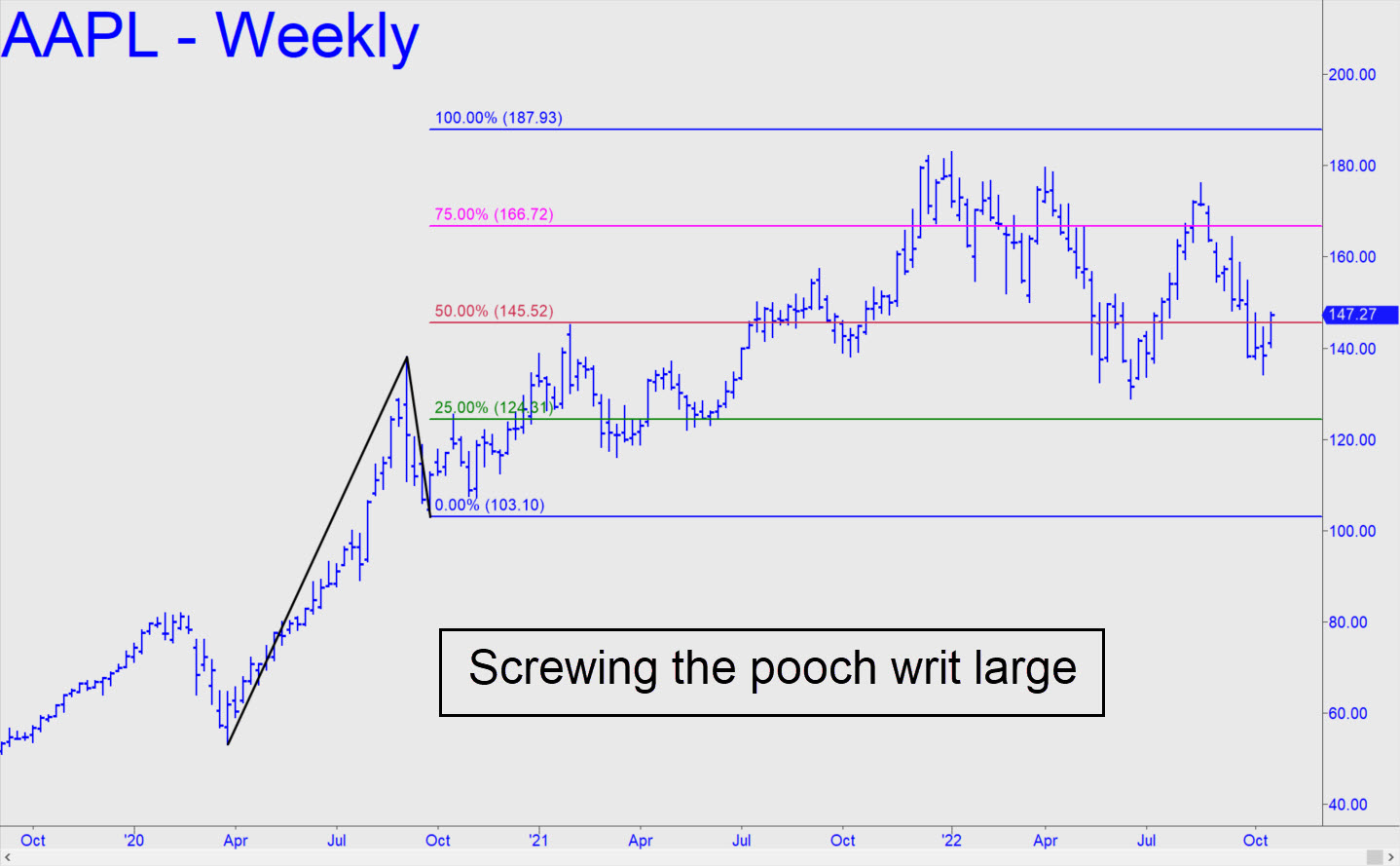

I hope you’ll pardon these two atrociously mixed metaphors, but separately they ring true, at least to me: AAPL, having lost one engine, has leveled off at cruising altitude and looks like it is fixing to screw the pooch indefinitely. Ordinarily I would say that the weekly chart (see inset) reflects dithering uncertainty, except that the thieves who routinely and mechanistically rig AAPL’s price action are never without intentions. Thus would it appear they are planning to hold the stock aloft for as long as possible, massaging it within the approximate range 120-175. Distribution will likely intensify above 160; accumulation, below 150.

I hope you’ll pardon these two atrociously mixed metaphors, but separately they ring true, at least to me: AAPL, having lost one engine, has leveled off at cruising altitude and looks like it is fixing to screw the pooch indefinitely. Ordinarily I would say that the weekly chart (see inset) reflects dithering uncertainty, except that the thieves who routinely and mechanistically rig AAPL’s price action are never without intentions. Thus would it appear they are planning to hold the stock aloft for as long as possible, massaging it within the approximate range 120-175. Distribution will likely intensify above 160; accumulation, below 150.

From a technical standpoint, the irresolute chart follows from the fact that neither the big move down in April-May, nor the steep rally in June-August, generated a true impulse leg on the weekly chart. To be more specific, the last-gasp low bar in mid-June did not exceed an additional ‘external’ low as required. This typically sets up duels between bulls and bears that can last for a long time.

Keep in mind that AAPL remains a perfectly reliable bellwether for the stock market as a whole. The implication is that if my forecast is correct, we are about to experience an extended period of trendlessness. I’d thought the gratuitous swings to nowhere in both directions would persist only until the November elections, but I am now prepared to watch pointless price action continue more or less indefinitely.

This would not likely happen if the Democrats were about to win, since that would leave the nation on a slick track to economic ruin and possibly civil war. Judging from the chart, however, it looks like GOP candidates will prevail. Even though that could conceivably delay the financial implosion that is coming while also driving a stake through the heart of wokeness, it would hardly be sufficient to goose stocks skyward, since severe economic problems, including massive debt that long ago became unpayable, would only continue to grow. The foregoing has not changed my long-term prediction that AAPL eventually will trade for less than $50, with commensurate losses in the broad averages. _____ UPDATE (Oct 27, 12:03 a.m.,): AAPL was weaker than the market today, but the selloff followed the creation of a robustly bullish impulse leg on the hourly chart. The decline should therefore be viewed as corrective until such time as the stock falls a further $7 or so to generate a ‘dueling’ impulse leg on the intraday charts. ______ UPDATE (Oct 27, 6:45 p.m.): Very impressive! AAPL’s handlers have turned reflexive earnings hysteria to their advantage with aikido, letting the psychotics who jump in after the bell duke it out to the point of exhaustion. Thus has AAPL avoided the disastrous hits that META and AMZN suffered this afternoon. This will likely hold bullish implications for the market in the days ahead, and for a short squeeze that outdoes what some contrarians might now be imagining. AMZN and META were sacrificed to advance this scheme, mere collateral damage..