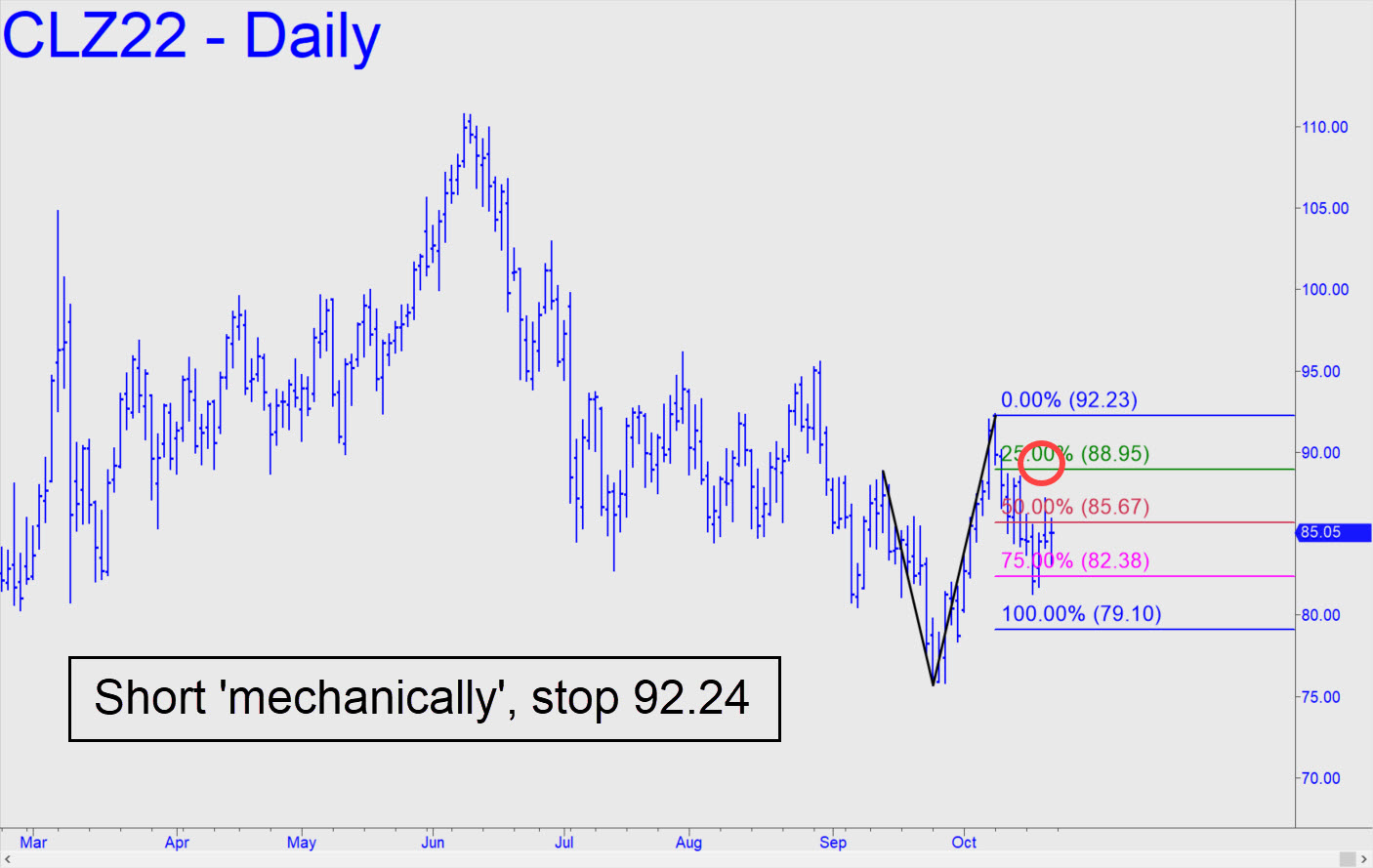

The futures would trigger an appealing ‘mechanical’ short if this bounce hits x=88.95. The ‘conventional stop-loss would be at 92.24, implying a little more than $13,000 of theoretical entry risk on four contracts. That’s why I am recommending this trade only if you know how to fashion a ‘camouflage’ trigger to reduce that to $600 or less theoretical per contract. I’d suggest paper-trading otherwise so that you can see for yourself not only how ‘camouflage’ works, but how consistently. ______ UPDATE (Oct 24, 6:25 p.m.): Cancel the trade, since the futures are taking too long to reach the green line (x=88.95). There’s not much to say about the trend, since there hasn’t been a trend in more than three months.

The futures would trigger an appealing ‘mechanical’ short if this bounce hits x=88.95. The ‘conventional stop-loss would be at 92.24, implying a little more than $13,000 of theoretical entry risk on four contracts. That’s why I am recommending this trade only if you know how to fashion a ‘camouflage’ trigger to reduce that to $600 or less theoretical per contract. I’d suggest paper-trading otherwise so that you can see for yourself not only how ‘camouflage’ works, but how consistently. ______ UPDATE (Oct 24, 6:25 p.m.): Cancel the trade, since the futures are taking too long to reach the green line (x=88.95). There’s not much to say about the trend, since there hasn’t been a trend in more than three months.

CLZ22 – December Crude (Last:84.77)

Posted on October 23, 2022, 5:10 pm EDT

Last Updated October 24, 2022, 6:26 pm EDT

Posted on October 23, 2022, 5:10 pm EDT

Last Updated October 24, 2022, 6:26 pm EDT