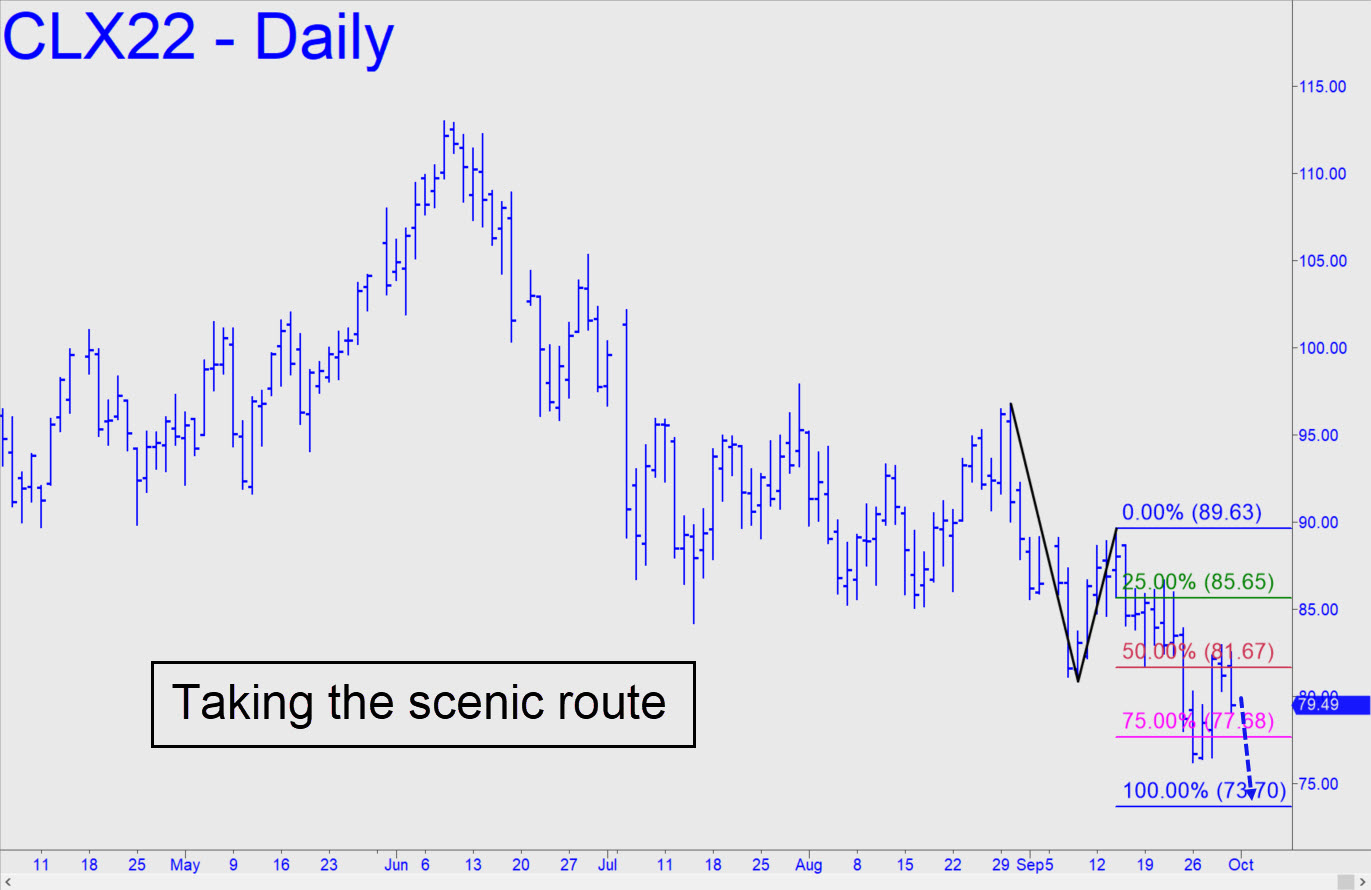

November Crude is taking its time achieving a bearish Hidden Pivot target at 73.70 that has been a month in coming. Upward stabs have been brutal on shorts, making a sell-and-hold strategy impractical and unwise in retrospect. The downtrend has nonetheless triggered two mechanical shorts on feints higher if you count the one at the red line that was signaled last Wednesday. We don’t typically initiate shorts at p, only at x, but this one would have taken a stop-loss at 84.33 if we had. That would have put at risk a third of what we stood to gain if CLX completes the pattern. It is sufficiently gnarly to imply that bottom-fishing at 73.70 with a tight stop-loss would enjoy attractive odds. _____ UPDATE (Oct 3, 6:50 p.m.): Tracking this dervish is mentally depleting, but we’ll still want to paper-trade the ‘mechanical’ short that would trigger if and when it hits X=85.65. I’d rate the trade a ‘5’ — a 50% chance to profit, and therefore not very enticing.

November Crude is taking its time achieving a bearish Hidden Pivot target at 73.70 that has been a month in coming. Upward stabs have been brutal on shorts, making a sell-and-hold strategy impractical and unwise in retrospect. The downtrend has nonetheless triggered two mechanical shorts on feints higher if you count the one at the red line that was signaled last Wednesday. We don’t typically initiate shorts at p, only at x, but this one would have taken a stop-loss at 84.33 if we had. That would have put at risk a third of what we stood to gain if CLX completes the pattern. It is sufficiently gnarly to imply that bottom-fishing at 73.70 with a tight stop-loss would enjoy attractive odds. _____ UPDATE (Oct 3, 6:50 p.m.): Tracking this dervish is mentally depleting, but we’ll still want to paper-trade the ‘mechanical’ short that would trigger if and when it hits X=85.65. I’d rate the trade a ‘5’ — a 50% chance to profit, and therefore not very enticing.

CLX22 – November Crude (Last:83.28)

Posted on October 2, 2022, 5:11 pm EDT

Last Updated October 3, 2022, 6:51 pm EDT

Posted on October 2, 2022, 5:11 pm EDT

Last Updated October 3, 2022, 6:51 pm EDT