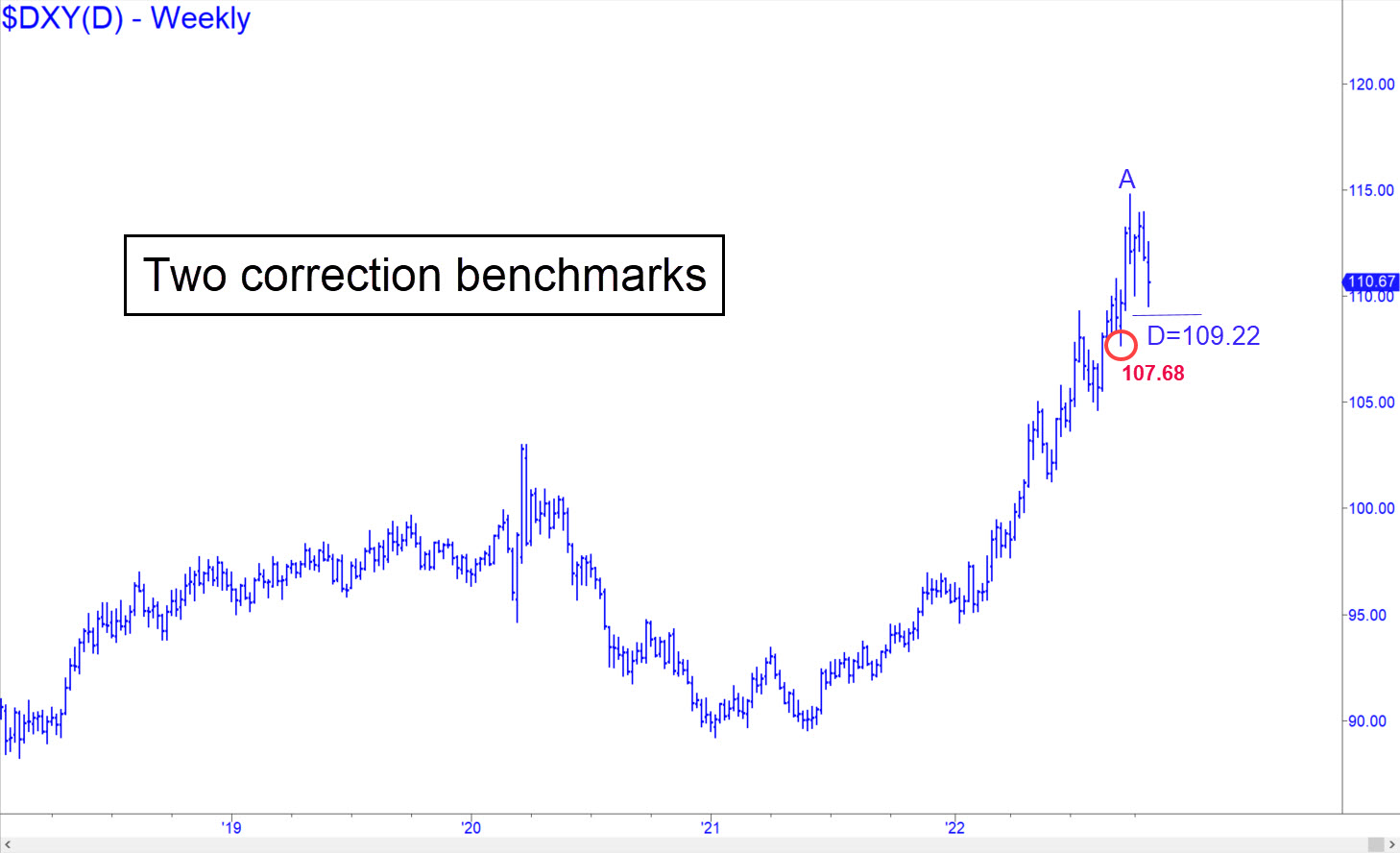

The long-term chart shows why the month of weakness we’ve seen so far may not be enough to correct the moon shot begun in mid-2021. Just a little more selling will bring the Dollar Index down to a Hidden Pivot target at 109.22 that has served as a minimum downside objective for the last two months. However, the downtrend would need to surpass the ‘external’ low at 107.68 to turn the weekly chart bearishly impulsive. For now, let’s see how the ‘hidden’ support at 109.22 handles whatever pounding occurs there if the dollar relapses. _____ UPDATE (Nov 8, 11:10 a.m.): Price action over the last two days has provided a new ABCD pattern with a 108.75 target. I expect DXY to get there, and also to reverse off a low within a few ticks. Here’s the chart. _______UPDATE (Nov 10, 8:51 p.m.): Following a steep dive on the opening bar, DXY got traction at 108.75, but this ‘hidden’ support’ failed and it plunged anew to 107.71. This suggests more weakness ahead, but a push above 109.09 to end the week would earn dollar bulls a reprieve.

The long-term chart shows why the month of weakness we’ve seen so far may not be enough to correct the moon shot begun in mid-2021. Just a little more selling will bring the Dollar Index down to a Hidden Pivot target at 109.22 that has served as a minimum downside objective for the last two months. However, the downtrend would need to surpass the ‘external’ low at 107.68 to turn the weekly chart bearishly impulsive. For now, let’s see how the ‘hidden’ support at 109.22 handles whatever pounding occurs there if the dollar relapses. _____ UPDATE (Nov 8, 11:10 a.m.): Price action over the last two days has provided a new ABCD pattern with a 108.75 target. I expect DXY to get there, and also to reverse off a low within a few ticks. Here’s the chart. _______UPDATE (Nov 10, 8:51 p.m.): Following a steep dive on the opening bar, DXY got traction at 108.75, but this ‘hidden’ support’ failed and it plunged anew to 107.71. This suggests more weakness ahead, but a push above 109.09 to end the week would earn dollar bulls a reprieve.

DXY – NYBOT Dollar Index (Last:108.26)

Posted on October 30, 2022, 5:03 pm EDT

Last Updated November 10, 2022, 11:43 pm EST

Posted on October 30, 2022, 5:03 pm EDT

Last Updated November 10, 2022, 11:43 pm EST